The LendIt Story

February 12, 2017

The LendIt Conference was supposed to be a smallish local meetup for New York-based members of the online lending community. But founders Jason Jones and Bo Brustkern soon discovered they had the makings of a big annual industrywide national convention. And before long, they found themselves replicating their successful American show on other continents.

To understand how the trade show was born and how it’s matured, flash back about seven years. In 2010, Jones and Brustkern were putting together venture capital deals when they happened onto the fledgling peer-to-peer lending movement. “Consumer credit was something we weren’t all that knowledgeable about, but we could see the market was large,” recalls Jones. “There was a clear opportunity that was structural in the market, and there were stable, consistent returns.” So the two of them launched one of the first P2P funds.

Their lending business soon took off, but Jones and Brustkern felt they were working in a void. The industry lacked community, and they decided to do something about it. Jones contacted his friend, Dara Albright, who had been organizing a series of crowdfunding conferences for Wall Street starting in mid 2011.

To heighten the credibility of the new confab, Jones, Brustkern and Albright decided to seek the help of Peter Renton. They didn’t know Renton personally but considered him “the voice of the industry,” Jones says. Renton had nurtured and sold off two printing businesses and used the proceeds to take up online lending as a hobby. He had also launched the Lend Academy in 2010 to teach the world about peer-to-peer lending. Somehow, he had also found the time to develop a following for himself as a blogger.

In early January of 2013, Jones and Albright cold-called Renton to gauge his interest in putting on a show. As fate would have it, Renton had just made a New Year’s resolution to launch a conference for lenders and was receptive to joining up. Together, they put a plan in action.

The originators put up their own money and worked together daily from January to June of 2013, when the first show convened. They secured space that would contain 220 people and calculated their break-even point as 200 attendees. “This was never intended to be a profitable enterprise,” Jones says of those early days. “This was something we all wanted to do for the community. We thought that if we wanted it, others would want it.”

More than 400 people registered for that first conference. “We had a line literally out the door,” Jones notes. “We had to shut off registration. We ended up squeezing about 375 people into that first event. It was completely shocking to us.” From the beginning, attendees came from all over the world. “That’s when I learned China had a P2P industry,” Jones says.

After the initial event, Jones, Brustkern and Renton formed a unified company. Renton brought in Lend Academy, while Jones and Brustkern added their investment fund. The conference also became part of the united company. Ever since, a holding company has owned all three businesses. Dara went on to launch Fintech Revolution TV and continues to support LendIt.

From the initial attendance of 375, the U.S. conference grew to 975 attendees in 2014, 2,500 in 2015, 3,500 in 2016 and a projected 5,000 for this year. About 33 percent of attendees come from the fintech industry, 23 percent are investors, 23 percent are service providers, 14 percent are banks and 2 percent come from government, the media and other backgrounds, Jones says. At first, many of the attendees come from the ranks of CEOs and managing partners, but that’s changing as the industry comes to view the conference as an annual convention where lower-ranking members of an organization can learn about the business, he notes.

Meanwhile, the exhibition floor is becoming an increasingly important component of the show. The gathering attracted 18 exhibitors in 2013, followed by 47 in 2014, 112 in 2015, 177 last year and an expected 210 this year. “We’re transforming from a conference-led event to an expo-led event,” Jones says. This year, exhibitor booths will occupy a 120,000 square-foot hall in New York’s Jacob K. Javits Convention Center.

The U.S. LendIt conferences alternate between San Francisco and New York City, renting larger spaces as the show has grown, Jones explains. Two years ago, the gathering seemed cramped in the gigantic New York Marriott Marquis near Times Square, he says, necessitating this year’s move to the Javits Center. Javits is designed for conventions with at least 10,000 attendees so the show is a little small for that venue, he admits. But the facility could become LendIt’s long-time New York home as growth continues, he predicts.

Jones traces some of the growth in exhibitors to the expansion of the fintech industry. “You have a meeting of the start-ups with the more traditional players who are rethinking their businesses and how to apply the new technology that’s being developed into their businesses,” he says.

Conferences that compete with LendIt in the fintech category are proliferating because of the nature of industry, in Jones’ view. As soon as fintech companies are launched, the internet quickly makes them national or even international in scope, he says. At the same time, the anonymity of cyberspace creates a need for gatherings that provide face-to-face meetings, he maintains. “They live online,” he says. “The spend their year online so there is a need for a convention to meet with their peers, their clients, their service-providers, their customers, their suppliers. There is a need for that physical connection.”

The increase in fintech conferences is also driven by content-related companies that provide articles on fintech innovation. Those sites have regarded conferences as money-makers that complement their journalistic endeavors, Jones says. For example, TechCrunch, an online publisher of technology industry news, puts on the TechCrunch Disrupt conferences in San Francisco, New York City, London and Beijing. In another example, Business Insider conducts the IGNITION conference.

Those forces – the internet, globalization and web-based publishing – are making themselves felt in the convention business in general, not just in fintech, Jones notes. Event-related companies trade at roughly 12 times EBITDA (earnings before interest, tax, depreciation and amortization), he says, characterizing the convention business as “a very healthy category of our economy.”

Still, the fintech field’s crowded with more than 30 conferences, but LendIt is succeeding because of its early start and an emphasis on community, according to Jones. “We come from the industry,” he contends. “People are happy with what we can produce. They love our content so they come to learn.” Because the conference has become established, the media outlets focus on covering it, which encourages businesses to use it as a stage for introducing products or announcing mergers and acquisitions, he maintains.

Jones views LendIt and Money20/20 as the largest pure-play fintech conferences. The latter, which attracts 11,000 attendees, focuses on payments and contains a “layer” of fintech, while LendIt specializes in lending and likewise offers a “layer” of fintech, he says. Payments and lending represent the two biggest categories in fintech, so the structure of the shows makes sense, he suggests. By chance, Money20/20 occurs in the fall and LendIt takes place in spring, creating what he considers a “nice balance” that encourages prospective attendees to go to both shows.

Finovate holds a rival fintech conference that focuses more narrowly on innovation than do the LendIt and Money20/20 shows, Jones says. A competing bank securitization conference offers information on lending but doesn’t address fintech in great detail, he says.

While LendIt has been coming of age in the U.S., it’s also gained siblings in Shanghai and London. The Chinese edition of the show, which made its debut in 2014, ranks as the largest fintech show in Asia. The Chinese fintech market has grown to at least five times the size of any other market in the world, and it’s home to four of the world’s five largest fintech companies, Jones says. “We were completely blown away,” he says of learning about the industry during a visit to China.

Despite the language barrier and the challenges of dealing with an unfamiliar culture, LendIt has managed to prosper in China. Through a joint venture with a local financial think tank, LendIt helped produce annual Chinese events known as the Bund Summit for two years with attendance capped at 500. For the third year, LendIt parted ways with its partner and recast the show as a larger event. After the change, the confab, now called the Lang Di Fintech Conference, attracted 1,200 attendees, making it China’s largest. “There’s a ton of future opportunity,” Jones predicts of the China endeavor. “We want to be the annual convention for the Chinese fintech industry.”

Although it’s difficult to set up operations in China, cooperation has prevailed there in at least some areas. “The government has been quite supportive,” Jones says of of Chinese officials. “They appreciate what we’re trying to do there.” In January, LendIt launched its Chinese language daily news feed.

Thousands of miles away, the European-based LendIt confab ranks second in size on that continent only to the European version of Money20/20, Jones says. Attendance at the London-based LendIt show numbered 450 in 2014, which was its initial year. It climbed to 800 in 2015 and reached 925 last year.

Putting on the European event requires much less effort than the Asian version because it’s almost an extension of the U.S. original, he says. It’s dominated by firms from the United Kingdom but draws a smattering of companies from other European nations. Crossing borders presents challenges for European fintech companies, which keeps the industry’s companies smaller there than in the U.S. and China, but that may change, he believes. “There’s a lot of innovation there, but they still have a ways to go,” he says.

To handle its far-flung operations, LendIt relies on 20 full-time employees, 11 contractors and 10 people working in a joint venture in China for a total of 41 staff members. “These events are incredibly large shows, and we constantly feel understaffed,” Jones says. That feeling prevails despite recent additions to the staff, he notes.

And additional opportunity beckons in myriad locations. “The challenge is, do you have a bunch of conferences all over the world, or do you do a beachhead and pull people to those three events?” Jones wonders aloud when asked about the future. “For the moment, we have made the strategic decision to stick with these three events and go deeper with them. But there are so many opportunities all around the world. We’re constantly being asked to come to different countries.” Then, too, LendIt could convene smaller, one-day events around the glove as feeders to the three main conventions, he allows. “That’s something we’re batting around now.”

The established two-day conferences could also grow into three-day affairs – but not right away, Jones suggests. “We’re totally running out of time,” he says of trying to cram in all the speakers and exhibitors that LendIt would like to present. Stretching the format could create conflicts because some participants attend other events immediately before or after LendIt.

Notable LendIt speakers have included Larry Summers, who’s served as Harvard president and U.S. Treasury Secretary; Karen Mills, former administrator of the U.S. Small Business Administration; John Williams, president and CEO of the Federal Reserve Bank of San Francisco; and Peter Thiel, venture capitalist and member of the Trump transition team. This year, attendees can look forward to meeting the robot that represents Watson, the IBM computer. Watson will take the stage to field questions about fintech. For Jones, however, creating a conference isn’t just about the big-name speakers be they human or mechanical. “People who are lesser-known can be really fascinating,” he says.

Whoever handles the speaking duties, the LendIt Conference executives vow that they’re in it for the long run as the fintech industry’s annual convention during both boom times and economic slumps. As Jones puts it: “We want to be a reflection of our industry.”

New Industry Group Established to Support Consumers’ Right to Access their Financial Data

January 19, 2017The Consumer Financial Data Rights (CFDR) group defends consumers’ access to their data and fuels new innovation in fintech

REDWOOD CITY, Calif., Jan. 19, 2017 /PRNewswire/ — The Consumer Financial Data Rights (CFDR), a new industry group formed by some of the most recognized companies in the financial sector, officially launched today in support of the consumers’ right to innovative products and services that improve their financial well-being and are powered by unfettered access to their financial data. As fintech companies increasingly collaborate with banks around the world to provide innovative solutions through open application program interfaces (APIs), this right ensures a consumer can continue to give permission to third party companies to use that individual’s data for managing their personal finances, obtaining loans, making payments, and providing investment advice in addition to many other applications.

The CFDR brings together organizations from across the fintech ecosystem and includes some of the most influential and innovative companies in the financial sector, including the following founding members: Affirm, Betterment, Digit, Envestnet | Yodlee, Kabbage, Personal Capital, Ripple, and Varo Money among many other companies.

Section 1033 of Dodd-Frank codified the consumers’ right to access their personal financial data through technology-powered third party platforms. Together with promoting consumer choice and access to these consumer-first financial health tools, the CFDR is also committed to improving dialogue throughout the financial industry, actively engaging the government and working with banks, fintech innovators, and third party platforms. The CFDR aims to be a resource for policymakers, including the Consumer Financial Protection Bureau, as they determine how to best assist consumers in leveraging their own financial data.

“Each consumer’s right to their own financial data is vital in helping to understand their finances and make the best saving and spending decisions,” said Max Levchin, Founder and CEO of Affirm. “As a company we’re committed to helping customers make the best financial decisions and improve their financial lives through technology and improved flexibility, and having a complete picture of a customer’s financial picture is essential to achieving this. As a founding member of the CFDR, we’re committed to ensuring that all consumers have access to data which makes their financial lives better.”

“Consumers and small business owners need to be able to view their entire financial picture to make decisions that are truly in their best interests,” said Rob Frohwein, Co-Founder of Kabbage. “The ability to freely access financial data empowers customers to take actions to improve their financial lives, whether it’s accessing capital to grow a business or better understanding their income streams. Access to financial data is not just vital for customers wanting to enjoy financial health, but it also allows companies to provide better user experiences. Kabbage is thrilled to join other companies also committed to democratizing access to financial data.”

CFDR’s first action will be the submission of a joint comment letter in response to an advanced notice of proposed rulemaking on Enhanced Cyber Risk Management Standards issued by the Federal Reserve, Office of the Comptroller of the Currency, and Federal Deposit Insurance Corporation. The submission will encourage the regulators to establish a risk hierarchy with regard to cybersecurity risk in the fintech industry and will note the importance of continuing to allow consumers to access secure tools that enable their financial well-being.

“Consumers have the right to access financial solutions that allow them to improve their financial well-being,” said Anil Arora, CEO of Envestnet | Yodlee. “The CFDR is committed to initiatives that enable fintech innovation in the United States, much of which has transpired globally including recent open API initiatives in Europe, the Open Banking standard in the UK, and the commitment by the Monetary Authority of Singapore to create an open API economy and promote the secure use of cloud environments. The consumers’ right to unfettered access to their financial data will help enable the continued growth of innovative financial technologies and ultimately help consumers improve their financial health.”

About Consumer Financial Data Rights (CFDR)

The Consumer Financial Data Rights (CFDR) is a new industry group formed by some of the most recognized companies in the financial sector, launched to support the consumers’ right to unfettered access to their financial data. Open data acess is critical to enabling innovative tools that can help consumers improve their financial lives. CFDR members seek to: drive financial innovation in a collaborative ecosystem by bridging the needs of consumers, banks, fintech innovators, and regulators; partner with banks to support unfettered access to consumer and small business data through a secure and open financial system; and promote consumer rights to access and share their financial data with third party companies that provide tools to enable better financial outcomes.

SOURCE Envestnet | Yodlee

WEX and OnDeck Announce Strategic Partnership to Offer Financing to WEX Small Business Customers

January 17, 2017

SOUTH PORTLAND, Maine–(BUSINESS WIRE)–WEX Inc. (NYSE: WEX), a leading provider of corporate and small business payment solutions, and OnDeck® (NYSE: ONDK), a leader in online lending for small business, announced a partnership in which WEX will offer business financing from OnDeck to its small business customers.

WEX is a global, multi-channel provider of corporate payment solutions representing more than 10 million vehicles and offering exceptional payment security and control across a wide spectrum of business sectors. The company and its subsidiaries employ more than 2,500 associates who provide services in the Americas, Europe, Australia, and Asia.

“Our partnership with OnDeck will be a huge benefit to our small to mid-sized business customers who will now have access to new sources of financing,” said Brian Fournier, vice president, fleet channel partner, WEX. “The strategic partnership will enable these customers to take advantage of OnDeck’s leading portfolio of products and services.”

“OnDeck is 100 percent focused on helping small businesses seize opportunities, such as hiring employees, funding marketing, or buying inventory,” said Jerome Hersey, vice president, OnDeck. “Our partnership with WEX, an innovator in the payments marketplace, will enable us to offer more small businesses an unparalleled set of choices to meet their financing needs.”

For more information about WEX’s small business offerings, please visit: http://www.wexinc.com/fleet/small-business/.

About WEX Inc.

WEX Inc. (NYSE: WEX) is a leading provider of corporate payment solutions. From its roots in fleet card payments beginning in 1983, WEX has expanded the scope of its business into a multi-channel provider of corporate payment solutions representing approximately 10 million vehicles and offering exceptional payment security and control across a wide spectrum of business sectors. WEX serves a global set of customers and partners through its operations around the world, with offices in the United States, Australia, New Zealand, Brazil, the United Kingdom, Italy, France, Germany, Norway and Singapore. WEX and its subsidiaries employ more than 2,500 associates. The company has been publicly traded since 2005, and is listed on the New York Stock Exchange under the ticker symbol “WEX.” For more information, visit www.wexinc.com and follow WEX on Twitter at @WEXIncNews.

About OnDeck

OnDeck (NYSE: ONDK) is the leader in online small business lending. Since 2007, the Company has powered Main Street’s growth through advanced lending technology and a constant dedication to customer service. OnDeck’s proprietary credit scoring system – the OnDeck Score® – leverages advanced analytics, enabling OnDeck to make real-time lending decisions and deliver capital to small businesses in as little as 24 hours. OnDeck offers business owners a complete financing solution, including the online lending industry’s widest range of term loans and lines of credit. To date, the Company has deployed over $5 billion to more than 60,000 customers in 700 different industries across the United States, Canada and Australia. OnDeck has an A+ rating with the Better Business Bureau and operates the educational small business financing website www.businessloans.com.

OnDeck, the OnDeck logo, OnDeck Score and OnDeck Marketplace are trademarks of On Deck Capital, Inc.

Contacts

WEX

Rob Gould, 207-523-7429

robert.gould@wexinc.com

or

OnDeck

Jim Larkin, 203-526-7457

jlarkin@ondeck.com

Bizfi Hits $2B Origination Milestone; Providing Financing to More Than 35,000 U.S. Small Businesses

December 22, 2016 NEW YORK–(BUSINESS WIRE)–Today, Bizfi, the premier fintech company with a platform that combines aggregation, funding and a marketplace on a single platform for small businesses, announced that it has surpassed $2 billion in financing – through both growth and working capital – to more than 35,000 small businesses across America.

NEW YORK–(BUSINESS WIRE)–Today, Bizfi, the premier fintech company with a platform that combines aggregation, funding and a marketplace on a single platform for small businesses, announced that it has surpassed $2 billion in financing – through both growth and working capital – to more than 35,000 small businesses across America.

The Bizfi.com marketplace was launched in 2015 to provide small business owners with access to multiple financing options from more than 45 lending partners. These financing options include short-term financing, franchise financing, lines of credit, equipment financing, medical financing, invoice financing, medium-term loans and long-term loans guaranteed by the U.S. Small Business Administration.

“Over eleven years ago, when Bizfi became one of the first alternative finance lenders, we understood that if we remained committed to the principle of providing business owners with fast access to smart capital, we could achieve growth while supporting the number one job engine in the economy,” said Stephen Sheinbaum, founder, Bizfi. “During the last decade we have invested in creating the best platform and user experience with the most advanced technology to ensure business owners can access the financing they need. Hitting this milestone reinforces that our business fundamentals are strong and we are providing a much needed service in this growing economy.”

“Every dollar we provide to a small business owner returns multiples of GDP,” said John Donovan, CEO of Bizfi. “Being able to support the small business community is at the heart of our company. We believe there is tremendous opportunity to grow our marketplace offerings. We have funded over 35,000 small businesses and we look forward to greatly expanding that number.”

Donovan continued, “One of the key reasons why I joined Bizfi as its Chief Executive Officer was its growth trajectory. In just two years, the company has gone from supplying $1B to small businesses to $2B. This is a testament to our unique business model of providing both a financial product and a marketplace.”

Built from proprietary technology, Bizfi’s platform uses application program interface (APIs) to leverage a wide variety of sources to quickly offer loans and other financial products to small businesses. The platform is strengthened by strategic relationships with more than 45 funding partners, 15 of which are integrated within the platform, including OnDeck (NASDAQ:ONDK), Funding Circle, Bluevine, and Kabbage. Bizfi is also a direct lender on the platform.

About Bizfi

Bizfi is the premier fintech company combining aggregation, funding and a marketplace on a single platform for small businesses. Founded in 2005, Bizfi and its family of companies have provided $2 billion in financing to more than 35,000 small businesses in a wide variety of industries across the United States.

Bizfi’s connected marketplace instantly provides multiple funding options and real-time pre-approvals to businesses from a wide variety of funding partners. Bizfi’s funding options include short-term financing, franchise financing, lines of credit, equipment financing, medical financing, invoice financing, medium-term loans and long-term loans guaranteed by the U.S. Small Business Administration. The Bizfi API provides a turnkey white label or co-branded solution that easily allows strategic partners to access the Bizfi engine and present their clients with financial offers from Bizfi lenders all while maintaining their customer’s user experience. A process that once took hours, now takes minutes.

Contacts

Media

KCSA Strategic Communications

Kate Tumino, 212-896-1252

ktumino@kcsa.com

or

Bizfi

Sales, 855-462-4934

bizfisales@bizfi.com

or

Bizfi

Marketing, 212-545-3182

marketing@bizfi.com

A Q4 To Remember – A Timeline

December 18, 2016In case you haven’t noticed, it’s been an interesting few months for alternative finance. The below timeline is an expanded version of what appears in the print version of our Nov/Dec magazine issue.

9/27 Able Lending secured $100 million in debt financing

9/30 The FTC won a judgement of $1.3 billion against payday loan kingpin Scott Tucker, its largest ever award through litigation

10/11 The United States Court of Appeals for The District of Columbia ruled the CFPB’s organizational structure unconstitutional. To remedy, the agency will either have to convert its one-person directorship to a multi-member commission or the director will have to report to the President of the United States. The CFPB is appealing the decision.

10/13 Affirm secured $100 million in debt financing

10/14

- CircleBack Lending was reported to have ceased lending operations

- Goldman Sachs unveiled its new online consumer lending division, Marcus

10/20 CommonBond secured a $168 million securitization deal

10/24 Bizfi announced that John Donovan had joined the company as CEO. Donovan was the COO of Lending Club from 2007 to 2012.

10/25

- Expansion Capital Group announced new management team. Vincent Ney, the company’s majority shareholder became the CEO

- Lendio raised $20 million through a new equity round led by Comcast Ventures and Stereo Capital

- Lending Club announced its foray into the $1 trillion auto refinancing market

11/1

- Cross River Bank raised $28 million in equity led by Boston-based investment firm Battery Ventures along with Silicon Valley venture capital firms Andreessen Horowitz and Ribbit Capital

- Square beat earnings estimates and extended $208 million through 35,000 loans in Q3

11/3

- OnDeck announced earnings, continued use of balance sheet to fund loans and extended $613 million in Q3

- Independent merchant cash advance training course goes live, allowing brokers and underwriters to earn a certificate

11/4 SEC concluded its investigation into Lending Club

11/7 Lending Club announced earnings and a deal to sell $1.3 billion worth of loans to a National Bank of Canada subsidiary

11/8 CFG Merchant Solutions secured a $4 million revolving line of credit

11/9 Donald Trump became the President-Elect

11/11

- Fintech leader Peter Thiel joins the executive committee of Trump’s transition team

- Kabbage appointed Amala Duggirala as Chief Technology Officer and Rama Rao as Chief Data Officer

11/14 Prosper’s CEO Aaron Vermut, stepped down

11/16

- UK-based p2p lender Zopa applied for a banking license

- Small business lender Dealstruck reportedly ceases lending operations

- Former Lending Club CEO revealed to be launching a new rival, Credify

11/17

- LiftForward secured a $100 million credit facility

- Prosper filed their Q3 10-Q, revealing that they only originated $311.8 million in loans for the quarter compared to $445 million in Q2

- The IRS sent a broad request to Coinbase, the nation’s largest bitcoin exchange, as part of a hunt for tax evaders

- PeerStreet raised a $15 million Series A funding round led by Andreessen Horowitz

11/18 P2Bi raised $7.7 million in venture financing

11/22 LendIt announced the first ever industry awards event

11/29 Three C-level executives at CAN Capital are placed on a leave of absence after the company identified assets that were not performing as expected

12/2

- Total Merchant Resources secures $20 million in private equity, launches wholesale funding division

- Bitcoin-based P2P lending platform BitLendingClub shuts down

- OCC announces they are moving forward with a special purpose national charter for fintech companies

12/8 Former CEO and co-founder of World Wrestling Entertainment tapped to run Small Business Administration

12/9 OnDeck announced new $200 million revolving credit facility with Credit Suisse

12/12 Knight Capital Funding announced new Chief Data Scientist

12/13 Fifth Third Bank is reported to buy a stake in franchise marketplace lender ApplePie Capital

12/14 BlueVine raised $49 million in Series D funding

12/15

- Swift Capital named Tim Naughton as Chief Legal Officer

- John MacIlwaine, Lending Club’s Chief Technology officer, submitted his resignation to the company to pursue another opportunity

12/16 CAN Capital is reported to have laid off more than 100 employees

OnDeck Announces New $200 Million Revolving Credit Facility with Credit Suisse

December 9, 2016

NEW YORK, Dec. 9, 2016 /PRNewswire/ — OnDeck® (NYSE: ONDK), the leader in online lending for small business, announced today the closing of a $200 million asset-backed revolving debt facility with Credit Suisse.

In addition to its other funding sources, OnDeck may now obtain funding under the new credit facility with Credit Suisse, subject to customary borrowing conditions, by accessing $125 million of committed capacity and an additional $75 million of capacity available at the discretion of the lenders.

“OnDeck has emerged as a leading provider of growth capital to small businesses around the country,” said Jon-Claude Zucconi, Managing Director, Credit Suisse. “The team’s innovative vision and commitment to financing is vital to expansion and growth in the small business community.”

Under the facility, loans will be made to Prime OnDeck Receivable Trust II, LLC, or PORT II, a wholly-owned subsidiary of OnDeck, to finance PORT II’s purchase of small business loans from OnDeck. The revolving pool of small business loans purchased by PORT II serves as collateral under the facility. OnDeck is acting as the servicer for such small business loans. The Class A Loans under the facility were rated by DBRS, Inc.

OnDeck intends to initially use a portion of this facility, together with other available funds, to optionally prepay in full without penalty or premium, the existing $100 million Prime OnDeck Receivable Trust, LLC facility which was scheduled to expire in June 2017. As a result, OnDeck will benefit from obtaining additional funding capacity through December 2018.

OnDeck intends to initially use a portion of this facility, together with other available funds, to optionally prepay in full without penalty or premium, the existing $100 million Prime OnDeck Receivable Trust, LLC facility which was scheduled to expire in June 2017. As a result, OnDeck will benefit from obtaining additional funding capacity through December 2018.

“This transaction marks a continuation of our financing strategy to diversify funding sources, extend debt maturities, and create additional funding capacity to pave the way for future loan growth,” said Howard Katzenberg, Chief Financial Officer, OnDeck. “We are pleased to have Credit Suisse, a leading global financial institution, support OnDeck in our mission to power the growth of small business through lending technology and innovation.”

About OnDeck

OnDeck (NYSE: ONDK) is the leader in online small business lending. Since 2007, the company has powered Main Street’s growth through advanced lending technology and a constant dedication to customer service. OnDeck’s proprietary credit scoring system – the OnDeck Score® – leverages advanced analytics, enabling OnDeck to make real-time lending decisions and deliver capital to small businesses in as little as 24 hours. OnDeck offers business owners a complete financing solution, including the online lending industry’s widest range of term loans and lines of credit. To date, the company has deployed over $5 billion to more than 60,000 customers in 700 different industries across the United States, Canada, and Australia. OnDeck has an A+ rating with the Better Business Bureau and operates the educational small business financing website BusinessLoans.com.

For more information, please visit www.ondeck.com.

About Credit Ratings

Credit ratings are opinions of the relevant rating agency. They are not facts and are not opinions of OnDeck. They are not recommendations to purchase, sell or hold any securities and can be changed or withdrawn at any time.

Safe Harbor Statement

This press release contains “forward-looking statements” within the meaning of the private Securities Litigation Reform Act of 1995 and other legal authority. Forward-looking statements include statements about the intended use of proceeds from the new facility and expected optional repayment in full of the existing facility, the extension of debt maturities and the availability of additional funding capacity, all of which are dependent upon compliance with the borrowing and other conditions of the new facility, as well as information concerning OnDeck’s business plans and objectives and financing plans including future loan growth. Forward-looking statements can also be identified by words such as “will,” “enables,” “expects”, “may,” “allows,” “continues,” “believes,” “intends,” “anticipates,” “estimates” or similar expressions. Forward-looking statements are neither historical facts nor assurances of future performance. They are based only on OnDeck’s current beliefs, expectations and assumptions regarding the future of its business, anticipated events and trends, the economy and other future conditions. Moreover, OnDeck does not assume responsibility for the accuracy and completeness of forward-looking statements. As such, they are subject to inherent uncertainties, changes in circumstances, known and unknown risks and other factors that are difficult to predict and in many cases outside OnDeck’s control.

As a result, you should not rely on any forward-looking statements. OnDeck’s expected results may not be achieved, and actual results may differ materially from OnDeck’s expectations. Important factors that could cause actual results to differ from OnDeck’s forward-looking statements are the risks that OnDeck may not be able to manage its anticipated or actual growth effectively, that its credit models do not adequately identify potential risks, and other risks, including those under the heading “Risk Factors” in OnDeck’s Annual Report on Form 10-K for the year ended December 31, 2015, Quarterly Report on Form 10-Q for the quarter ended September 30, 2016 and in other documents that OnDeck files with the Securities and Exchange Commission, or SEC, from time to time which are available on the SEC website at www.sec.gov. OnDeck undertakes no obligation to publicly update any forward-looking statements for any reason after the date of this press release to conform these statements to actual results or to changes in OnDeck’s expectations, except as required by law.

OnDeck, the OnDeck logo and OnDeck Score are trademarks of On Deck Capital, Inc.

Logo – http://photos.prnewswire.com/prnh/20150812/257781LOGO

SOURCE On Deck Capital, Inc.

Smile, Dial and Trial? Why the Next Call Might be Your Worst Nightmare

October 26, 2016

Aaron Smith sued a merchant cash advance company in the United States District Court of Southern California earlier this year for allegedly making unsolicited calls to his personal cell phone registered on the Do-Not-Call list. His name has been changed for this story because he’s a vexatious litigator, even landing on an official list of vexatious litigants by the State of California in the early 2000s thanks to his tendency to file harassing lawsuits. But that’s not all, Smith has a criminal history that includes stalking and extortion and he’s served time in prison for his role in a multi-million dollar mortgage fraud RICO conspiracy.

These days he’s suing small business financing companies for alleged violating phone calls, at least five of which we could identify through San Diego court records just over the last several months. Two of the suits appeared while we were researching this story, which means that there could probably be even more by the time that you are reading this.

Smith presumably runs a business as his website has and still continues to advertise services to consumers. But if you are not an existing customer or have not been referred by an existing customer, his website warns that attempting to contact him by any means is a violation. Suffice to say that AltFinanceDaily did not attempt to contact Smith to get his side of the story.

In one complaint, Smith claims that the phone number receiving the unsolicited calls is a “private personal cellular telephone.” To his credit, a cursory glance of his business website does not appear to list any phone number for it at all. However, the Internet Archive Wayback Machine which allows users to see archived versions of web pages across time, revealed that very same phone number being prominently displayed on his business website for several years including up to as recent as September, 2015, after which it was removed. There’s reason then to question if Smith might be up to no good.

While the merits of Smith’s claims will be up to the courts to decide, his background doesn’t inspire confidence. Countless other plaintiffs using the Telephone Consumer Protection Act (TCPA) to file lawsuits have colorful backgrounds in their own right, a lot of which can be found using Google. But a suggestion relayed by some of our readers is that plaintiffs appear to be doing what they do for profit, not because they have been harmed by the calls they allegedly receive. AltFinanceDaily decided to conduct its own independent research on this issue.

SUING FOR PROFIT?

That’s just what the headline of a WDSU TV story alluded to in its coverage in 2004 of a stay-at-home Pennsylvania dad named Stewart Abramson. Titled, Man Who Turns Table On Telemarketers Turns Profit, Too, quotes Abramson as saying, “First, I’ll write them all and tell them that I’m willing to settle for the minimum statutory damages per call, which is $500, but if they don’t want to settle, then I’ll file a civil complaint.”

In a case he won against a debt consolidation firm for calling him with a prerecorded message, Abramson reportedly said, “It would have made sense for them to pay the minimum damages due me, but they wanted to put up a fight. I don’t mind. I’ll take more money.”

Abramson continued to say at the time that he felt empowered by Congress to stop this illegal activity and that he was just doing his part and making a little money for doing so. More than a decade later, Abramson’s name is still showing up as a plaintiff in TCPA cases, including in at least one complaint discovered by AltFinanceDaily against a small business financing company.

Abramson continued to say at the time that he felt empowered by Congress to stop this illegal activity and that he was just doing his part and making a little money for doing so. More than a decade later, Abramson’s name is still showing up as a plaintiff in TCPA cases, including in at least one complaint discovered by AltFinanceDaily against a small business financing company.

According to court records, the defendant contended that Abramson was “in the business of suing entities for violations of the TCPA,” an accusation the judge ruled irrelevant to the particular matter at hand.

Michael Goodman, a partner in the Washington DC office of law firm Hudson Cook, who was not asked about this case specifically, said in an emailed interview that generally accusing someone of being a serial plaintiff might not really help.

“Accusing a plaintiff of being a serial or professional TCPA plaintiff is unlikely to affect the outcome much, if at all,” Goodman said. “While there are outliers, the general rule is that the court will assess the merits of each case individually and will not ‘punish’ a plaintiff for being a serial or professional TCPA plaintiff.”

An email address for Abramson could not be located and given the special circumstances of his history, we did not attempt to call him.

If ever there was a TCPA celebrity however, it’d be Diana Mey, a self-described stay-at-home mom who started wrangling with telemarketers in 1998 after what her website described as “a series of intrusive telemarketing calls by a Sears affiliate pitching vinyl siding.”

She’s an important figure in TCPA history, not just because she’s been awarded millions through her lawsuits but also because she helped draft the FTC’s rules. Reports show her participating in FTC-hosted telemarketing forums in 2000 and 2002 and her name even appears in the footnotes of the FTC’s Telemarketing Sales Rule entered into the Federal Register in 2003. And so we followed Mey’s story online, noting that she has actually become famous for her pursuits, even appearing in a TV segment for ABC News in 2012. Her website at www.dianamey.com teaches others how they too can pursue monetary damages from telemarketers that engage in illegal practices.

“The first step is to write a formal ‘demand’ letter to the president of the company, stating that the letter is a formal claim for money […] for violations of the Telephone Consumer Protection Act of 1991,” her website advises.

It was quite a surprise then to discover that this Diana Mey was the same Diana Mey captioned as a plaintiff in a current case against a small business financing company. Almost two decades after her first experience, she is still filing lawsuits for alleged telemarketing violations.

Mey declined to respond to our questions even though they were not about that case, citing pending litigation.

“I’m a mom and I’m a housewife, and I’m an accidental activist,” Mey said in that 2012 ABC News interview. Others have referred to her as a “private attorneys general,” defined as someone who brings a lawsuit considered to be in the public interest.

That same title has been attributed to one Robert Braver who is the man behind www.do-not-call.com which launched in 1998 as “a consumer’s resource for stopping unsolicited telemarketing calls.” His comments appear in FCC records and he was also featured in a Dateline NBC special in 2002 about a new telemarketing scheme that was alarming consumers. Suffice to say Braver has been a consumer proponent in this area of the law for a long time, a role that has not come without risks.

According to Braver, the attorney for one telemarketer he sued, arranged to have his (then) elementary school age kids stalked and photographed, a terrifying ordeal that was only made worse after the attorney allegedly sent him a fax bragging about it. But he has continued on, noting that while he has gotten much fewer junk faxes, telemarketing calls have gotten more out of hand over time, to the point where they’re disruptive to everyday life.

“My wife is a middle school teacher,” Braver said. “She doesn’t work in the summer and gets home before I do when she is teaching. She typically leaves her phone in her purse in a spot in the kitchen and hangs out in in the den or back patio. It’s gotten so bad at times that when I need to call her, she doesn’t get up and run to look at her phone when it rings, and I have ignored unknown calls on my cell and let them go to voicemail, only to find out later that they were legit calls.”

And sometimes it’s a total mystery how they even get added to a list. “We have two teenage boys still at home, and they have cell phones too. Somehow my youngest son’s cell number got on a marketing list for student loan debt relief, and was getting 10-15 calls a day for a while,” Braver explained.

Contrast that with a story that appeared in the Dallas Observer in 2010 about one Craig Cunningham, another celebrity-like TCPA figure who still has active cases pending, public records reveal.

According to the story, Cunningham stays at home on a “dumpy couch” to wait for a particular type of phone call, “one from a representative of a debt collection agency or a credit card company, whom he’ll try to ensnare like a Venus fly trap,” the Observer reported. Cunningham is said to have learned his trade from online message boards, where we decided to look next to see if there was anyone out there indeed talking about TCPA lawsuits for profit.

On May 25, 2014, a participant using the pseudonym codename47 published a thread titled, TCPA enforcement for fun and for profit up to 3k per call on fatwallet.com, the exact kind of salacious headline that defendant companies have probably imagined in their worst nightmares. Codename47 has a big fan base it seems, with one user even suggesting to him that he should create and sell a “sue telemarketers” package so that people could do what he does for side income.

Codename47 is Craig Cunningham, who we reached out to with some questions through the fatwallet forum. He declined to answer them, citing pending litigation and the fact that he no longer does interviews.

One user on fatwallet in 2010 said of Cunningham, “It’s kind of hard to convince a Federal judge that you are a victim when you are trying to find a publisher for a book called CREDIT TERRORIST.”

WAIT, WHAT?

WAIT, WHAT?

It now being six years later, no such book can be found in Amazon or through Google. A link to where purported information on it once was leads to a page-not-found error. The Archive Wayback Machine however, produces an interesting find.

Tales Of A Debt Collection Terrorist: How I Beat the Credit Industry At Its Own Game and Made Big Money From the Beat Down is the title of a proposed book in 2010 by Craig Cunningham and Brian O’Connell. O’Connell is a writer/content producer for TheStreet.com and a well-known and widely published author. He tells AltFinanceDaily that he wished he had written it with Cunningham but that they didn’t move forward with it.

But the proposal remains, including the description of Cunningham as being a highly sought after expert in the field of debt collection “revenge” industry.

Outside of fatwallet, the only other real mention of the proposed book could be found on a website called debtorboards.com. Lenders might find the website horrifying considering the forum’s tagline is “Sue Your Creditor and Win.” With more than 20,000 members and nearly 300,000 posts, the forum has an entire section dedicated to TCPA. Legal strategy is a dominant topic and it’s abundantly obvious that people are working together to stop companies from calling them.

Sadly, it’s not all innocent consumers out there. For example, the TCPA has invited abuse to the point where at least one person admitted to buying cell phones to maximize the chances of getting illegal calls so that they could sue. That’s what serial plaintiff Melody Stoops said in a June 2016 deposition as part of her case against Wells Fargo in the Western District of Pennsylvania.

Q. Why do you have so many cell phone numbers?

A. I have a business suing offenders of the TCPA business — or laws.Q. And when you say business, what do you mean by business?

A. It’s my business. It’s what I do.Q. So you’re specifically buying these cell phones in order to manufacture a TCPA? In order to bring a TCPA lawsuit?

A. Yeah.

Purchasing at least 35 phones, she even went so far as to register them with out-of-state area codes in places she thought were more economically depressed and therefore more likely to get violating calls. Stoops sent out so many pre-litigation demand letters and filed so many lawsuits that she could not be certain how many she sent out or how many suits she was in, according her to deposition.

Purchasing at least 35 phones, she even went so far as to register them with out-of-state area codes in places she thought were more economically depressed and therefore more likely to get violating calls. Stoops sent out so many pre-litigation demand letters and filed so many lawsuits that she could not be certain how many she sent out or how many suits she was in, according her to deposition.

Apparently Stoops found the line of legal perversion and crossed it. On June 24, 2016, the judge ruled in favor of Wells Fargo because she wasn’t injured by the calls she received, nor were the injuries she claimed within the “zone of interests” the law was meant to protect. “It is unfathomable that Congress considered a consumer who files TCPA actions as a business when it enacted the TCPA,” he wrote.

A TURNING POINT?

Hudson Cook law partner Michael Goodman said, “the impact of Stoops v. Wells Fargo is still to be determined, but I would say that it is significantly fact specific and therefore unlikely to result in large-scale changes in TCPA private actions. Stoops put a lot of effort into becoming a magnet for calls that could violate the TCPA. In many TCPA cases, consumers do not need to try that hard to receive a call that could prompt a TCPA suit.”

Stoops was pursuing calls while most of the advice and discussion uncovered online is about what to do if you get a call, not about how to create the calls in the first place. Even debtorboards, for example, is a registered non-profit, keeping consistent with its image as a consumer empowerment tool.

If the tide is turning though, it’s not in a direction favorable to telemarketers. Goodman said that “in July 2015, the FCC announced a new interpretation of the TCPA’s ‘autodialer’ standard that significantly expanded the definition and introduced a lot of unnecessary uncertainty as to what is and is not a regulated autodialer. That interpretation is currently being challenged in court. There’s a bit of a trend among courts requiring plaintiffs in autodialer cases to do more than simply allege that they were called with an autodialer. These courts, possibly in an effort to frustrate TCPA autodialer cases, are requiring plaintiffs to include circumstantial evidence of dialer use in their complaints: dead air, hang-up calls, generic messages, and so on. But the TCPA’s penalty structure still encourages suits that should not be brought.”

FCC Commissioner Ajit Pai, who was appointed by President Obama, voiced dissent to this new interpretation, echoing Goodman’s comments that it encourages frivolous suits.

An excerpt of Pai’s official dissent is below:

“Some lawyers go to ridiculous lengths to generate new TCPA business. They have asked family members, friends, and significant others to download calling, voicemail, and texting apps in order to sue the companies behind each app. Others have bought cheap, prepaid wireless phones so they can sue any business that calls them by accident. One man in California even hired staff to log every wrong-number call he received, issue demand letters to purported violators, and negotiate settlements. Only after he was the lead plaintiff in over 600 lawsuits did the courts finally agree that he was a “vexatious litigant.”

The common thread here is that in practice the TCPA has strayed far from its original purpose. And the FCC has the power to fix that. We could be taking aggressive enforcement action against those who violate the federal Do-Not-Call rules. We could be establishing a safe harbor so that carriers could block spoofed calls from overseas without fear of liability. And we could be shutting down the abusive lawsuits by closing the legal loopholes that trial lawyers have exploited to target legitimate communications between businesses and consumers.

Instead, the Order takes the opposite tack. Rather than focus on the illegal telemarketing calls that consumers really care about, the Order twists the law’s words even further to target useful communications between legitimate businesses and their customers. This Order will make abuse of the TCPA much, much easier. And the primary beneficiaries will be trial lawyers, not the American public.”

The FCC reviewed 19 individual petitions on the matter, some of which included relatively recent comments from the individuals we’ve mentioned so far. The appearance is that the FCC has collaborated with some individuals continuously over time or that individuals have collaborated continuously with the FCC. It might not matter though. Michael Goodman says that “the TCPA gives distinct enforcement rights to the FCC as well as persons who receive a call that violates the statute.”

“It isn’t really a matter of whether a particular violation should be handled by the FCC or privately,” Goodman adds. “Private plaintiffs have independent incentive to sue thanks to the TCPA’s penalty structure, and, compared to the FCC, private plaintiffs do not have to be as choosy in picking targets for actions.”

And what are the violations and penalties exactly? Goodman explained as follows:

“Depending on the specific TCPA provision at issue, private actions may be brought by individual consumers as well as businesses. The autodialer and prerecorded message provisions can be enforced by individuals and consumers, and they can sue based on a single improper call. For these provisions, the TCPA directs courts to award $500 per violation; courts do not have discretion to award a lesser figure. Courts do have discretion to award up to three times that amount (i.e., up to $1,500) per violation for willful or knowing violations. The TCPA’s do-not-call provisions are enforced by individual consumers, and this type of action requires more than one unlawful call in a 12-month period. For the do-not-call provisions, courts do have discretion to award less than $500 per violation (and can triple the penalty for willful or knowing violations).

The FCC has authority to obtain penalties of up to $16,000 per day of a continuing violation or per violation. FCC rules establish factors for the FCC to consider in calculating a proper penalty figure, including the nature of the violation, history of prior offenses, and ability to pay.”

“The base $500 per violation in statutory damages that consumers are entitled to hasn’t increased since the TCPA went into effect in 1992,” said activist Robert Braver. “This should be increased, especially since the TCPA does not allow for the recovery of attorney’s fees.”

Goodman said that private actions are much more common than FCC enforcement actions. That much is obvious. Private actions are becoming all too common in the small business financing industry where so many cases were uncovered through public records that we lacked the resources to follow them all.

More lawsuits might not be the cure though, according to Braver. He said that “more egregious telemarketing (massive robocall campaigns) should be criminalized on the federal level,” adding that “it’s one thing for an unscrupulous telemarketer to allow their shell corporation to have an uncollectible money judgment, but it’s another thing when individuals can wind up with a felony conviction on their records, and possible jail time.”

More lawsuits might not be the cure though, according to Braver. He said that “more egregious telemarketing (massive robocall campaigns) should be criminalized on the federal level,” adding that “it’s one thing for an unscrupulous telemarketer to allow their shell corporation to have an uncollectible money judgment, but it’s another thing when individuals can wind up with a felony conviction on their records, and possible jail time.”

While that suggestion might antagonize telemarketers, Braver said that his cell phone, which is listed on the Do-Not-Call-Registry, can receive as many as 4-5 telemarketing calls per day, generally robocalls.

Whether plaintiff allegations from cases in this industry are true or not, legal fees over TCPA cases have continued to be an expense that many small business financing companies are contending with. Those costs have a way of being tacked on to the price of financing for small businesses that need capital, making it a lose-lose situation.

One marketing company in the industry who had to remain anonymous because settlement negotiations at the time were likely to include a non-disclosure clause, posed the question, “how are you supposed to help small businesses if you can’t actually call small businesses?”

“More and more merchants are using their cell phone as their business phone,” he argued. “The TCPA regulations need to be changed so that a merchant can’t claim his cell phone is his business phone one minute and his personal phone the next.”

Indeed, the motivations, facts and alleged damages in TCPA complaints are not always clear. And even though the plaintiffs don’t always win, the laws as they are, can make telemarketing difficult no matter how careful one is.

Still dialing for dollars these days? Just know that some folks may be just a little too happy that you called them. And for all the wrong reasons.

Good luck out there.

FIRE DRILL IN ILLINOIS: BUSINESS FUNDING COMPANIES TARGETED IN REPRESSIVE BILL

June 30, 2016* Update 6/30 AM: Sen. Jacqueline Collins, D-Chicago is expected to introduce a revised bill today.

** Update 6/30 PM: Reintroduction of the bill has been delayed while they wait for comments from additional parties

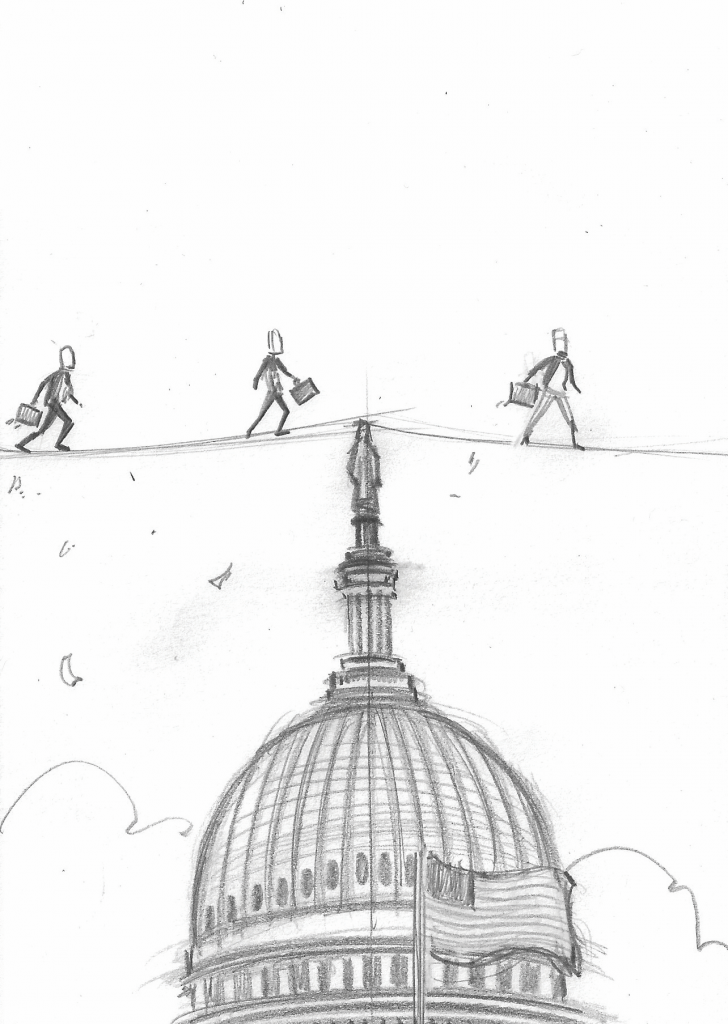

Bankers and non-bank commercial lenders – two groups that often disagree – are united in their opposition to financial regulation proposed in Illinois. Both contend that if the state’s Senate Bill 2865 becomes law it could choke the life out of small-business lending in the Land of Lincoln and might set a precedent for a nightmarish 50-state patchwork of rules and regulations.

Bankers and non-bank commercial lenders – two groups that often disagree – are united in their opposition to financial regulation proposed in Illinois. Both contend that if the state’s Senate Bill 2865 becomes law it could choke the life out of small-business lending in the Land of Lincoln and might set a precedent for a nightmarish 50-state patchwork of rules and regulations.

Foes say the measure was created to promote disclosure and regulate underwriting. They don’t argue with the need for transparency when it comes to stating loan terms, but they maintain that a provision of the bill that would cap loan payments at 50 percent of net profits would disrupt the market needlessly.

Opponents also regard the bill as an encroachment on free trade. “The government shouldn’t be picking winners or losers – the market should be,” said Steve Denis, executive director of the Small Business Finance Association, a trade group for alternative funders.

The states or the federal government may need to protect merchants from a few predatory lenders, but most lenders operate reputably and have a vested interest in helping clients succeed so they can pay back their obligations and become repeat customers, several members of the industry maintained.

“The ability to pay is really a non-issue,” noted Matt Patterson, CEO of Expansion Capital Group and an organizer of the Commercial Finance Coalition, another industry trade group. “I don’t make any money if a borrower doesn’t pay me back, so I don’t make loans where I think there is an inability to pay.”

Outsiders may find interest rates high for alternative loans, but companies providing the capital face high risk and have a short risk horizon, said Scott Talbott, senior vice president of government affairs for the Electronic Transactions Association, whose members include purveyors and recipients of alternative financing. Several other sources said the risks justify the rates.

Besides, a consensus seems to exist among industry leaders that most merchants – unlike many consumers – have the sophistication to make their own decisions on borrowing. Business owners are accustomed to dealing with large amounts of money, and they understand the need to keep investing in their enterprises, sources agreed.

In fact, no one has complained of any small-business lending problems in Illinois to state regulators, said Bryan Schneider, secretary of the Illinois Department of Financial and Professional Regulation and a member of Gov. Bruce Rauner’s cabinet.

Regulators should not indulge in creating solutions in search of problems, Sec. Schneider cautioned. “When you’re a hammer, the world looks like a nail,” he said, suggesting that regulators sometimes base their actions on anecdotal isolated incidents instead of reserving action to correct widespread problems.

But the proposed legislation could itself cause problems by placing entrepreneurs at risk, according to Rob Karr, president and CEO of the Illinois Retail Merchants Association, which has 400 members operating 20,000 stores. “It would stifle potential access to capital for small businesses,” he warned.

Quantifying the resulting damage would present a monumental task, but a shortage of capital would clearly burden merchants who need to bridge cash-flow problems, Karr said. Shortfalls can result, for example, when clothing stores need to buy apparel for the coming season or hardware stores place orders in the summer for snow blowers they’ll need in six to eight months, he said.

Restaurant owners and other merchants who rely on expensive equipment also need access to capital when there’s a breakdown or a need to expand to meet competition or take advantage of a market opportunity, Karr observed.

Capital for those purposes could dry up because just about anyone providing non-bank loans to small merchants could find themselves subject to the proposed legislation, including factoring companies, merchant cash advance companies, alternative lenders and non-bank commercial lenders, said the CFC’s Patterson.

Banks and credit unions are exempt, the bill says, but a page or two later it includes provisions written so broadly that it actually includes those institutions, said Ben Jackson, vice president of government relations at the Illinois Bankers Association.

Trade groups representing all of those financial institutions – including banks and non-banks – have joined small-business associations in working against passage SB 2865. “The most important thing is to make sure we’re coordinating with the other groups out there,” the SBFA’s Denis contended. “Actually, Illinois was good practice for the industry in how we’re going to go about dealing with attempts at regulation.”

Patterson of the CFC agreed that associations should coordinate their responses to proposed legislation. “We’ve tried to gather all the affected players in the space and have dialogue with them,” he maintained.

Even though that various associations reacting to the bill generally agreed on principles, their competing messages at first created a cacophony of proposals, according to some. “There was a lot of noise, and I think we’ll all learn from that,” Denis said. “The industry has to learn to speak with one voice to legislators.”

Citing the complexity of dealing with 50 states, 435 members of Congress and 100 senators, Denis said everyone with an interest in small-business lending must work together. “If we don’t, we lose,” he warned.

Many of the groups came together for the first time as they converged upon the Illinois capital of Springfield last month when the state’s Senate Committee on Financial Institutions convened a hearing on the bill. The committee allowed testimony at the hearing from three groups representing opponents. The groups huddled and chose Denis, Jackson and Martha Dreiling, OnDeck Capital Inc. vice president and head of operations.

City of Chicago Treasurer Kurt Summers was the only witness who testified in favor of the bill, according to Jackson. The idea of regulating non-bank commercial lenders in much the same way Illinois oversees lending to individuals arose in Summers’ office, said an aide to Illinois Sen. Jacqueline Collins, D-Chicago. Sen. Collins serves as chairperson of the Financial Institutions Committee and introduced to the bill in the senate.

Sen. Collins declined to be interviewed for this article, and Treasurer Summers and other officials in his of office did not respond to interview requests. However, published reports said Drew Beres, general counsel for Summers, has maintained that transparency, not underwriting, is the main goal. Talbott has met with Sen. Collins and said she’s interested primarily in transparency.

Support for the bill isn’t limited to the Chicago treasurer’s office. Some non-profit lending groups and think tanks back the proposed legislation, opponents agreed. The bill appeals to progressives attempting to shield the public from unsavory lending practices, they maintained.

Politicians may view their support of the bill as a way of burnishing their progressive credentials and establishing themselves as consumer advocates, said opponents of the legislation who requested anonymity. “It’s an important constituency,” one noted. “No one is against small business.”

After listening to testimony at the hearing, committee members voted to move the bill out of committee for further progress through the senate, Jackson said. Eight on the committee voted to move the bill forward, while two voted “present” and one was absent. But most of the senators on the committee said the legislation needs revision through amendments before it could become law, according to Jackson.

The legislative session was scheduled to end May 31. If the bill didn’t pass by then it could come up for consideration in a summer session if the General Assembly chooses to have one, Jackson said. If it does not pass during the summer, it could come to a vote during a two-week “veto session” in the fall or in an early January 2017 “lame duck session.” Unpassed legislation dies at that point and would have to be reintroduced in the regular session that begins later in January 2017, he noted.

Although time is becoming short for the proposed legislation, it’s a high-profile measure that could prompt action, particularly if amendments weaken the rule for underwriting, Jackson said. The Illinois General Assembly sometimes passes important legislation during lame duck sessions, he said, noting that a temporary increase in the state sales tax was enacted that way.

Whatever fate awaits SB 2865, some in the alternative funding business have suspected that the bill came about through an effort by banks to push non-banks out of the market. But cooperation among groups opposed to the proposed legislation appears to lay that notion to rest, according to several sources.

“I don’t get that impression,” Denis said of the allegation that bankers are colluding against alternative commercial lenders. “I think this shows banks and our industry can get together and share the same mission.”

Talbott of the ETA also counted himself among the disbelievers when it comes to conspiracy theories against alternative lenders. “I’d say that’s a misreading of the law and not the case,” he said. “Traditional banks oppose this because it would effectively reduce their options in the same space.”

The interests of banks and non-banks are beginning to coincide as the two sectors intertwine by forming coalitions, noted Jackson of the state bankers’ association. A number of sources cited mergers and partnerships that are occurring among the two types of institutions.

In one example, J.P. Morgan Chase & Co. is using OnDeck’s online technology to help make loans to small businesses. Meanwhile, in another example, SunTrust Banks Inc. has established an online lending division called LightStream.

At the same time, alternative funders who got their start with merchant cash advances and later added loans are contemplating what their world would be like if they turned their enterprises into businesses that more closely resembled banks.

At the same time, alternative funders who got their start with merchant cash advances and later added loans are contemplating what their world would be like if they turned their enterprises into businesses that more closely resembled banks.

And however the industries structure themselves, the need for small-business funding remains acute. Banks, non-banks and merchants agree that the Great Recession that began in 2007 and the regulation it spawned have discouraged banks from lending to small-businesses. The alternative small-business finance industry arose to fill the vacuum, sources said.

That demand draws attention and could lead to bouts of regulation. Although industry leaders say they’re not aware of legislation similar to Illinois SB 2865 pending in other states, they note that New York state legislators discussed small-business lending in April during a subject matter hearing. They also point out that California regulates commercial lending.

Many dread the potential for unintended results as a crazy quilt of regulation spreads across the nation with each state devising its own inconsistent or even conflicting standards. Keeping up with activity in 50 states – not to mention a few territories or protectorates – seems likely to prove daunting.

But mechanisms have been developed to ease the burden of tracking so many legislative and regulatory bodies. The CFC, for instance, employs a government relations team to monitor the states, Patterson said. The ETA combines software and people in the field to deal with the monitoring challenge.

And regulation at the state level can make sense because officials there live “close to the ground,” and thus have a better feel for how rules affect state residents than federal regulators could develop, Sec. Schneider said.

Easier accessibility can also keep make regulators more responsive than federal regulators, according to Sec. Schneider. “It’s easier to get ahold of me than (Director) Richard Cordray at the Consumer Financial Protection Bureau,” he said.

Also, state regulators don’t want to take a provincial view of commerce, Sec. Schneider noted. “As wonderful as Illinois is, we want to do business nationwide,” he joked.

State regulators should do a better job of coordinating among themselves, Sec. Schneider conceded, adding that they are making the attempt. Efforts are underway through the Conference of State Bank Supervisors, a trade association for officials, he said.

At the moment, state legislatures and federal regulators have small-business lending “squarely on their agenda,” the ETA’s Talbott observed. The U.S. Congress isn’t paying close attention to the industry right now because they’re preoccupied with the elections and the presidential nominating conventions, he said.

The goal in Illinois and elsewhere remains to encourage legislators to adopt a “go-slow approach” that affords enough time to understand how the industry operates and what proposed laws or regulations would do to change that, said Talbott.

At any rate, the industry should unite in a proactive effort to explain the business to legislators, according to Denis. “We need to work with them so that they understand how we fund small businesses,” he said. “That’s the way we can all win.”