SBFA Launches Broker Council

May 11, 2018

The Small Business Finance Association (SBFA) announced today the launch of a new initiative called the SBFA Broker Council designed to create and implement a set of best practices for brokers of alternative funding products.

“I think this would create two playing fields,” said SBFA member and CEO of United Capital Source Jared Weitz. “A playing field where a group belongs to this association and we understand that that group is acting in best practice, and another group that is acting on their own behalf, and we hope that they’re acting in best practice, but we can’t verify it. Folks in our group we can verify.”

Weitz and James Webster, CEO and co-founder of National Business Capital, are spearheading the SBFA Broker Council. They are the co-chairs and are in the process of selecting a board of other brokers.

What would membership in the SBFA Broker Council mean? It would mean abiding by a set of best practices. Weitz told AltFinanceDaily that he and Webster would like to implement background checks on owners of brokerages and would like to make sure that brokers are storing data in their offices properly so that merchants aren’t vulnerable to having their private information stolen and abused.

They also want to make sure that brokers have the appropriate licenses in states that require them, that fees are being explained to merchants transparently and that merchants are not being triple or quadruple funded at once, “hurting the cash companies and the merchants,” Weitz said.

Membership in the SBFA Broker Council would require SBFA membership. Current members include funders, ISOs/brokerage companies and vendors that are active in the alternative funding space.

“To participate, we want members,” said Jeremy Brown, Chairman of the SBFA. “We want to give [broker members] sort of our seal of approval, and we want to know that they’re going to represent the ideals we stand for.”

Brown said that brokers have a reduced membership fee: $475/month for smaller brokerages and $950/month for larger ones.

Brown, who is also Chairman of RapidAdvance, a funding company, said that having membership in or an organization that has a set of standards would give him comfort as a funder.

“[This] would give me a lot of confidence that you’re a good actor,” Brown said, “because one of the problems in the industry is that you do have people in an unregulated business that do unethical things. So knowing who to deal with is really important and valuable.”

The SBFA is a non-profit advocacy organization with a mission to educate policymakers and regulators about the alternative funding business. According to today’s announcement, a goal of the SBFA Broker Council is to promote brokers who act fairly. But how could a third party association advance a broker’s career?

Weitz said:

“We would be able to have a badge on our email and on our website that says we are SBFA broker approved, meaning that anyone who’s a part of this council…would be on the [SBFA] website so we can build credibility when we’re on the phone with a merchant. We can say, ‘Hey, you probably spoke to three or four different brokerage shops today. It’s prudent to do that…however, let’s make sure that the ones you’re talking to belong to this association because those are the ones that are going to act on your behalf, the right way.”

Announcing the Launch of the SBFA Broker Council

May 11, 2018Washington, D.C.—The Small Business Finance Association (SFBA) today announced the launched a new initiative called the SFBA Broker Council dedicated to bringing together responsible brokers that serve small businesses to focus on creating best practices. The Council is co-chaired by Jared Weitz, founder & CEO of United Capital Source and James Webster, CEO & co-founder of National Business Capital. The mission of the Council will be to create standards and a certification for brokers who agree to best practices focused on four basic principles—transparency, responsibility, fairness, and security.

“We want to give small business owners confidence that the brokers they work with are trustworthy, vetted, and committed to being responsible,” said Jared Weitz. “We need to take steps to promote brokers who are acting in the best interest of small business owners and send a clear message about the valuable role we play in the small business finance ecosystem.”

“We need brokers who believe in best practices to enter the national conversation about small business alternative finance and show policymakers how we serve small business customers,” said James Webster. “We all know there are bad actors out there, but the goal of this Council is to help show the how responsible brokers are working to capitalize underserved small businesses.

“We appreciate Jared’s and James’ leadership in creating this new initiative within SBFA,” said Jeremy Brown, chairman of RapidAdvance and chairman of SBFA. “It is important we send a message to the millions of small businesses we serve that we support brokers who understand that transparency, responsibility, fairness, and security are critical to our industry’s future.”

SBFA is a non-profit advocacy organization dedicated to ensuring Main Street small businesses have access to the capital they need to grow and strengthen the economy. SBFA’s mission is to educate policymakers and regulators about the technology-driven platforms emerging in the small business lending market and how our member companies bridge the small business capital gap using innovative financing solutions. The SBFA is supported by companies committed to promoting small business owners’ access to fair and responsible capital.

“Small business owners are a powerful constituency and we want to give them the utmost confidence in the alternative finance industry,” said Steve Denis, Executive Director of the SBFA. “This includes promoting brokers who are providing transparent capital solutions that they can trust.”

The Small Business Finance Association (SBFA) is a not-for-profit 501(c)6 trade association representing organizations that provide alternative financing solutions to small businesses.

Despite Movement of Negative Bill for MCA and Factoring Industries, Hope for a Solution

April 23, 2018 Last week, California State politicians gathered for a hearing on SB 1235, a bill that would require the disclosure of an Annual Percentage Rate (APR) for all loans and non-loans, including MCA and factoring products. This is very problematic because APR (which includes interest rate) cannot be calculated for most MCA and factoring products for one reason: time. What makes merchant cash advance and factoring unique is that the timing of payments is flexible, and therefore unknown.

Last week, California State politicians gathered for a hearing on SB 1235, a bill that would require the disclosure of an Annual Percentage Rate (APR) for all loans and non-loans, including MCA and factoring products. This is very problematic because APR (which includes interest rate) cannot be calculated for most MCA and factoring products for one reason: time. What makes merchant cash advance and factoring unique is that the timing of payments is flexible, and therefore unknown.

“It’s impossible to compute,” said veteran factoring lawyer Bob Zadek about calculating APR for most MCA and factoring products. “Interest = principal x rate x time. Since [they] cannot determine how long the advance will be outstanding – since repayment is a function of the borrower’s cash flow – the algebra doesn’t work.”

The bill, introduced by California State Senator Steve Glazer, moved out of the Senate committee on Banking and Financial Institutions and is headed to the Judiciary committee – closer to potential passage. Yet advocates of the MCA industry, one of whom testified in the assembly room in Sacramento, are hopeful.

“There were a number of state senators who clearly understood the problems with applying an APR to a commercial transaction and to a purchase and sale of receivables transaction,” said Katherine Fisher, a partner at Hudson Cook, LLP who spoke on behalf of the Commercial Finance Coalition (CFC). CFC is an alliance of financial companies that educates government regulators and elected officials on issues related to non-bank commercial finance. CFC Executive Director, Dan Gans, told AltFinanceDaily that he believed the committee really understood what Fisher was trying to convey.

Another major advocacy group is the Small Business Finance Association (SBFA). They brought Joseph Looney, COO and General Counsel of RapidAdvance, to testify against SB 1235, and SBFA Chief of Staff Steve Denis sounded optimistic, saying that they have a very good relationship with State Senator Glazer’s office.

“To me, despite the fact that they moved [on] a bill that we’re opposed to through the process,” Denis said. “I think the folks that we’ve been meeting with out there – the senators – they’re all very open to our industry and open to having broader discussion about how to [best] disclose these terms and how to make sure we’re doing what’s in the best interest of small business owners. That’s a real positive, and I’m optimistic that we can get something done.”

As for concern about the bill moving forward, Denis said it’s what he expected.

“It’s just the way the process works in California,” Denis said. “If you look at committee history, they don’t really reject a lot of bills. They like to move bills forward so they can be discussed and negotiated.”

As of this story’s publication, SB 1235’s Judiciary committee hearing had not yet been scheduled.

Update 4/26/18: The hearing is scheduled for May 8, 2018 at 1:30 p.m. PST in Room 112.

Full video of the April 18th hearing below:

What Got Said in The California Senate Hearing About Commercial Loan Disclosures

April 19, 2018

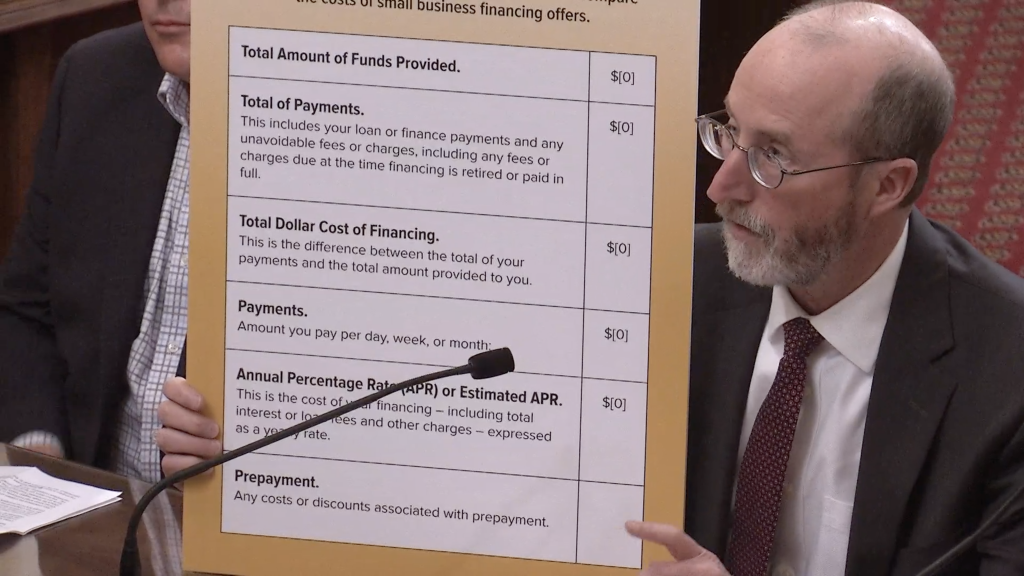

California State Senator Steve Glazer was the reason that representatives from small business finance trade associations were in Sacramento on Wednesday. Glazer’s bill, SB 1235, calls for mandatory APR disclosures on loan and non-loan products alike, even if the transaction is business-to-business and even if the transaction assesses no interest charges and even when no such APR can be calculated or exists.

That proposal caught the attention of several interested groups, including those whose members offer short term small business loans, factoring, and merchant cash advances. Among those who testified in front of the Senate Committee on Banking and Financial Institutions on Wednesday was Joseph Looney, COO & General Counsel of RapidAdvance, who spoke on behalf of the Small Business Finance Association, and Katherine Fisher, Partner at Hudson Cook, LLP, who spoke on behalf of the Commercial Finance Coalition. Each of them were there representing separate constituents with their own individual views.

Transcripts of their testimonies are below:

“Chairman Bradford, Vice Chair Vidak, and Members of this committee. I am Joseph Looney and I am the General Counsel for a commercial finance company named RapidAdvance. We are a California Finance Lender licensee and have provided more than $200,000,000 in capital to thousands of businesses in California. Today I am providing testimony on behalf of the Small Business Finance Association or SBFA, which is the leading association for companies that provide funding to Main Street businesses. The SBFA is in opposition to Senate Bill 1235 as currently drafted. While there are various issues with the Bill, the overarching concern we have is that it treats small businesses like consumers. States and the federal government have generally refused to treat small businesses the same as consumers when it comes to financing disclosures for two reasons. First, there is a significant concern that imposing consumer disclosures and regulation on small businesses would reduce the flow of capital and negatively impact the economy. Second, small business owners are sophisticated and do not need the same protections provided to consumers. Business owners hire and fire employees, handle taxes and payroll, negotiate with customers and vendors, arrange financing, handle litigation and execute on business strategies every day. Also, businesses look at money differently than consumers. A business gets capital and uses it to make more money or solve a problem in their business. In this scenario, the most important item to the business owner is how fast can they get the money and what are the conditions for getting it. The APR disclosure included in the Bill is problematic as it will create confusion. The CFPB has recently concluded the APR is confusing, does not provide as much value as thought and is extremely complicated for creditors to calculate. In fact, the CFPB is making the APR less important by moving it to the end of some disclosures and completely removing it in some cases. The APR is so complicated to calculate there are numerous pages in the Code of Federal Regulations devoted to explaining the calculation. Additionally, there are pages of guidance on how to handle various consumer products and payment types and what assumptions should be made for various products as well as shielding creditors from liability for minor calculation errors. This Bill does not address any of these issues. It simply takes an APR disclosure requirement for fixed monthly payment consumer finance transactions and concludes it should apply to materially different commercial products. While we do not support the Bill as it imposes consumer disclosures such as the APR on small business transactions, we are supportive of the idea of providing businesses with cost disclosures. Thank you.” |

“Chairman Bradford and committee members: Thank you for the opportunity to present testimony today regarding SB-1235. My name is Kate Fisher and I am here today on behalf of the Commercial Finance Coalition, a group of responsible finance companies that provide capital to small and medium-sized businesses through innovative methods. Small businesses face a gap in credit availability. Commercial Finance Coalition member companies are trying to close this gap and help spur entrepreneurship so more Americans and Californians can own and operate their own businesses. I also am a lawyer who works with providers of commercial financing on complying with state and federal law. The Commercial Finance Coalition supports California’s efforts to make business financing more transparent. Businesses benefit from having different types of financing available, and being able to comparison shop. SB 1235 would require commercial finance providers to disclose the cost of capital by providing the following helpful disclosures: The Total Amount of Funds Provided These three disclosures will help a California business owner understand and compare the cost of financing across different products. However, the Commercial Finance Coalition opposes requiring an APR disclosure. It’s important to note that SB 1235 aims at providing comparable disclosures across very different financing types. Commercial Finance Coalition members mostly engage in “accounts receivable purchase transactions.” These transactions are also known as merchant cash advance or factoring, and involve a business selling its receivables at a discount. For example, if a business’s sales go down, the business can pay less. If a business’s sales go up, the business can pay more. And if a business is burned down in a fire, the business can pay nothing until it can reopen its doors. SB 1235 would require disclosure of an Annual Percentage Rate (or APR). There are two problems with requiring an APR disclosure or even an “Estimated APR”: First – SB 1235 fails to address the complexity of calculating APR for different types of commercial finance transactions. This creates a significant litigation risk and minefield for finance providers making a good faith effort to disclose APR, and may stifle small business financing in California. Second – Requiring an Estimated APR disclosure creates an unfair disadvantage for offers of “accounts receivable purchase transactions” – or factoring. Again, these transactions are purchases, and do not need to be “paid back” unless the business has sufficient sales. Also, this disclosure could confuse a business owner who is looking for alternatives to lending. I’m very optimistic that California can lead the way in providing businesses with disclosures that are helpful – and not confusing. |

In response, Senator Glazer deferred to the experts who testified but he was not willing to make a key concession in the moment. At Glazer’s prodding, the bill made it out of committee with enough votes, and with the goal of continuing to fine tune the details particularly with respect to APR.

More information surrounding the bill and it’s progress will be made available soon.

Full video of the hearing below:

Industry Representatives to Testify at California Hearing

April 18, 2018

Several people will be testifying in front of the Senate Committee on Banking and Financial Institutions in California today. Among them are Joe Looney, COO & GC at RapidAdvance, who will be speaking on behalf of the Small Business Finance Association, and Katherine Fisher, Partner at Hudson Cook LLP, who will be speaking on behalf of the Commercial Finance Coalition.

At issue is SB 1235, a bill that would require providers of commercial financing to provide disclosures about the cost of that financing to the recipients of the financing.

Industry analysts believe the bill could have implications not just for small business lending but also for factoring and merchant cash advance.

Update: Full video of the hearing below

SBFA Braved Snow Storm for Spring Fly-In

March 23, 2018 The Small Business Finance Association (SBFA) had their Washington DC Spring fly-in earlier this week. SBFA members met with Karen Kerrigan, the President and CEO of the Small Business & Entrepreneurship Council, on Tuesday afternoon, and Congressman Josh Gottheimer (D-NJ) in the evening.

The Small Business Finance Association (SBFA) had their Washington DC Spring fly-in earlier this week. SBFA members met with Karen Kerrigan, the President and CEO of the Small Business & Entrepreneurship Council, on Tuesday afternoon, and Congressman Josh Gottheimer (D-NJ) in the evening.

Despite the blizzard, a handful of members continued to meet with members of Congress on the Hill on Wednesday.

Founded ten years ago, The SBFA is a non-profit advocacy organization dedicated to ensuring Main Street small businesses have access to the capital they need to grow and strengthen the economy.

Mad Over Madden

March 15, 2018 In a dispute that reflects the nation’s rigid political polarization, a piece of legislation pending before Congress either corrects a judicial error or condones “predatory lending.” It depends upon whom one asks. Either way, the proposed law could affect the alternative small-business funding industry indirectly in the short run and directly in the long term by addressing the interest rates non-banks charge when they take over bank loans.

In a dispute that reflects the nation’s rigid political polarization, a piece of legislation pending before Congress either corrects a judicial error or condones “predatory lending.” It depends upon whom one asks. Either way, the proposed law could affect the alternative small-business funding industry indirectly in the short run and directly in the long term by addressing the interest rates non-banks charge when they take over bank loans.

The easiest way to understand the controversy may be to trace it back to a ruling in 2015 by the United States Court of Appeals for the Second Circuit in New York. The case of Madden v. Midland Funding LLC started as claim by a consumer who was challenging the collection of a debt by a debt buyer, says Catherine Brennan, a partner in the law firm Hudson Cook LLP.

“Debt buyers like Midland are sued on a regular basis,” Brennan notes. “That’s a common occurrence.” What’s uncommon is that the appellate court affirmed the idea that the loan debt that Midland sought to collect from Madden became usurious when Midland bought it. The court ruled that because Midland wasn’t a bank it was not entitled to charge the interest the bank was allowed to charge, she maintains.

Under the ruling, non-banks that buy loans can’t necessarily continue to collect the interest rates banks charged because non-banks are generally subject to the limits of the borrower’s state, according to the Republican Policy Committee, an advisory group established by members of the House of Representatives in 1949. Banks can charge the highest rate allowed in the state where they are chartered, which could be much higher than allowed in the borrower’s state.

“So it undermines the concept that you determine the validity of a loan at the time the loan is made,” Brennan says of the decision in the Madden case. The “valid-when-made” doctrine – a long-established principle of usury law – states that if a loan is not usurious when made it does not become usurious when taken over by a third party, published reports say. In 2016, the U.S. Supreme Court declined to hear the Madden case, which in effect upheld the appellate court ruling.

In response, both houses of Congress are considering bills that would ensure that the interest rate on a loan originated by a bank remains valid if the loan is sold, assigned or transferred to a non-bank third party, the Republican Policy Committee says.

On Feb. 14, 2018, the House passed its version of the proposal, H.R. 3299, the Protecting Consumers’ Access to Credit Act of 2017, or the “Madden fix,” as it’s known colloquially. The vote was 245 to 171, mostly along party lines with 16 Democrats joining 229 Republicans to vote in favor. The Senate version, S. 1642, had not reached a vote by press time.

“It’s not a revolutionary concept,” Brennan says of the proposed law. “It had been understood prior to Madden that you determine usury at the time the loan is originated, and that should be restored.”

As the alternative small-business funding industry continues to mature it could benefit from the legislation, Brennan predicts. In the future, alt funders may begin to buy or sell more debt, which would make it subject to the state caps if the legislation fails to pass, she says.

The proposed law would also benefit partnerships in which banks refer prospective borrowers to alternative funders because it would eliminate uncertainty and would thus improve the stability of the asset, Brennan continues. “I would think anyone in the commercial lending space would want to see the Madden bill pass,” she contends.

Stephen Denis, executive director of the Small Business Finance Association, a trade group for alt funders, agrees. While most of the SBFA’s members don’t work with bank partners, the trade group has supported the lobbying efforts of other associations and coalitions representing financial services companies directly affected, he says. “We are concerned on behalf of the broader industry because we all work closely together and everyone has the same goal of making sure that we’re providing capital to small businesses,” he maintains.

That goal of keeping funds available to entrepreneurs also motivates the sponsor of H.R. 3299, Rep. Patrick McHenry, R-N.C., who’s chief deputy whip of the House and vice chair of the House Financial Services Committee. His interest in crowdfunding, capital formation and disruptive finance is fueled by events he experienced in his childhood, when his father attempted to operate a small business but struggled to find financing, according to the Congressman’s website.

Although H.R. 3299 passed in the House with mostly Republican votes, it attracted bipartisan co-sponsors in that chamber. They are Rep. Gregory Meeks, D-N.Y.; Rep. Gwen Moore, D-Wis., and Rep. Trey Hollingsworth, R-Ind. The Senate version of the legislation is sponsored by Sen. Mark R. Warner, D- Va.

Although H.R. 3299 passed in the House with mostly Republican votes, it attracted bipartisan co-sponsors in that chamber. They are Rep. Gregory Meeks, D-N.Y.; Rep. Gwen Moore, D-Wis., and Rep. Trey Hollingsworth, R-Ind. The Senate version of the legislation is sponsored by Sen. Mark R. Warner, D- Va.

But opponents of the proposed law aren’t feeling particularly bipartisan and argue vehemently against it, Brennan contends. “There’s been a lot of misinformation put out there by consumer advocates saying this would somehow embolden payday lending in all 50 states,” she says. “It’s simply not true.”

Payday lenders aren’t banks, so the proposed legislation would not apply to them and thus would not enable them to avoid interest caps imposed by borrowers’ states, Brennan notes, adding that some states don’t even allow payday consumer lending.

Consumer advocates are spreading propaganda because they oppose interest rates they consider high, Brennan continues. Advocates are incorrectly conflating payday lending with marketplace lending, she maintains.

The latter is defined as partnerships where non-banks sometimes work with banks to operate nationwide platforms, mostly online and sometimes peer-to-peer, she says, noting that examples include LendingClub and Prosper.

There’s no evidence marketplace lenders would astronomically increase their interest rates if the president signs into law a bill that resembles those now before Congress, Brennan says. It wasn’t happening before Madden, she notes, and banks involved in those partnerships operate under strict guidance of the Federal Deposit Insurance Corp. (FDIC) or the Office of the Comptroller of the currency, depending upon their charters.

But consumer advocates haven taken to the warpath, Brennan reports. Opponents of the legislation call partnerships between banks and non-bank lenders by the derogatory term “rent-a-bank schemes.” But it’s lawful to create such relationships because the FDIC oversees them, she asserts.

Just the same, the House is considering H.R. 4439, a bill to ensure that in a bank partnership with a non-bank, the bank remains the “true lender” and can set the interest rate, Brennan notes. If the bill becomes law, it would clear up the conflict that has arisen in inconsistent case law, some of which has defined the non-bank as the true lender, she says.

Meanwhile, opponents of H.R. 3299 and S. 1642 have written a letter to members of Congress, urging them to vote against the bills. The letter, drafted by the Center for Responsible Lending (CRL) and the National Consumer Law Center (NCLC), was signed by 152 local, state, regional and national organizations. Most of the signers belong to a coalition called Stop the Debt Trap, says Cheye-Ann Corona, CRL senior policy associate.

The bills create a loophole that enables predatory lenders to sidestep state interest rate caps, Corona maintains. That’s because non-banks are actually originating the loans when they work in tandem with banks, she says. The non-banks are using banks as a shield against state laws because banks are regulated by the federal government. If the legislation passes, non-banks would not have to observe state caps and could charge triple-digit interest rates, she contends.

“This bill is trying to address the issue of fintech companies, but there is nothing innovative about usury,” Corona says. “They are just repackaging products that we’ve seen before. A loan is a loan. These lenders don’t need this bill if they are obeying state interest-rate caps.”

The lenders disagree. In fact, a trade group formed by OnDeck, Kabbage and Breakout Capital calls itself the Innovative Lending Platform Association, according to a report in the Los Angeles Times. The article cites the need for small-business capital but questions whether the loans are marketed fairly.

Innovative or not, lenders offering credit with higher interest rates could condemn consumers to a nightmare of debt, according to the letter from the CRL and NCLC to Capitol Hill. “Unaffordable loans have devastating consequences for borrowers – trapping them in a cycle of unaffordable payments and leading to harms such as greater delinquency on other bills,” the letter says.

However, alt funders say their savvy small-business customers understand finance and thus don’t need much government protection from high interest rates. But the CRL doesn’t adhere to that philosophy, Corona counters. “Small businesses are at risk with predatory lending practices,” she says, maintaining that some alt funders charge interest rates of 99 percent.

Small-business owners plunged themselves into hot water by borrowing too much in anecdotal examples provided by Matthew Kravitz, CRL communications manager. In one example, an entrepreneur found himself automatically paying back $331 every day. He overestimated his future income and now says he feels like hiding under the covers every morning.

Corona also dismisses the idea that high risk calls for high interest rates to compensate for high default rates. When interest rates rise to a level that borrowers can’t handle, no one wins, she maintains.

The right to charge higher interest rates could also encourage lenders to loosen their underwriting criteria, Corona warns. That could result in shortcuts reminiscent to the practices that gave rise to the foreclosure crisis and the Great Recession, she says, adding that, “we don’t want to see that happen again.”

As NY Lending License Proposal Looms, Industry Trade Groups Mobilize

February 13, 2017

The alternative small-business finance community plans to lobby hard against a far-reaching proposed expansion of the New York state lending license. The proposal calls for any person or company that solicits, arranges or facilitates business and consumer loans – or other types of financing – to obtain a license. That could include MCA companies, business loan brokers and ISOs.

Critics claim the expansion, which Governor Andrew M. Cuomo included in his proposed state budget, could trigger a series of ominous and possibly unintended events in the courts and on Wall Street. “It could destroy the industry if the worst comes to fruition,” declared Robert Cook, a partner at Hudson Cook LLP.

Some opponents also contend that the public hasn’t had a reasonable opportunity to respond. “Sneaking a provision with significant impact like this into the budget and not going through regular order is really disturbing,” said Dan Gans, a Washington lobbyist who also serves as executive director of the the Commercial Finance Coalition. “They should allow all the stakeholders to have their voices heard.”

The industry’s trade groups have been quick to react. The Small Business Finance Association has been in contact with New York state legislators to help them understand the ramifications of the proposal, according to Stephen Denis, the trade group’s executive director. Meanwhile, Gans is recommending that the CFC’s board hire an Albany lobbying firm to help advance the industry’s interests.

New York’s current consumer licensing law is written broadly enough to cover any loan to an individual for less than $25,000, even if it’s made for commercial purposes, said Cook. That means the current law could cover loans to sole proprietorships but would not affect loans to corporations, limited liability companies, partnerships or limited liability partnerships, he noted.

Under the proposal in Governor Cuomo’s budget, any type of commercial loan of up to $50,000 would require a license, Cook said. Today, the state requires a license only if a loan carries a simple interest rate of more than 16 percent. Under the budget proposal, all lending would require a license, even if the interest rate is less than 16 percent. Loans made by alternative funders typically carry interest rates of 36 percent to 100 percent, he said.

Under the proposal in Governor Cuomo’s budget, any type of commercial loan of up to $50,000 would require a license, Cook said. Today, the state requires a license only if a loan carries a simple interest rate of more than 16 percent. Under the budget proposal, all lending would require a license, even if the interest rate is less than 16 percent. Loans made by alternative funders typically carry interest rates of 36 percent to 100 percent, he said.

New York already has a criminal usury rate of 25 percent, but lenders have two methods of avoiding that cap, according to Cook. Under one method, the parties to the loan can use a provision called the “choice of law clause” and thus agree that the contract is subject to the laws of a state that does not limit commercial usury rates, he said. Or, using the second method, the small-business finance company can solicit the loan and refer it to a bank in a state without a cap. The bank makes the loan but then sells the loan back to the small-business finance company or an affiliate, he noted.

But adopting the changes proposed in the New York budget could possibly stymie both methods of circumventing the state’s usury laws. Consider the choice of law clause, Cook suggested. The courts could interpret the proposed expansion as an effort by the state to gain more control of commercial lending. That could prompt the courts to refuse to enforce choice of law clauses involving New York state because doing so would violate a significant policy in New York, he maintained. The proposal could also gut the second way around the usury law – the bank model – by requiring employees of out-of-state banks to have a license in order to originate loans or by prohibiting rates in excess of New York’s cap, he said. Both outcomes are speculative but constitute distinct possibilities, he added.

Expanding the license would also grant additional regulatory authority to the New York State Department of Financial Services, Cook maintained. Besides requiring the license, the DFS would have the ability to regulate, supervise and examine commercial lenders, he said. In the past the department has imposed some significant regulations on licensees, including fair lending requirements and cyber security requirements, he said. “They’re a very active regulator,” he contended. “They could require commercial lenders to jump through a lot of hoops that aren’t there today.”

Expanding the license would also grant additional regulatory authority to the New York State Department of Financial Services, Cook maintained. Besides requiring the license, the DFS would have the ability to regulate, supervise and examine commercial lenders, he said. In the past the department has imposed some significant regulations on licensees, including fair lending requirements and cyber security requirements, he said. “They’re a very active regulator,” he contended. “They could require commercial lenders to jump through a lot of hoops that aren’t there today.”

What’s more, time would pass while a company negotiates the initial hoops simply to obtain a license. Qualifying for the current New York license, for example, can take up to nine months, Cook said. “It’s a fairly intensive licensing process that requires a lot of information about the company, the officers and directors of the company,” he noted. “The licensing process is tough in New York.”

The expansion could also limit the industry’s access to capital, Cook warned. Some alternative funders raise money by selling loans or interests in loans on the secondary market. Requiring a license to buy those products could prompt Wall Street to look elsewhere for less-burdensome investment opportunities, he said.

The laundry list of potential bad effects has many in the industry wondering about the state’s intentions toward the industry. “It’s not clear whether the people up in Albany understand the potential effect this has,” Cook said.

To help bring about that understanding, the CFC intends to call upon its members and merchants who have benefitted from alternative finance to visit officials in the state capital, Gans said.

Gans finds reason for optimism as the associations coalesce around the issue. The state Senate in Albany tends to be pro-business, and I am confident we will find allies that will stand up to this, he said.

Denis also seems upbeat about the industry’s efforts to make itself heard in Albany. In Illinois, some legislators failed to differentiate between consumer loans and commercial loans when considering legislation last year, he noted. That might be the case in New York, too, and the SBFA might help them make the distinction, he said. As an example of the differences, he pointed out that business loans often carry high interest rates because of high risk. “We have talked to some folks in Albany, and everyone is receptive to the industry,” he said. Small business is a powerful constituency, he maintains.

Gans, Denis and Cook all said they’re not opposed to legislation or regulation that addresses problems caused by bad actors in the industry, but all three oppose government action that they believe unnecessarily limits members of the industry who are operating in good faith.

The proposed license in New York differs in at least one significant way from the California lending license that many alternative funders have obtained, Cook noted. The California license doesn’t impose a cap on interest rates, he said. If the New York proposal imposed licensing requirements but did not limit interest rates, the industry probably would reluctantly accept it, he suggested.

—-

Dan Gans at the CFC can be contacted at dgans@polariswdc.com

Stephen Denis at the SBFA can be contacted at sdenis@sbfassociation.org

Robert Cook at Hudson Cook can be contacted at rcook@hudco.com