Commercial Financing Disclosures Bill – June 25 CA Assembly Debate, Video, and Transcript

July 21, 2018Commercial Financing Disclosures Bill – Assembly Banking and Finance Committee

[0:00:03]

Limon: We didn’t put any time limits on it, but I will ask for brevity in comments that are made. So, with that, I will have you begin, Senator.

Glazer: Thank you, Chair Limon. Senate Bill 1235 would give to small business owners many of the same protections that our country’s truth in lending laws have given consumer borrowers for more than half a century. This bill would require lenders and finance companies to provide clear and consistent disclosure to small business owners when they offer them financing and when they close a deal. This information would help small business owners understand the cost and the consequences of the financing options available to them in the rapidly evolving commercial lending market. Until now, our truth in lending laws have applied only to consumer finance. Business owners were left to fend for themselves on the theory that they were sophisticated merchants who understood the world of finance. Increasingly, however, that is no longer true. Today’s small business owners are often immigrant entrepreneurs struggling to get their enterprises off the ground with little knowledge of the finance industry. Traditional banks, meanwhile, are no longer interested in making smaller loans. Instead, that space is being filled by innovative lenders offering an array of financial options. This new online lending industry is bringing capital to people who badly need it, but there are abuses. This bill offers a modest measure, disclosure to help level the playing field for small business owners. It would make California a leader in placing the interests of small business owners on par with the big players in the financial industry. Now, if you borrowed money for a house or a car or simply taken out a personal loan or used a credit card, you’ve seen the kind of disclosures that this bill would require. They tell you how much you’re borrowing, all the fees you’ll be paying, how long it will take you to repay the loan, and the annual annualized interest rate. The lenders know all this information already. Some of them even disclose it in the financial markets when they package their small business loans and sell them as securities. All we’re asking is that they disclose the same information to their customers. What’s good for Wall Street should be good enough for Main Street. How this bill has undergone extensive changes since I first introduced it in February, we’ve taken suggestions from many of the players in this industry and for most of the opponents, but will never satisfy everyone. Many of the companies that lend to small business simply do not want to disclose the terms of their loans to their customers. And many consumer finance advocates want this bill to precisely mirror the laws that govern consumer lending even if that might not be practical for the business lending market. Let me finish up. I think we’ve struck the right balance in this bill. It requires clear consistent disclosure, but does not restrict the kind of financing that lenders can offer and will not lead to any loss of access to capital in the small business world. With me today are Robyn Black representing the California Small Business Association and Caton Hanson who is a cofounder of nav.com, a company that helps small business owners navigate the tricky new online lending marketplace.

Hanson: Thank you, Chair Limon and members of the committee, for allowing me to share my support of this bill. My name is Caton Hanson, cofounder and chief legal compliance officer at nav.com. Now, as a small business credit and finance platform used by more than 370,000 business owners in the United States including 35,000 in the State of California, I’m speaking to you today because I believe this bill is an important step towards helping small business borrowers more easily compare sources of capital, which ultimately means more successful business in California. Consider the impact this legislation can have. Small business employs nearly half of all of California State’s employees. But according to the U.S. Department of Labor, 100,000 California small businesses close each year. And the data show a top reason these businesses fail is due to poor credit arrangements. I cofounded Nav for the very reason of bringing transparency and efficiency to business financing credit. I come from a small business family. My grandfather started a pool plastering company in Southern California 1948. My cousin runs the same business today. Growing up, I watched my father work a full-time job and run a small business on the side. As a small business owner of 2 businesses prior to Nav, I’m intimately aware of the help this bill would provide small business owners. I’ve seen their struggle on a daily basis and have been in their shoes. I know what it’s like to feel like the success of your business hang on whether you have the right financing or not. Transparency and efficiency are essential in the business lending world. If you haven’t experienced it, it’s easy to say the borrower will figure it out.

[0:05:00]

They know what they’re doing. The reality is that small business owners are not financial experts. These are not Fortune 500 companies we are talking about. In fact, 75 percent% of all small businesses employ one or fewer people. These are businesses without a finance department. running a business and having to perform finance, HR, sales, product development is extremely taxing. Business owners can’t spend hours and hours trying to decipher loan disclosures. That’s why an annualized cost of capital needs to be a part of this legislation. It’s the best method we have to create a quick applies to apples cost comparison. We’ve had this protection for consumers for years. It’s already settled law. The bill’s opposition claim an annualized cost of capital will confuse borrowers. The fact is that an annualized rate, which includes all costs, will simply reveal how expensive some of these products can be. If this forces them to explain the difference between short term versus long-term capital and the effect that has on an annualized rate, then so be it. It’s better than the current system that puts all the burden on the small business owner. We’ve already agreed that using an annualized rate is the best way for consumers to compare loans. Why should it be different for small business owners? Most reputable business lenders already provide an annualized rate because they know it’s the best way for a borrower to compare loans and terms. Alternative lenders such as Kabbage, OnDeck, and SmartBiz Loans are using tools such as a SMART box to provide necessary disclosures. They know it’s the right thing to do. This bill is just a way to standardize and require this across the industry so that the few bad apples can’t continue to deceive business owners. This bill isn’t about regulating the cost of business loans or trying to harm business lenders, which we wouldn’t support. There are legitimate times when a triple digit annualized rate is a smart decision for a business owner, but the business owner deserves to have a clear way of comparing products and knowing how much it’s going to cost them. If the terms are transparent and the business owner makes a bad decision, then it’s on them. To claim educating a small business owner on the true cost of capital is a harm to them is simply ridiculous. Unlike the opponents, we have nothing to gain by passing this bill. We just know it’s the right thing to do. We also believe it can become a model for the entire country and will positively impact millions of business owners, their families and communities. On behalf of the 100 team members at Nav along with our 35,000 small business customers in the State of California, I urge you to pass the bill. Thank you.

Limon: I will ask for a quorum. Before we finish up, if we can just call a quorum.

Speaker: Limon.

Limon: Here.

Speaker: Limon here. Chen. Acosta.

Acosta: Here.

Speaker: Acosta here. Burke. Gabriel.

Gabriel: Here.

Speaker: Gabriel here. Gloria. Gonzalez Fletcher.

Gonzalez Fletcher: Here.

Speaker: Gonzalez Fletcher here. Grayson.

Grayson: Here.

Speaker: Grayson here. Steinorth.

Steinorth: Here.

Speaker: Steinorth here. Stone. Weber.

Weber: Here.

Speaker: Weber here.

Limon: Thank you. We’ll have you proceed.

Black: Good afternoon, Madam Chair and members of the committee. Robyn Black on behalf of the California Small Business Association. We are a nonpartisan nonprofit organization representing small business in California. Many of you were at our luncheon last week with your honorees. We love small business. We celebrate small business. And we really wanna thank the Senator for bringing this bill forward. As all of you know, access to capital is the most important challenge facing small business in California and startup businesses in particular in California as has already been stated. That transparency that this bill would provide for small businesses looking for that kind of capital specially in the new markets online is something that’s really important. I won’t repeat everything that’s already been said, but informing the consumers, giving them the transparency that is already there for consumer loans in California, providing it for small businesses, many of whom are not as sophisticated in the finance laws and the understanding what the true cost of a loan or borrowing money can be. This will go a long way to help those individuals. So, on behalf of the California Small Business Association, we thank you for your time and we urge your aye vote.

Speaker: Thanks, Robyn. Thank you.

Limon: Any opposition? Or support. Sorry. We’ll start with support. If you could please state your name and association.

Speaker: [0:09:31][Inaudible] On behalf of the Small Business Finance Association, support of the bill.

Limon: Any additional support? All right. Those in opposition.

[Talk Out of Context]

[0:09:59]

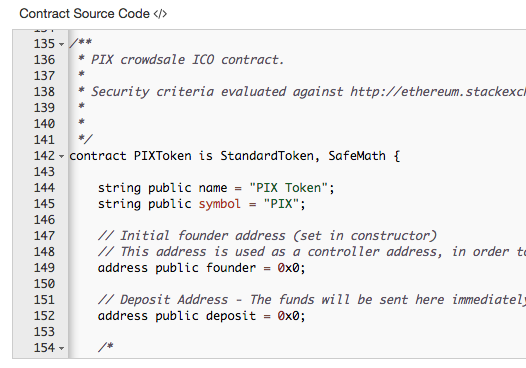

Patterson: Good afternoon, Madam Chair and members of the committee. My name is Ann Patterson. I’m a partner at Orrick, Herrington & Sutcliffe, an outside council for the Innovative Lending Platform Association. I feel like I’m in theater at the round here. [Laughter]. We’re here regretfully in opposition to SB-1235 because of the inclusion of the untested new metric, the ACC, that is in the bill. The ILPA is the leading trade association for small business lending and service companies and our members include OnDeck Capital, Kabbage, and The Business Backer. I wanna start by making it clear that we do not oppose SB-1235 subjective here and its attempts to create disclosures. We absolutely support transparency. And actually, as the witness from Nav mentioned, all members of the ILPA already provide borrowers with a comprehensive disclosure. It’s called the SMART box. It looks a little bit like the Schumer box. Or for those of you more familiar with Cheerios, the nutritional label on the back of that. We spent about 18 months developing the SMART box and worked in consultation with small businesses to identify the metrics that were most meaningful to them when they were trying to compare between financial products and then you can see those metrics reflected here. We have total cost of capital at the top, which is usually ranked as one of the highest and most meaningful for folks. We disclosed APR (annual percentage rate), average monthly payments, cents and dollar, and whether there are any prepayment penalties. So, I’m sure you probably can’t see this from here. I’m happy to provide— I brought copies if people would like to see it more closely. So, we did make these disclosures voluntarily because we want our small business customers to be informed so that they can pick the right financing product for their use cases and we do believe I think, as the author and the other witnesses, that transparency is critical to that. But we strongly SB-1235’s inclusion of this untested new metric, the ACC or EACC, because we believe that it will frustrate rather than facilitate an apples to apples comparison across products. And here is why. Let me find my little card. [Laughter]. As you can see, APR and ACC look a lot alike. They’re both percentages, which is gonna cause confusion for borrowers. And these two here, APR and ACC, are for the exact same loan. One 6-month 50,000-dollar loan with the exact same interest and fees. As you can see, APR 33.6, ACC 22.63. One’s looking a lot higher than the other for the exact same loan with the same costs. So, this is basically ACC is APR, but smaller. That to us is sort of like introducing a new food measurement for example where I can look at Cinnabon and say, “Oh, it doesn’t have 900 calories anymore. It has 600 calories.” And I think just like that would drive people to make bad food decisions. This ACC is gonna potentially mislead borrowers into choosing potentially more expensive products because they’re gonna conflate APR and ACC. And the danger is gonna occur here because borrowers are gonna be comparing different products. One quoted with APR and one ACC. Lots of things are still gonna be quoted in APR. The Schumer box in your credit card is still gonna have APR. And I can tell you the credit that small business customers are gonna confuse them when they’re looking at one that says APR 33 and one that says this. And it’s just lower. It’s like buying the Cinnabon. Right? Suddenly, you’re gonna pack the one that looks lower even though in fact it’s not the actually less expensive product. It’s just a different metric entirely. So, the problem is going to I think not go away over time with this because we are gonna continue to live in an ecosystem where APR remains, you know, the prominent metric. So, people are going to be really doing apples to oranges comparisons between APR and ACC. And for us, this isn’t actually just speculation. I think I mentioned we did a lot of homework when we developed SMART box over 18 months. And one of things we did is actually considered putting a second percentage metric, the AIR, into the SMART box. So, it would have had one more percentage here. And when we shared that with small business customers, it immediately caused confusion. They’re like “Which one is the real one? Which one is the right one?” And so, it just led to a ton of questions. And so, we ultimately said only one percentage-based metric on this because it’s just gonna confuse people. And so, I think the concern for us is that we’re either now in a position as the ILPA of having to drop APR entirely and replace it with this new metric, which is untested from our perspective. I don’t know anyone who’s ever used it. I don’t know if there had been any studies on whether or not it actually kind of works over time. So, we either are going to replace it or we can go back to a situation where we are gonna have to have 2 percentages on the SMART box again, which we know based on our own back information does cause confusion for people.

[0:15:07]

So, in closing, we support the concept here. We believe in transparency and disclosure, but we are very concerned that this metric will be confusing for people. I’m happy to answer any questions.

Limon: Thank you.

Fisher: Thank you. Chair Limon and committee members, thank you for the opportunity to present testimony today regarding SB-1235. My name is Kate Fisher. And I am here today on behalf of the Commercial Finance Coalition, a group of responsible finance companies that provide capital to small and medium sized businesses through innovative methods. We support California’s efforts to provide business financing disclosures. CFC members already disclose the cost of financing and welcome all of the disclosure requirements of SB-1235 except for one. That is the estimated annualized cost of capital disclosure. For clarity, we do not oppose disclosure. Instead, we’re advocating for an effective and accurate disclosure. Our concern is that requiring any annualized percentage for financing that is not alone will mischaracterize the underlying transaction. Senator Glazer’s bill recognizes that requiring an estimated annualized cost of capital disclosure does not make sense for other non-loan products such as commercial leasing or invoice factoring. Commercial leasing is completely exempt from SB-1235. And invoice factoring is exempt from the annualized cost of capital disclosure. That is because commercial leasing and invoice factoring are not loans, but SB-1235 proposes to require an annualized cost of capital disclosure for future receivables factoring, also not loan. This is illogical. Future receivables factoring is fundamentally different from a loan. The business pays only a percentage of its receivables. For example, when wildfires swept across California last fall, a business that was damaged and could not operate would owe nothing. Because the transaction is not a loan, any APR or annualized cost of capital disclosure would only confuse and mislead small business owners. I’m very optimistic that California can lead the way in providing businesses with disclosures that are helpful and not misleading. For example, the disclosure in SB-1235 that would require the disclosure of total dollar cost of financing, which is currently in the bill in Section 22802 (b) (3). Thank you.

Limon: Thank you. Any other witnesses in opposition? Please state your name and association. All right. Hearing or seeing none, members, we will turn it over to you. Any questions or thought Assembly Member Grayson?

Grayson: Thank you, Madam Chair. I was hearing the testimony about APR versus ACC and it was almost like you— It sounded like it was apples and oranges, right, compared between the two. So, as long as the consumer or in this particular case the business owner that was seeking a commercial loan was aware that they were apples and oranges, then as long as they were aligning the apples together or the oranges together and comparing the right rates, then there wouldn’t be confusion. Is that right?

Patterson: I think that if people got past the similarities between them and actually sort of dug in, they could potentially say, “Okay. ACC is basically computed completely differently and is designed to be a different metric.” I think the hard part is when you just see APR, ACC and you see rates. People are making quick decisions and I think they’re gonna see 36%, 23% and just go with that. One of the other things I think that’s problematic here is that the underlying differences— I wouldn’t even begin to try to explain because trying to say why APR is computed one way and why ACC is computed the other way is gonna be complicated and take up a lot of time on the phone where people try to understand which one is the real one that they’re supposed to be looking at.

Grayson: Sure. So, if we were comparing products—

Patterson: Yes. Uh-huh.

Grayson: …whether that product from three different lenders was using APR, then I would have a fair comparison between.

Patterson: Yes. Apples-apples.

Grayson: So, if I had all three providers also providing an ACC and they were being compared strictly amongst just ACC, there would be a fair comparison.

Patterson: I would be. And I think the challenge that they will have in doing straight up real-time and apples to apples is going to be that credit cards will never be using an ACC.

Grayson: Right.

Patterson: They’re off doing their TLA, you know, program with the Schumer box and they’re gonna continue to use APR. A lot of small businesses rely on that. So, they’re gonna have an orange, an apple, maybe a couple apples. Maybe a pair. No. Just apples and oranges.

Grayson: I love fruit.

Patterson: You’re gonna have to try to figure. [Laughter]. You’re gonna try to figure it out. So, I don’t think there’s gonna ever be kind of a true, you know—

[0:20:01]

Grayson: Madam Chair, if I may, and I don’t wanna—

Limon: Yeah. No.

Grayson: …take up too much time and I know I have members here that may have concerns or questions. If I may to the author ask a question of what was the motivation to depart from an APR and come up with this new untested ACC?

Glazer: Thank you for the question, although I wouldn’t agree with the untested part. But originally in my bill, I did have APR and opponents came in and said, “We don’t want you to have APR because APR changes with every payment you make. It changes the number.” And they said it creates legal vulnerability for us to add that to use APR. And I said, “Okay.” The purpose here is not to curtail small business lending. We need that capital out there. The only issue I want is disclosure and I don’t wanna create legal liability. So, I said, “Okay. Because APR changes with every payment, let’s come up with another metric that’s not a new metric, but a metric in the world of business that says let’s take a snapshot in time of what that would cost over the course of a year.” And that’s why we annualize cost of capital (ACC). It’s not based on whether you make more payments this month or less payments next month. It’s one snapshot, thereby providing a fair estimate without legal vulnerability and a very simple standard and that’s where ACC has come from.

Grayson: You said without legal vulnerability because I know that’s been one of the concerns of ACC is that you could draw a figure out there and it actually not be the exact figure and it creates liability on the lender’s part. What have you done to be able to mitigate that liability?

Glazer: Because in the bill, it says an estimate. It says an estimate, an annualized cost of capital. So, that’s the required disclosure and that is something that I think provides appropriate legal protection for any lender who is providing that capital and that proposal too.

Grayson: So, within their disclosure, you’re saying if you put estimate on there, then that would help mitigate it.

Glazer: And I certainly haven’t heard any criticism on those terms in regard to ACC.

Grayson: All right. Thank you.

Glazer: Thank you.

Limon: Any other questions or thoughts? Vice Chair Chen.

Chen: Thank you, Madam Chair. I do want to say that, you know, as a Republican, one thinks that is always a concern is government overreach. This bill doesn’t do that. You know, my opinion, this is a bill which is helpful for the lender. It’s helpful for the consumer. It is information that is helpful in which will prevent them from making decisions that will be financial duress for them in the future. So, I appreciate bringing this bill forward. So, with that said, I’d be happy to move the bill.

Limon: [0:22:37][Inaudible]

Gabriel: Yeah. So, I was just curious for the opponents of the bill. If you’re opposed to ACC and you’re opposed to APR, is there a metric that you would recommend and suggest?

Patterson: Well, all of the members of ILPA do disclose APR now. So, we’re not opposed to APR. I think there were people in the business community. Let them speak.

Fisher: Yeah. Thank you. The total dollar cost of financing, which is not a percentage, but tells the small business owner this is how much the money will cost, that is the best metric and particularly because the goal is to provide a measurement that works across different products. So, that measurement works whether it’s a loan or a sale.

Gabriel: And is that something that’s already required to be disclosed?

Fisher: No. I mean, not by law. It is required to be disclosed by contract so that the customer understands what kind of financing they’re getting. And the members of the group I represent do provide disclosures like that.

Patterson: I would say that when we developed the SMART box and did a survey of small businesses part of that. Total cost of capital was something— Dollars and dollars out, at the end of the day, that is what is most meaningful to them. I’m not suggesting annualized metric or whatever. The problem with annualized metrics generally is that the shorter the term of the loan, they just look a lot— if it starts to fall apart under year. But to the point that you made, total cost of capital is something that business owners say is the metric and it’s why it’s at the top of our SMART box.

Limon: Assembly Member Weber.

Weber: Just wanted to get some clarity. Now, this SMART box that you have, how long have you had the SMART box? I mean, is this something that small businesses have access to and have for years or it’s something new?

Patterson: We launched it in June of 2016. So, it’s been around for 2 years.

Weber: Okay. But it’s not required.

Patterson: It is not. It’s a voluntary industry model. Anybody who joins the ILPA must disclose it as part of that membership. So, you have some of the larger lenders like OnDeck and Kabbage using it, but it is not mandatory. It’s not mandated by any government.

Weber: Okay. Okay. So, therefore, it’s kind of an uneven thing in terms of who has access to it or whether or not people know what the real cost of their loans are.

Patterson: Yes.

[0:25:00]

There’s no mandate to make these disclosures. That’s correct.

Weber: Okay. And the industry initially was opposed to APR and I assume they still are. I would imagine. Has there been some revelation—

[Crosstalk]

Fisher: Thank you. The financing companies that don’t offer loans, but offer a type of factoring program, they are opposed to any type of annualized metric because those types of transactions don’t have a term. The business only pays a percentage of its revenue as that revenue is created. So, the transaction will take as long as it takes the business to generate the revenue that they will then deliver to the company.

Weber: Okay. And I assume that any new system that you come up with will be untested. I mean, that’s the nature of something new. If it was not, it would be old rather than being something new. So, I’m not necessarily persuaded by the untested element of it. I think there needs to be some transparency. I was surprised that there wasn’t that much transparency in terms of commercial loans. I just assume everybody had transparency and knew what a loan cost. And so, I found it rather incredible that it didn’t happen. I’m not sure I’m convinced that ACC is the best thing, but I haven’t heard anybody tell me thing else. I know people don’t like the APR very much, but I think I heard that ACC is so horrible. I’m probably gonna support this as it goes forward with hopes that whatever problem there is you guys will work it out before it gets to the floor. I’m not sure that I will vote for it on the floor, but I do wanna give life to this so the conversation can continue because I think it is very important especially for small businesses. So, I’ll second the motion that was made.

Limon: Thank you, Assembly Member Weber. And I think we have Assembly Member Acosta and then Assembly Member Gabriel.

Acosta: Thank you very much. I kind of appreciate the discourse today. You know, I appreciate Senator Glazer coming by and having some significant conversations around this. It is a complicated issue when you’re talking about introducing a new metric by which consumers which— I know we’re calling them business owners, but they’re still people and they still have credit cards, and auto loans, and mortgages. And all these things are calculated somewhat differently. So, I think there is an opportunity here for more disclosure. I share my colleague’s— from San Diego— sympathies that this may not be the best answer because these things are all calculated differently whether it’s, you know, traditional factoring, whether it’s future receivables. My concern has been that as a consumer and a small business owner because they’re still individuals, they’re still people that you’re on one side of the fence and you’re getting a credit card offer or a small business loan offer from one entity on your credit card. It popped up on my screen from one of my bank statements the other day. And then over on this side, we’re doing something entirely different. And I’m concerned that there will be confusion there. I think of you have made attempts to try to address this. I think that we need good disclosure in this realm. Can you tell me just for the record the sunset date on this? We have a sunset of what?

Glazer: 4 years.

Acosta: 4 years. So, I’m not thrilled with no disclosure. I’m not sure this is 100% percent the way to go. But I think that given the fact that APR doesn’t work, ACC may not work, we gotta try something. You seem to be very interested in making something work. So, I really encourage you to work with, you know, the opposition to try to fix things to their liking and to really try to find something that small business owners can sink their teeth into. You know, maybe you’re gonna invent something new here that’s gonna carry throughout the rest of the country. I don’t know. I’m not 100% comfortable with the discrepancies that small business owners are gonna be finding themselves, but it’s a step. And so, I’m gonna be taking a look at this. I may lay off at this moment, but I’m leaning towards supporting your bill today just so we can continue to work on this, but I’m reserving judgment on the floor for what the final product is. Thank you.

Glazer: Thank you.

Limon: Assembly Member Gabriel and then Assembly Member Gloria.

Gabriel: Yeah. I just wanted to associate myself with the comments of my colleague from San Diego. I appreciate, Senator Glazer, your effort to do this and bring transparency to the space. I think that’s a very worthwhile objective. I’m inclined to support you today to continue the conversation, but then I’m gonna reserve judgment on the floor just to help myself understand this a little bit better, but very much appreciate what you’re trying to do here and thank you for bringing this bill forward.

Glazer: Thank you.

Gloria: Thank you, Madam Chair. And Senator, thank you for the bill today. I’m reading it furiously after being substituted just a few hours ago.

[0:30:01]

Sorry. It’s why the pass the medium-sized box. Right? I know you bring up a common sense approach here legislating. I was struggling with the conversation in terms of different metrics. I think I heard that part a bit. Forgive me if I missed the portion when you addressed one of the other things. In my quick read of this, what was somewhat troubling to me is the 4th page of the committee analysis talking about the ability or lack thereof to provide oversight or enforcement on this. It would seem to me then if we’re looking out for small businesses, we’d have to have some way of trying to actually enforce what you’re to do with this bill. It’s difficult for me to vote for something that says what it says here in terms of having— It’s either silent or it’s impossible to hold folks accountable so on and so forth. Can you speak to that and why the bill is at its current state with these comments?

Glazer: Absolutely. Thank you, Assembly Member. There are some that we like to regulate and the thing that we in our conversations about it that we’d rather start with this step of disclosure and not licensing and not regulation. And the hope would be that the marketplace can act appropriately, disclose appropriately and that can be the end of it. But under current law, if you have a contract dispute, you have the same remedies under this bill as proposed as you would in any other circumstance that you have today. And our public law enforcement officers have that same ability if they see violations to engage is appropriate. So, the same remedies that exists today, you know, are in place with the exception of regulation. And it was my view that— ‘cause you get folks from all sides on these kinds of things. And it’s a new engagement because it is the Wild West today. There is no requirement We heard from witnesses that she does this and they do that. There is no requirements anywhere in this space in California or across the country. And so, it was at that context that my feeling was— And we took a lot of amendments to narrow this bill and I can go through those. The first step should be a simple disclosure mechanism with a sunset and we can evaluate it as it goes. I don’t wanna curtail the lending market, whatsoever. But if we have bad actors that continue to not follow those rules, then I’m very open to trying to see what else is required. And that’s why we’ve taken a small step today that you see in front of you.

Gloria: So, this is not a matter of this will be addressed in a future committee or before it to the floor. It is the intent to leave it sort of open at least at this point.

Glazer: Again, given the various players in this space, the smaller step to me would seem to be the more appropriate step. No. It is not my intention to put a new regulatory framework under this bill. I think that makes it more difficult. And listen, if we didn’t have the opposition to APR from the start, we might be in a different place today, but I’ve tried to accommodate opposition and that’s why you have the narrowness of this bill before you.

Gloria: Okay. Thank you.

Glazer: Okay.

Limon: Assembly Member Gonzalez Fletcher.

Gonzalez Fletcher: And obviously, I don’t know what the opposition was to APR. All of this is new to me. I’m fairly new to this committee, but I am concerned with kind of— I don’t wanna say unsophisticated. But you know, my father has had small businesses and has made determinations whether he put something on a credit card versus takes out some sort of loan. Is the ACC always going to be smaller than the APR? I really know nothing about these things.

Glazer: It depends on the duration. It’s meant to say over 12 months. There’s a lot of loans and this is part of the problem in that space, is I say you need $1,000 for a pizza oven repair.

Gonzalez Fletcher: Right.

Glazer: And I say to you “Listen, I’ll give you $1,000. It will cost you $200.” And this is what the opposition said. The small business people wanna know what that total cost. Well, it’s $1,200 to get $1,000 now and you have to pay it back when? Well, you have to pay it back in 90 days. That interest rate that you’re paying is gonna be a lot higher than you can pay it back in a year or if you paid it back based on taking a penny out of every credit card transaction. So, when these lenders come in, they can offer you this wide array of ways in which it’s not gonna cost you anything to your dad and that’s been the challenge. The issue of the annualized cost of capital is to say whether you take that loan for 90 days or for 2 years. You have an annualized cost as if it was for 12 months and more importantly knowing how much it’s gonna cost you. You can shop the next vendor and the next financier and have an apples to apples to compare it to because one vendor may say, “Pay me in 6 months.” Another one will say, “Well, 18 months.” Well, what’s the difference?

[0:34:59]

And so, that annualized cost is a way to have that one standard review. And I did do a chart here to give you a sense of these are the standards required by the bill. And at the bottom of it, it says, “What’s the annualized cost of capital?” You have a way of reviewing that. This chart is based on $150,000 one time over the period of time. And so, each of these steps disclosed and then this is the last one, the bill that’s being debated today. What’s the annualized cost if you paid it over 12 months? This is a 15-month example, but this is what it would be over 12. And you can compare it from person to person or lender to lender.

Gonzalez Fletcher: As long as the product you’re getting is all from— Like I think what I’m struggling with is you’re making an assumption that they’re looking just at this one product, right, this online product and they’re not thinking through like “Well, I have space on this credit card. I have the ability—” You know? And if we’re not using the same percentage, then it’s biased to this because you’re gonna get a lower percentage. That’s what I’m concerned. Does that make sense?

Glazer: Yes. So now—

Gonzalez Fletcher: I feel really ignorant in this space. I have to tell you.

Glazer: No. No. And listen, welcome to the world of small business lending. Okay?

Gonzalez Fletcher: Right.

Glazer: Even us have struggle with it. So, this is an example based on 150,000 one-time loan paid off over— is it— about 3 years. Okay? Now, here’s another example of $150,000. But now, it’s paid off— let’s see here—

Gonzalez Fletcher: A little over a year.

Glazer: Right. A little over a year and it comes from money out of your— See, it says— Let’s see. Okay. This is the 15-month loan one time. This is money out of your cash register over a much longer period of time. And you can see how these charts then work out. Under this one, they’re both $150,000. This is the total cost of all your payments. This is 170. That’s 179. Here’s your financing costs under this example. It’s 20,000. On this example, it’s 29,000. Here’s how much you paid everyday. If what’s most sensitive to your dad was how much he had to put out everyday, this one is $370. That one is $163. And so, you work down this chart and then you say, “Well, what if I had to pay this over 1 year?” The apples and apples, this is a 10% cost and that one is a 6% cost, but you can get a sense of the complexity of these. Just two different examples. A flat loan versus something that you’re gonna pay off everyday out of your cash register. And this is the dilemma that they all face. How do you create the apples to apples with these different products? And this shows you that you can have different products with different loan amounts and different directions, but the one thing that you can compare the apples to is the annualized cost of capital in both charts. They’re never gonna give you an APR and an ACC. They’re gonna just show you the— whatever the law requires is what they’re gonna provide. And this is a way for you to cross comparison shop that doesn’t exist today.

Gonzalez Fletcher: Okay. So, I’m sorry. So, I get how you can compare these two. And I applaud what you’re trying to do. I think this is good. My concern is how do you compare this to my business credit card or something that’s giving me just an APR?

Glazer: That’s a consumer loan and that is a—

Gonzalez Fletcher: But small businesses use credit in a variety of way. I mean, I guess you can say loan, but I mean especially small businesses use a variety— I’m just worried about that like are we— This makes very good for what you are trying to do, but that’s not the only way people borrow money to—

Glazer: Right. And the challenges that the credit card APR— it’s based on how much you pay and when. In other words, that’s just an estimate, but it’s a changing estimate every month. If you decide to only pay so much in the principal, that’s gonna change that number. And so, that’s the dilemma of even looking at that financial instrument of if I put this on my credit card versus take out a business loan. It’s a very challenging thing for anyone to understand because— And that’s why I go back to the simplicity, is the annual cost, not an APR that fluctuates. And obviously, some in the industry say we love it and some say they hate it and wanted a change in the bill. And that will always remain that dilemma. Buyer beware, lender beware. We’re just trying to give that small business owner one additional tool and that’s not how much is the money gonna cost me or how much do I pay everyday. What would this cost if I had it for 12 months?

Gonzalez Fletcher: Why wouldn’t you have both?

Glazer: Well, we do. The bill does require that all these elements be provided.

Gonzalez Fletcher: No. APR and ACC. Why wouldn’t you have both?

[0:39:59]

Glazer: Well, first, we had the concern on APR about the legal jeopardy of that number fluctuating and how can you have it be a fair estimate.

Gonzalez Fletcher: How do they do it on credit cards? I get a credit card or I’m applying for a credit card and it tells me this is the APR and that’s [0:40:13][Inaudible]

Glazer: There is about a stack of federal regulation this high that went into that high plus more that have gone into the whole determination of APR. And when you say it’s been around a long time, it’s been hotly debated on the federal level. And so, you have this body of information that’s now there that guides companies in how they do it and how they calculate it.

Gonzalez Fletcher: So, these companies could do that.

Glazer: They could do that today. Most of them don’t. I’m happy to hear one that does provide it. But again, it’s the Wild West, so—

Gonzalez Fletcher: So, why wouldn’t we want both? I mean, there’s a function to do it and then it could better cross compare between different products. I meant more disclosure, not less.

Glazer: Yes.

Gonzalez Fletcher: I’m not like setting you— I have no idea. I’m totally confused on trying to do the right thing in this bill, so—

Glazer: Yeah. Well, look, I’m open minded. For me, the fundamental issue is how do we provide an appropriate level disclosure to give that small business person a fighting chance in the lending market. I hadn’t thought about whether providing both and whether that would be helpful or less helpful. I’m open minded to it. I’ve been trying to simplify this because there’s been a lot of efforts to complicate it and that’s why I hadn’t gone in that direction, but I’m still open minded about whether that would be more helpful or less.

Gonzalez Fletcher: Well, I would say for a lot of small businesses and I think that small business is my community where you have a lot of non-English speakers, a lot of non-native speakers being able to actually look at two completely different products. One that’s maybe not supposed to be used for small business loans. But as a credit card versus this to line up the letters regardless of how you get to that number and what it means, but line up the letters and try to get to some comparison would be helpful rather than assuming the level of knowledge I think that even if it was in their home language, probably— I mean, it’s beyond me and I consider myself slightly educated, but definitely with folks who are new to this country and who are trying to figure this all out I’m a little concerned. That’s all.

Glazer: Yeah. Thank you.

Limon: Thank you. Assembly Member Steinorth.

Steinorth: First, I just like to say I think this is very clever. I’ve been in business for over 20 years and my business is helping local and small businesses grow. I’ve been doing that successfully. I’ve probably helped over 10,000 businesses be successful and the single greatest reason for their failure is under capitalization. Period. That’s it. And so, short term versus longer term access to capital, I believe that your way of— I’m really trying to add the transparency to the short term access to capital so people have a clear understanding of what it’s going to cost their business. It’s gonna be very useful for their success.

Glazer: Thank you.

Steinorth: So, I’ll be voting yes on this bill. Thank you.

Glazer: Thank you. I appreciate it.

Limon: Thank you. Senator, you and I have had multiple conversations about this and I think the analysis does express some concern with the ability to enforce particularly because enforcement is also a way to ensure that your objective is met. It’s not just an enforcement mechanism, but it’s also about the objective. But we’ve also had conversations about the direction of the bill and knowing how important it is for any, you know, consumer to have the information they need to make the best decisions. What I’m hearing is that at this point APR— You’re lucky if you have it. Some do. Some don’t. It’s not a standardization. And so, as I listen to colleagues bring concerns forward about how do you compare all of your options, not just your online lending, but all of your options, I also understand that currently that can’t exist because if they— Right now today, if they were to try to go to an online loan or a cash advance and also compare credit cards, they don’t have the mechanism to look at it apples to apples. I appreciate that this is at least for the moment a temporary solution. It has a 4-year sunset so that we can understand. I still continue to have concerns about how the objective is going to be met, how we know that whether it’s ACC or something else is going to be met, and how we’re ensuring that over the next 4 years potentially all the consumers or customers of this product see the same thing. I’m not sure. But there are certain themes that you have brought forward, themes that I have been very sensitive to this year in the world of banking and finance. And those include the importance for transparency, for disclosure, and for people to understand the true cost of a loan.

[0:45:08]

I understand how hard it is for these things or these elements to be in place with a lot of products. And for those reasons, I’m going to give you an aye vote in good faith that we can try to get there, but I will note that there are still some concerns and I’m happy to be part of any kind of conversation to make sure that the objective you’re trying to get to is one that is able to be met. And I know how hard this work is. And with that, if there are no other comments, I think we will have you close and then we’ll take a vote. Thank you.

Glazer: Thank you, Madam Chair and members, for this thoughtful, thorough conversation that we’ve had today. I appreciate it. I wanna underscore again how hard we have worked (my staff, your staff, and others) to try to narrow the differences, take out leasing, take out some of the receivables issues that we can’t really fit into this box so that we could provide something that’s simple, and easy, and understandable, and transparent. I think we’ve gone a long ways here. I know there’s more work still to be done and I’m happy to look— I look forward to that work that we can do together. We do need to protect our small business people. And it is a Wild West of financing out there. And I think this bill does get us closer to that space and I appreciate your consideration. Thank you.

Limon: Thank you. Please call the roll.

Speaker: Limon.

Limon: Aye.

Speaker: Limon aye. Chen:

Chen: Aye.

Speaker: Chen aye. Acosta.

Acosta: Aye.

Speaker: Acosta aye. Burke. Gloria. Gabriel.

Gabriel: Aye.

Speaker: Gabriel aye. Gonzalez Fletcher. Gonzalez Fletcher not voting. Grayson.

Grayson: Aye.

Speaker: Grayson aye. Steinorth.

Steinorth: Aye.

Speaker: Steinorth aye. Stone. Weber.

Weber: Aye.

Speaker: Weber aye.

Limon: All right. The motion is do pass and that is out 7-0. We will leave the roll open for additional add-ons.

Glazer: Thank you very much.

Limon: Thank you.

Glazer: Thank you all.

[0:47:24] End of Audio

Gale Force Twins

April 24, 2018

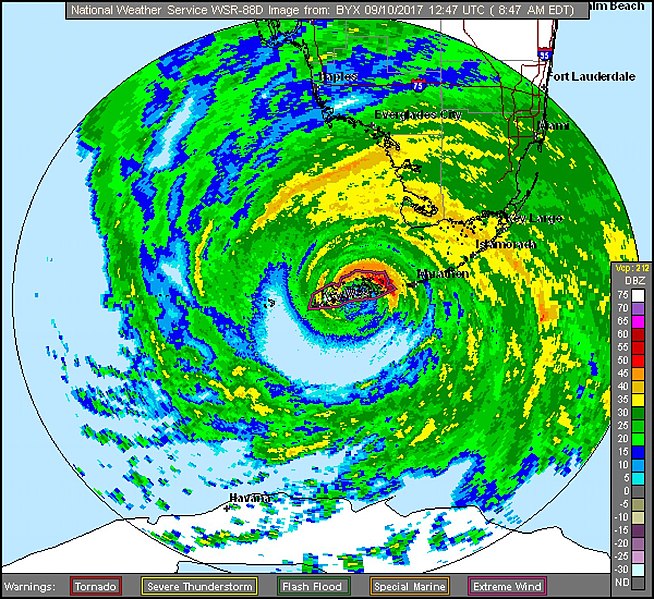

As Hurricane Irma swept through the Caribbean and barreled toward the Florida Keys early last September, Wendy Vila, chief executive, at Unicus Capital evacuated her home in West Palm Beach and decamped to Panama City in the Florida panhandle where “it was just a little bit rainy.”

After safely waiting out Irma, she says, her return south was precarious. The roads were strewn with tree branches and other debris. Fuel was scarce. Many gas stations were either closed or posted signs reading “No Gas.” “Restaurants had run out of food,” Vila adds, “so there was nothing to eat” along the highway.

She returned to West Palm Beach but didn’t stay long. Instead, Vila again drove west, this time across the Florida peninsula to the South Florida city of Naples, not far from where Irma had made landfall. “I went there to volunteer with Samaritan’s Purse for two days,” she says, referring to the Boone, N.C.-based Christian organization that provides humanitarian aid to people in physical need. “Things were a lot worse there than in West Palm Beach,” she reports. “A lot of trees were down, houses were flooded and people had to throw all of their belongings out onto the street.”

Meanwhile, many of the Florida merchants whom Unicus funds were distressed. “If people had no power,” Vila says, “they couldn’t function. A lot of businesses had to close down. For some merchants in the affected areas,” she adds, Unicus extended “a 90-day grace period.”

Vila’s experience with Hurricane Irma – both professionally and personally — is not an isolated one. She is among several business lenders whom AltFinanceDaily interviewed about the storm and its aftermath. This article grew out of AltFinanceDaily’s Florida networking event at the Gale Hotel in South Beach in late January. We went back to many of the attendees as well as to other business-funders in The Sunshine State and sought out their experiences before, during and after the powerful tempest.

At one point, Hurricane Irma was the strongest hurricane ever recorded in the Atlantic by the National Hurricane Center. As Irma took dead aim at Florida, it packed sustained winds exceeding 157 miles per hour, earning it the designation of a Category 5 storm, the highest and most destructive. It slammed into the Florida Keys as a Category 4 hurricane, reached the Gulf of Mexico, and then came ashore a second time on Florida’s west coast at Marco Island, just south of Naples, and began traversing the state as a Category 3 hurricane, gradually losing strength. By the time Irma exited Florida, it had been downgraded to a tropical storm. According to the National Hurricane Center, Irma caused an estimated $50 billion in damage in the U.S., making it the fifth-costliest hurricane to hit the mainland.

Financiers and brokers told personal stories of working with and assisting merchants across Florida who sought to regain their lost footing and keep from going — literally — underwater. In many cases, members of the alternative business financing community said, they were simultaneously assisting troubled merchants while they themselves struggled with Irma-occasioned troubles that ranged from inconvenience to hardship.

“I was ten days without power,” says Manny Columbie, funding manager at Axiom Financial, based in South Miami. Columbie, who lives in the residential Westchester district of Miami, not far from the campus of Florida International University, says that he conducts much of his business from his home. That power loss not only constrained his ability to keep working but posed a life-or-death situation for his family: Columbie’s 90-year-old grandmother, who lives with him and his girlfriend, depends on electrical power to operate her oxygen pump.

Fortunately, he says, he had a backup generator, the use of which alternated between providing power for his grandmother’s oxygen and the family’s refrigerator. Meanwhile, his roof was leaking and there was six inches of rainwater swamping the house — the water gushing into the kitchen through the laundry room, dishwasher and even the oven.

Fortunately, he says, he had a backup generator, the use of which alternated between providing power for his grandmother’s oxygen and the family’s refrigerator. Meanwhile, his roof was leaking and there was six inches of rainwater swamping the house — the water gushing into the kitchen through the laundry room, dishwasher and even the oven.

While Columbie saw instances of tempers growing short in Miami’s September heat, he was nonetheless cheered by the way his community responded. “Neighbors were coming by to see if I needed gasoline for my generator,” Columbie says. “People were firing up food on their outside grills. There was no air-conditioning or cold showers but we cooled off by jumping in a neighbor’s pool. I saw a lot of people coming together.”

At the same time, he was doing what he could to assist merchants who did business with Axiom. Only one – a retail clothing store in Miami – was permanently shuttered. One of his clients, Oscar Pratt, owner of Odessy Party Supplies in Miami Gardens, was grateful for a moratorium on daily payments.

“We’re in the business of selling party accessories for events from births to funerals and everything in-between,” Pratt says. “Baby showers, christenings, birthdays, quinceaneras, ‘Sweet Sixteens,’ graduations, weddings, and all kinds of themed parties like Halloween,” he says. “We sell plates and cups, candy bags, cake-toppers, small favors, pinatas…”

Pratt said he’d called his funders ahead of the storm and “requested some leeway” from payments. Once the storm hit – and for two weeks afterward while there was no electricity – the party-supply business was pretty much on hold. “We had a few days without electricity or phone,” he says. “We couldn’t open the doors and do business because we use computer-generated receipts. Our customer base was down to just about nothing. Without electricity, people weren’t working and they weren’t having parties.”

Following the two-week grace period, Pratt says that his funders, which included QuarterSpot, granted a second two-week period of leniency in which Odessy was allowed to make reduced payments. “It was very difficult,” he says. “There was no help from FEMA (Federal Emergency Management Agency) or from our insurance company since we’re on high ground and there were no physical damages, just the electricity.”

He reckoned that Odessy, which boasts annual revenues of $1.2 million, was deprived of roughly $50,000-$60,000 in sales because of Irma. Pratt reports that if his lenders had “played hardball” and demanded that he make his payments, he could have stayed in business thanks to “cash on hand” but it wouldn’t have been easy.

Meantime, his lenders’ forbearance was soon rewarded. By October, business was back to normal and he resumed making payments in full. “As soon as the lights went on,” Pratt says, “the parties started again.”

Similarly, says Paul Boxer, chief marketing officer at Quicksilver Capital in Brooklyn, the ultimate impact of Hurricane Irma on his firm’s funding business was to build trust and cement relationships with clients in South Florida. “We had a full team on board to answer the large number of calls coming in and to assist our merchants with any questions they had,” he says.

Many affected merchants, Boxer reports, were forced to evacuate ahead of the storm. When they returned, it was common for them to discover that their shops and stores sustained flooding damage from the heavy rains and a storm surge. Roofs were blown-off and structures were battered by 100-plus mile-an-hour winds, falling trees, and whipped-up debris. Even businesses that suffered little damage were paralyzed by the loss of electricity, impassable roads, and the absence of customers.

Many affected merchants, Boxer reports, were forced to evacuate ahead of the storm. When they returned, it was common for them to discover that their shops and stores sustained flooding damage from the heavy rains and a storm surge. Roofs were blown-off and structures were battered by 100-plus mile-an-hour winds, falling trees, and whipped-up debris. Even businesses that suffered little damage were paralyzed by the loss of electricity, impassable roads, and the absence of customers.

“Some were down for a few days,” Boxer reports. “Some were down a month to two months. We kept in touch. We were really on top of things with our merchants and asking them what they needed. We even fielded general safety questions and directed them on whom to call with insurance questions and other related business questions. It was good business,” he adds, “because it showed you cared. We were looking to do the right thing by our merchants and they appreciated it.”

Quicksilver typically offered merchants a two-to-three week “reprieve” on payments, Boxer says. For those businesses and entreprenuers whose operations were “completely out of commission” and needed more time, he says, the company suspended payments for as long as two months.

In the end, Quicksilver’s policy of forbearance reaped dividends. It not only built up good will with its customer base but also with the Independent Sales Organizations (ISOs) who’d brokered many of the firm’s Florida deals. “We helped grow that relationship,” Boxer says of the merchant-ISO connection. “They (ISOs) love getting renewals. It’s been a win-win for everybody.”

Doug Rovello, senior managing partner at Fund Simple, Inc., an alternative business lender and broker in Palm Harbor, a beach town just outside Tampa, says the Tampa-St. Petersburg area was spared from severe flooding but “we did experience power outages.” Among his clients, he reports, businesses in the food industry were among the most vulnerable. “I had one restaurant that lost $200,000 in business in the month of September,” he says.

When the electricity went down, grocery stores and bodegas, restaurants, bars, pizzerias, sub shops, delis and luncheonettes suffered outsized losses. Without power, businesses in the food industry were forced to dump spoiled meat, rotting fish, unusable dishes like appetizers and other foodstuffs requiring refrigeration.

When the electricity went down, grocery stores and bodegas, restaurants, bars, pizzerias, sub shops, delis and luncheonettes suffered outsized losses. Without power, businesses in the food industry were forced to dump spoiled meat, rotting fish, unusable dishes like appetizers and other foodstuffs requiring refrigeration.

Rovello reports that the hurricane managed to bollix up the business of one top client, a leading ticket broker in the area with a reputation for obtaining “exclusive” tickets to major events such as A-list rock concerts and featured sporting contests – including the Super Bowl. “He buys tickets in advance and when one big event was canceled he got stuck with $30,000 in tickets that he had to eat,” Rovello says.

Other kinds of businesses that depend on alternative lenders and got hit hard from the loss of power, Rovello observes, were medical clinics, doctors’ offices, pain-management centers, and assisted-living quarters – particularly those south of Sarasota. A number of golf courses also closed down for a couple of weeks, Rovello notes, further impairing the tourism and entertainment economy. “They were not allowed to move any of the damage that was done – poles, trees, et cetera until FEMA got there,” he says.

For some 30 days following Irma’s arrival, Rovello reports that he asked clients to make modest payments – perhaps $100 instead of a $750 monthly payment — “to keep their accounts active.” He also used his connections with FEMA adjusters and interceded with funders on behalf of clients– and even businesses that were not clients – who found themselves in arrears.

While many Floridians were seeking higher ground or hightailing it out of state, Jay Bhatt, who is a senior vice president of marketing at Breakout Capital in McLean, Va., was catching one of the last Jet Blue flights into Orlando to help out his aging parents. They are now in their late 60s and 70s, he reports, and living in a retirement community in Polk County, about ten miles south of Disney World.

Irma was still a Category 1 hurricane with 100 mph winds when it hit Orlando. The electrical grid went down, but Bhatt was able to purchase a generator – the kind designed specifically to provide electricity for oxygen respirators — from Home Depot. During his stay, Bhatt made several car trips in search of fuel, each of which took him probably 35-40 minutes. “We also leveraged some of the neighbors’ sockets,” he says, “but they were so small that the wattage only allowed for the operation of the fridge and a fan.”

Electricity was restored after four or five days. “The fact that it was a retirement community might have been why we got power back so soon while it took two or three weeks for many others,” he reckons.

While Bhatt’s attention was focused on his parents, his employer – which had just offered a blanket hold on payments to its merchant accounts in 11 Texas counties that had been simultaneously inundated and walloped by Hurricane Harvey – now faced the challenge of responding to the second hurricane in two weeks. With Irma, Breakout chose to deal with its customers individually. “We didn’t do an immediate blanket response” as in Texas, Bhatt says, adding: “We were able to contact each one and we only wrote off one small business.”

While Bhatt’s attention was focused on his parents, his employer – which had just offered a blanket hold on payments to its merchant accounts in 11 Texas counties that had been simultaneously inundated and walloped by Hurricane Harvey – now faced the challenge of responding to the second hurricane in two weeks. With Irma, Breakout chose to deal with its customers individually. “We didn’t do an immediate blanket response” as in Texas, Bhatt says, adding: “We were able to contact each one and we only wrote off one small business.”

Rakem Lampkin, senior customer service representative at Pearl Capital, a New York-based alternative funder, says that his firm funds “roughly 175” businesses in South Florida. In addition to those establishments already mentioned as economically reeling because of Irma, such as restaurants, he cited “car dealerships, automotive repair shops and tech companies” as among the hardest hit, especially from the lack of electricity.

Lampkin also noted that many of Pearl’s merchants felt Irma’s wrath when colleges and state schools closed their doors. “Everything from transportation, lunches, sports equipment, even mom-and-pop florists” were slammed, he says, adding: “When the schools shut down, our payments slowed down.”

Pearl provided preferential treatment to merchants on the coast who were granted “a hold on debit payments,” Lampkin says. Even for coastal businesses that remained “structurally sound,” the business owners’ and employees’ “homes were affected, which kept them from getting to work,” he says.

As for businesses situated inland, “We were still sympathetic,” Lampkin says, but after an initial five-day grace-period their discounts were in the range of 66%-75% “so that we could focus our resources toward the people on the coast.”

To monitor the situation from New York, Lampkin says, the company was able to rely on accounts in the local news media, Google Maps, and other Internet sources. “We evaluated the situation case-by-case and week-by-week,” he says.

Jennifer Legg, a co-owner of Rochelle’s Jewelry & Watch Repair at the Indian River Mall in Vero Beach, is a Pearl-funded merchant who says she shut down the family-run business “for six or seven days” after Irma while the electricity went out. “Trees were down and a lot of people lost food and trailers, but we were not impacted as much as we were supposed to be,” she remarked.

Most of the shop’s business consists of customers stopping in for a new battery or a watch-band. Once they’re in the store, there’s a chance that they’ll purchase something else. But Irma put the kibosh on mall traffic. “A lot of people left the state, so that hurt business,” Legg says.

The store – which records annual sales of about $200,000 — lost probably $10,000 in revenue because of Irma. “It was very hard for that month of September,” Legg says. “Even after the doors opened, it was dead. No money came in for about two weeks.”

Fortunately, though, her capital source “did not take money out for a week,” she says. “If they’d kept taking it out,” she added, “we would have defaulted.”

Ron Suber: ‘This Industry Will Look Very Different One Year From Now’

February 25, 2018 Ron Suber wears many hats. His official LinkedIn profile lists him as President Emeritus and Senior Advisor at Prosper Marketplace. Now you can add a new title to his repertoire – the Magic Johnson on fintech. That’s because when it comes to Suber’s legacy, he’s all about the passing game.

Ron Suber wears many hats. His official LinkedIn profile lists him as President Emeritus and Senior Advisor at Prosper Marketplace. Now you can add a new title to his repertoire – the Magic Johnson on fintech. That’s because when it comes to Suber’s legacy, he’s all about the passing game.

“I really enjoy the assist in basketball more than the score or the dunk and so I’m trying to be that leader of assists in our industry, Magic Johnson, if you’ll let me use that analogy … I want to be him for our industry and help everybody win and help the whole thing be bigger, but you have to give the ball to the people in the position where they can score and that’s what I’m trying to do,” said Suber in a podcast discussion with Lend Academy’s Peter Renton, who is also a co-founder of LendIt.

Since Suber stepped down as president of Prosper, his presence in marketplace lending and fintech only seems to have blossomed, which in hindsight may have been the plan all along. The godfather of fintech, as he’s also known, is in the midst of what he’s dubbed a professional rewiring, one that didn’t prevent him from participating in a podcast with Renton.

During the discussion, Suber didn’t shy away from any topic, fielding questions on everything from his investment portfolio, to Prosper, to travel and his views on marketplace lending and fintech. His travels have taken Suber to Patagonia and the straits of Magellan to his favorite Aussie city of Melbourne. Next up Suber plans to explore Africa, including Rwanda and Tanzania.

Suber on Aussie IPO Credible

Suber on Aussie IPO Credible

San Francisco-based Credible, a consumer finance marketplace for millennials, just raised $50 million in an Australian IPO. Suber, who serves as chairman of the fintech, got to know Credible CEO Stephen Dash a few years ago. When Dash needed to raise money, Suber was the first to work with other fintech influencers including a group in Asia to invest $10 million in the company at a $40 million valuation.

Credible followed up with another equity round before deciding to IPO in Australia, where the market is different versus the United States or Hong Kong.

“We were able to meet with the asset managers, the family offices, and the superannuation funds and some of the pension funds in Asia, Hong Kong in particular, and throughout Australia who were very supportive of Stephen Dash, who is from Australia,” said Suber, adding that Credible was the biggest tech/fintech IPO in Australia last year.

Incidentally, Suber has also met with Australia Treasurer Scott Morrison, who sparked a meeting with Suber, Dash, US cryptocurrency exchange Coinbase and other members of the payments market to discuss how Australia can engage with young US entrepreneurs.

We asked Suber what to expect with crypto and lending, in response to which he told AltFinanceDaily: “Like the very early days of the internet, there were lots of dot-com companies with high valuations in the hype cycle, little revenue and unclear long-game solutions…think Amazon. Big winners emerged, and the majority lost money on the early bets. The same is true for cryptocurrencies. Enormous winners will emerge. In my opinion, the winners include CoinBase, Ripple and Ethereum.”

Suber on Prosper

While Suber has moved on from an executive role at Prosper, he remains engaged with the company and is close with the leadership team, including CEO David Kimball and CFO Usama Ashraf. Suber’s involved across the board, from customer acquisition, to business development and on the capital markets side of things as well.

While Suber has moved on from an executive role at Prosper, he remains engaged with the company and is close with the leadership team, including CEO David Kimball and CFO Usama Ashraf. Suber’s involved across the board, from customer acquisition, to business development and on the capital markets side of things as well.

“It’s again doing close to $300 million a month in originations, it has $100 million in cash it generates cash each quarter, it has its own securitization channel at this time in addition to the consortium … There’s a lot going on there including some product expansion, so there’s no shortage of things to do with Prosper, which I care a lot about,” said Suber.

Suber on Hindsight Being 20/20

Marketplace lending has had peaks and valleys along the way as it has matured from a nascent segment to essentially a transformational influence on the lending space, with its technology touching everything from the business model, to the borrower to the banks.

But if hindsight were 20/20, there are some things he’d do differently the second time around.

He pointed to Prosper’s acquisition of American HealthCare Lending, which he characterized as a “great decision,” giving the marketplace lender an opportunity to tap the healthcare borrower market. But as in any relationship, you can’t change each other.

“We changed American Healthcare Lending too much and tried to make it into something that it just couldn’t be with the point of sale financing. I think the lesson there is it’s great to do an acquisition, but you have to make sure you execute and keep it fresh and focused and successful once you get it,” said Suber, pointing to the acquisition of Tel Aviv’s BillGuard as yet another example of this.

Prosper also took on too much office space around the country.

“Perhaps we could have outsourced a little more instead of all the hiring. Clearly diversifying committed capital and maybe back then even using some of the capital we raised to do these own CLUB deal securitizations, which Prosper does now very successfully with its balance sheet,” he noted.

Suber also urged the marketplace lending market to showcase its technology and unique abilities as “tech-enabled finance companies” more. As the innovator that he is, Suber suggested there should be greater collaboration among marketplace lenders, comparing it to the airline industry. He explained:

Suber also urged the marketplace lending market to showcase its technology and unique abilities as “tech-enabled finance companies” more. As the innovator that he is, Suber suggested there should be greater collaboration among marketplace lenders, comparing it to the airline industry. He explained:

“So, the airline industry is competitive, they’re competing for dollars and seats and people and talented pilots and the best planes, but the reality is they have to work together, they have to make sure that planes don’t crash and that the industry is on time and does lots of good things together… And that’s really what I think we can do better, a better job of as an industry is really working together, competing, but communicating and making sure everybody lands safely.”

Suber on Marketplace Lending

As the godfather of fintech, Suber is often looked to as a guiding voice on the status of the market. That’s why when he says the industry has advanced in innings, it’s revelatory.

“I think we’re in the home stretch, I think we’ve done the seventh inning stretch,” he said. Suber pointed to Asia, where the market has gone from 3,000 platforms to 50 and in the United States where it’s consolidated from 300 to fewer than 100.

“The mature are maturing,” he said,” pointing to a race in which some platforms are pulling away from others in terms of valuation, volume and the ability to engage the industry.

“The separation will continue,” he said. “The industry will look very different one year from now.”

Suber on His Investment Portfolio

If you’ve ever wondered which investment areas Suber believes represent the next opportunity, look no further. He’s “struck” by financial inclusion, in particularly a telecom play Juvo for which he’s an advisor and in which invested a few rounds. Juvo is looking to serve the unbanked in the developing world where they lack financial identities, internet access and smartphones. The company has partnered with the likes of Samsung.

“We talk a lot in the online lending industry about top down, super-prime and prime and near prime; this is my way of coming from the bottom up with technology and data and finance to be involved in financial inclusion. I’m really quite excited about that one,” said Suber.

He also likes startup Unison and the emerging fractionalization of the home equity market, which he characterizes as “the next big thing.” In addition to Suber, this market has attracted the likes of Marc Andreessen.

Suber has nearly 20 investments in private companies, including payment companies, financial inclusion and lending. He’s also become a debt investor to some online lenders, invoice finance plays among others. “I’ve really enjoyed the debt side of investing as much as the equity side,” he proclaimed.

Suber on Broader Fintech

In addition to marketplace lending, Suber is also a believer in the point-of-sale (PoS) solution and invoice finance companies, which he says are “fixing the way invoicing is financed and making it better, cheaper and quicker.” And in taking an overarching view of the market, he also likes the cleantech, pointing to solar fintech play Mosaic and a company called CleanCapital.

Suber on Rewiring

Suber on Rewiring

Suber is a big believer in rewirement, both in his personal life and in business. He defines it as “redesigning one’s life personally and professionally.” Before he applied it to his career, Suber and his wife Caryn pursued a rewirement in their personal lives, one that included selling their home and material possessions, buying a new home and traveling.

In 2017, he decided to do the same thing professionally to strike a better balance in his life. Since then, he’s developed a color-coded regiment by which to live, separating the hours of the week across categories including exercise = blue, personal = green, work = purple and teaching and managing his family office = red.

“There’s a lot of green on my calendar,” he said.

For those interested in rewirement, Suber has launched a blog on the topic, with the maiden couple of entries documenting the first 360 days and counting.

Many of Suber’s quotes here originated from his interview with Peter Renton. Renton is the co-founder of the LendIt Conference.

The Madden Decision, Three Years Later

February 18, 2018

At first, reversing the 2015 Madden v. Midland Funding court decision, which continues to vex the country’s financial system and which is having a negative impact on the financial technology industry, seemed like a fairly reasonable expectation.

The controversial ruling by the Second Circuit Court of Appeals in New York, which also covers the states of Connecticut and Vermont, had humble roots. Saliha Madden, a New Yorker, had contracted for a credit card offered by Bank of America that charged a 27% interest rate, which was both allowable under Delaware law and in force in her home state.

But when Madden defaulted on her payments and the debt was eventually transferred to Midland Funding, one of the country’s largest purchasers of unpaid debts, she sued on behalf of herself and others. Madden’s claim under the Fair Debt Collection Practices Act was that the debt was illegal for two reasons: the 27% interest rate was in violation of New York State’s 16% civil usury rate and 25% criminal usury rate; and Midland, a debt-collection agency, did not have the same rights as a bank to override New York’s state usury laws.

In 2013, Madden lost at the district court level but, two years later, she won on appeal. Extension of the National Bank Act’s usury-rate preemption to third party debt-buyers like Midland, the Second Circuit Court ruled, would be an “overly broad” interpretation of the statute.

For the banking industry, the Madden decision – which after all involved the Bank of America — meant that they would be constrained from selling off their debt to non-bank second parties in just three states. But for the financial technology industry, says Todd Baker, a senior fellow Harvard’s Kennedy School of Government and a principal at Broadmoor Consulting, it was especially troubling.

“The ability to ‘export’ interest rates is critical to the current securitization market and to the practice that some banks have embraced as lenders of record for fintechs that want to operate in all 50 states,” Baker told AltFinanceDaily in an e-mail interview.

A 2016 study by a trio of law professors at Columbia, Stanford and Fordham found other consequences of Madden. They determined that “hundreds of loans (were) issued to borrowers with FICO scores below 640 in Connecticut and New York in the first half of 2015, but no such loans after July 2015.” In another finding, they reported: “Not only did lenders make smaller loans in these states post-Madden, but they also declined to issue loans to the higher-risk borrowers most likely to borrow above usury rates.”

With only three states observing the “Madden Rule,” the general assumption in business, financial and legal circles was that the Supreme Court would likely overturn Madden and harmonize the law. Brightening prospects for a Madden reversal by the Supremes: not only were all segments of the powerful financial industry behind that effort but the Obama Administration’s Solicitor General supported the anti-Madden petitioners (but complicating matters, the SG recommended against the High Court’s hearing the case until it was fully resolved in lower courts).

Despite all the heavyweight backing, however, the High Court announced in June, 2016, that it would decline to hear Madden.

That decision was especially disheartening for members of the financial technology community. “The Supreme Court has upheld the doctrine of ‘valid when made’ for a long time,” a glum Scott Stewart, chief executive of the Innovative Lending Platform Association – a Washington, D.C.-based trade group representing small-business lenders including Kabbbage, OnDeck, and CAN Capital — told AltFinanceDaily.

Even so, the setback was not regarded as fatal. Congress appeared poised to ride to the lending industry’s rescue. Indeed, there was rare bipartisan support on Capitol Hill for the Protecting Consumers’ Access to Credit Act of 2017 — better known as the “Madden fix.”