Company Acquiring Funding Circle USA Had Previously Acquired Knight Capital and Assets of Fountainhead

June 24, 2024 iBusiness Funding, LLC, which is acquiring Funding Circle’s US arm, is no stranger to the small business finance industry. That’s because the company not only acquired select assets of Fountainhead SBF LLC last year, but its parent company, Ready Capital, had also acquired Knight Capital in 2019.

iBusiness Funding, LLC, which is acquiring Funding Circle’s US arm, is no stranger to the small business finance industry. That’s because the company not only acquired select assets of Fountainhead SBF LLC last year, but its parent company, Ready Capital, had also acquired Knight Capital in 2019.

Ready Capital, a non-bank SBA lender, had also been one of the largest PPP lenders in the country during the pandemic. The designation of being an SBA lender is a highlight in the acquisition of Funding Circle because it means it does not need Funding Circle’s SBLC license to do SBA loans. Funding Circle had faced hostility by members of congress earlier this year for exploring a sale of its business only after it had lobbied for and finally secured an SBLC license. Now the matter is moot.

“As the Ready Capital group already holds an SBLC license, Funding Circle has, with SBA consent, surrendered its SBLC license,” the announcement by Funding Circle said. “The transaction is expected to close by the end of June.”

It was a share purchase agreement for a total cash consideration of £33 million ($42 million) which includes all of the company’s loan portfolios.

Funding Circle CEO Lisa Jacobs said, “We are pleased to have reached an agreement with iBusiness Funding, one of the leading processors of loans to US small businesses. In iBusiness, we have found a partner that shares in our mission, and we look forward to seeing the success of the combined entity.”

Ready Capital CEO Thomas Capasse said, “We’re excited to acquire FC USA and expect the acquisition to yield meaningful revenue and earnings to the combined company in the years to come.”

Founder and CEO of iBusiness Funding LLC Justin Levy said, “We are thrilled to welcome the exceptional FC USA team to the iBusiness family. FC USA’s mission to be the largest SBA lender for loans under $500,000 aligns with our goal to support underserved borrowers, the only difference is iBusiness achieves this goal through many SBA-approved lenders in our network.”

“Something’s Happened” – How a funding platform weathered a shocking crisis and is flourishing

June 21, 2024 “[The CEO] called me just before seven in the morning…but [he] would never call me at that hour, so I picked up the phone and he goes ‘Paul, something’s happened, it’s very serious.’ and I’ll never forget, he says ‘you need to take care of our company.'”

“[The CEO] called me just before seven in the morning…but [he] would never call me at that hour, so I picked up the phone and he goes ‘Paul, something’s happened, it’s very serious.’ and I’ll never forget, he says ‘you need to take care of our company.'”

That’s how Paul Vega, Senior Operations Manager at Funders App, retold the story of a phone call he received in June 2021 that would shake up everything about the small business finance company he was working at. At the time, the business was known as 24 Capital, Funders App was a platform they were developing internally, and Mark Allayev who was the CEO, was riding high from having weathered all the uncertainties of startup life and the Covid era. With Vega having played a key role in that success and the business running smoothly, Allayev felt he had earned a much needed vacation and traveled to Europe with some friends.

“And it was just five days,” Allayev said. “But one of our friends had an event in New York and we just had to come back, and the only flight to New York was with a layover in Germany, in Frankfurt. So we got to flying and it was supposed to be a two hour layover in Germany, but came out to be an eight month layover in Germany.”

That’s when the fun and life as he knew it came to a grinding halt. The German authorities never let him get on a plane to the United States. Instead, he was placed under arrest when his name registered as a match with Interpol. Despite his insistence that it was all some misunderstanding, he was directed to a local jail and told he’d soon be extradited to the country that wanted him, Russia. Allayev, then 31 years old, who had been born in Soviet-era Tajikistan and at the time enjoyed dual American and Russian citizenship, had not been to Russia at all since he moved to the United States in 2015. He had, however, previously worked at a family business in Russia as a youngster that found itself ensnared in the unique political environment. Allayev said that his family’s business had been the victim of fabricated allegations and they had left as a result. As an American citizen he had enjoyed international travel for years without issue, and he had almost forgotten about it all. That is until this moment in June 2021 that would change his whole world view and send his family scrambling to save him. While those efforts would eventually enlist help from Democratic Reps. Debbie Wasserman Schultz of Florida and Greg Meeks of New York, Allayev was swiftly cut off from being able to manage his business and was no longer able to contact Paul Vega directly.

“I was aware of what had happened years ago with him and his family because he was transparent with me from the first day we met,” Vega said. That fateful phone call he received that morning lasted all of 3 minutes. “I was like, Okay, I guess this is what’s happening,” Vega recalled.

For Vega, the realization hit that the company had nearly two dozen employees at the time, all of whom depended on it for their livelihood, and all of whom were probably going to question the circumstances their boss was in. Nevertheless, crisis management is how Vega had been introduced to the business from the beginning. Vega started at 24 Capital in January 2020 with about six years of industry experience under his belt, with the objective of completely revamping the underwriting process.

“I think it was actually perfect timing, I think it was meant to happen that way,” Vega said. For instance, family members living across the globe had tipped him off that Covid was going to be much worse than the oblivious American media was making it out to be. Vega was also operating out of an office in New York City where a potential doomsday scenario was a lot easier to imagine than where Allayev sat in South Florida.

“When I first expressed this idea [to Allayev] of the possibility of the universe being shut down, I know that Mark was questioning whether he had made the right decision in bringing me on because here I am brand new to the company and I’m telling him that, ‘hey, the US is going to shut down,'” Vega said. Despite having come across as alarmist, Vega felt that it was better to act on his conviction and plan for the impossible.

“Behind Mark’s back I started to research the idea of remote work, and nobody knew what remote work was back then,” he said. Vega proceeded to set up staff with home computers and began testing out software they had never used before.

“By the time they shut down the city, we were well situated to just literally flip a switch and be able to process and run the business from home,” he said.

And ready they were because not only did the company never stop funding but it also never let anyone from the company go during that time. Through it all Vega and Allayev formed a really trusting relationship with each other, the kind that would only make survival of the company possible once Allayev was detained in Germany the following year.

As days turned into weeks and weeks into months, Allayev’s extradition to Russia seemed inevitable despite a growing lobbying effort to free him. Then Russia invaded Ukraine. Once that happened, the politics in Europe changed, and Allayev was suddenly freed in March 2022 and put on a plane back to the United States. The emotional journey and the circumstances that enabled his return became a big news story in the newspapers, one of many about people whose fortunes changed for better or worse as a result of the war.

Once he was reunited with family and had the opportunity to acclimate back into life, he looked toward his business, which he now had a newfound perspective on. “Before, all I cared about was just working and just living my own life,” Allayev said. “So I think what changed is me understanding that probably your family’s the most important part and you need to focus and spend more time with your parents, your siblings, all your loved ones. I think that’s the thing that really changed my mindset.”

Of course, it wasn’t as if this perspective was shaped by losing his business in the process, because it had somehow managed to continue running like normal during the eight months he was away, thanks to Vega. Even the employees stayed on, as everybody stood in supportive solidarity with Allayev.

“So one thing that I learned that was funny when I came back is that the company could be run without me,” Allayev said. “And I think that Paul and all the other team members did an amazing job, keeping everything in place and keeping the funding amounts pretty decent.”

Today, the brand Allayev and Vega are under is known as Symplifi Capital. The company’s internal infrastructure platform has also blossomed into its own publicly licenseable service known as Funders App for companies that want to be their own funders. Allayev says that Funders App provides technology, underwriting services, collections, accounting, servicing, distribution of funds, contracts, white label services, and more. It can be customized to provide just what one needs. A sizable number of companies are already using it, to the point where last year Funders App announced it had collectively originated $500M in funding to small businesses since inception.

“I think there’s so many talented kids and young people that have the vision to create their own companies but they just have absolutely no help and no backup,” Allayev said, “and this is what we want to create with funders. We want to help those people, we want to get them in, train them, help them, and provide them with the right tools, the infrastructure, and even with leverage, even the money because you need capital to become a funder.”

Allayev drew some of this inspiration from how he started in the business in late 2016, when he talked to numerous companies about what they could provide to help him launch his business and felt like nobody could provide all the pieces. As for the trajectory forward, their eyes are on efficiencies and growth.

“As you know speed is kind of the name of the game here,” Vega said. “If the typical lending house is taking three to four hours to put out an offer, make a decision, ask for additional information, our goal is to have a file from submission to funding in that three-to-four hour timeline where most people are just getting an answer back to the ISO. So we’re hoping to have the merchant funded in that timeline. And that’s going to create just a huge competitive advantage for us.”

That’s the kind of thing they’re working on today. The backdrop with what happened to Allayev is now just part of the company’s founding story. For Vega, there was never any question that it wouldn’t work out. Referencing the early months of Covid when companies were doing mass layoffs, he expected that Allayev would ultimately, through no fault of his own, do the same.

“[Allayev’s] the only person that I know in the whole industry that actually said, ‘I’m not doing that, I’m keeping everybody’ and kept his word,” Vega said. “That day he sold me. That’s a big portion of the reason why I have so much trust in him, because he’s a man of his word.”

Kapitus Closes $45 Million Investment-Grade Corporate Note Financing

June 18, 2024NEW YORK, NY JUNE, 18, 2024 — Kapitus, a leading provider of financing for small and medium sized businesses, today announced the closing of a $45 Million investment-grade corporate note financing. The closing of this most recent financing increases the Company’s total debt facilities to $585 Million. Proceeds from the transaction will be used to further expand the Company’s portfolio of financing products and making further technology investments in its funding platform, making it easier for more small businesses to acquire critical growth capital more quickly.

“With this most recent round of financing, Kapitus reaffirms its commitment to stand ready to support small businesses with fast and efficient funding alternatives. Recent research continues to show that businesses are finding it more and more difficult to access capital as both bank and non-bank lenders pull back,” said Andrew Reiser, Chief Executive Officer of Kapitus. “By expanding the products we are able to provide and enhancing the speed in which small businesses can receive financing, we will be able to address the unmet needs of thousands of small businesses across the U.S.”

To date, over $6 Billion in growth capital has been provided to almost 55,000 small businesses through Kapitus.

“This capital raise also shows a vote of confidence from our investors in our business model, diversifies our capital structure, and gives us flexibility as to how and when we deploy capital to support small businesses,” adds Anthony Rose, Chief Financial Officer of Kapitus. “Despite a tight credit environment, we continue to see opportunity to provide capital to small businesses and this raise further enables us to execute our strategic plan more effectively while maintaining our focus on delivering enhanced value to small businesses”

Brean Capital, LLC served as the company’s exclusive financial advisor and sole placement agent in connection with the transaction.

About Kapitus

Founded in 2006, Kapitus is one of the most experienced and trusted names in small business financing. As both a direct lender and a marketplace with an expansive network of financing partners offering a variety of products, Kapitus has provided over $6 billion in growth capital to almost 55,000 small businesses. Kapitus, either directly or through trusted partners, offers products tailored to the need of every small business including term loans, sales-based financing, SBA loans, equipment leases, and revolving lines of credit. For additional information about the company, visit: https://kapitus.com

Media Contact:

Jackie Quintana

Pitch PR

Jackie@PitchPublicRelations.com

480.606.8180

Cloudsquare Unveils Cloudsquare Lend: The Most Secure and Robust End-to-End Lending Platform, powered by Salesforce

June 17, 2024Los Angeles, CA – June 17, 2024 – Cloudsquare, a leader in the LOS/LMS platform arena and a renowned Salesforce consulting partner specializing in alternative lending solutions, proudly announces the general availability of Cloudsquare Lend. This revolutionary end-to-end loan management system is meticulously crafted to empower small business lenders with unparalleled efficiency and scalability.

Cloudsquare Lend stands as a beacon of innovation, offering a highly flexible, scalable, and customizable loan management platform built on the robust Salesforce ecosystem. This groundbreaking solution seamlessly integrates all lending processes, providing deep business insights and automating the entire funding journey, all without the need for coding expertise.

“Cloudsquare Lend was developed in response to a pressing industry need for a comprehensive platform capable of managing all facets of the lending process,” stated Jeffrey Morgenstein, CEO of Cloudsquare. “Our solution scales effortlessly, empowering users with the ability to configure the platform independently, thus eliminating the dependency on service providers and development costs. Our mission is to deliver the most robust end-to-end lending platform, ensuring our clients can thrive and adapt as their business evolves.”

Gerbian King, CEO of Fundr shared, “Partnering with Cloudsquare was one of the best decisions we made for our business. Their hands-on approach, responsiveness, and commitment, to delivering results have elevated our operational capabilities and positioned us for long-term success.”

Cloudsquare Lend highlighted features include:

- Loan Origination: Automated workflows; KYC; underwriting automation; credit, Thomson Reuters CLEAR, and Plaid integrations; email submissions, duplicate submission management, referral source management, pricing, stipulation management, e-sign contract integrations

- Loan Servicing: ACH integrations, same day and next day processing, payment auto-scheduling, concurrent payment schedules, fees and collections automation, streamlined funding and disbursements, white-labeling, merchant statements

- Syndication: Syndicator onboarding, flexible fee settings, remittance automation and reporting, participation portal

- Secure and Compliant: Built on the Salesforce platform, Cloudsquare Lend leverages Salesforce’s robust security infrastructure, which includes encryption, advanced threat detection, and compliance with global standards like GDPR, HIPAA, and ISO 27001. Salesforce’s dedication to security ensures that sensitive financial data is protected against unauthorized access and breaches, offering a more secure alternative compared to other platforms.

Dennis Mikhailov, COO of Cloudsquare, added, “Our extensive experience in providing technology solutions to leading players in the alternative lending industry has underscored the need for a reliable, robust, scalable, and affordable platform. We have not only met these needs but continue to listen to and collaborate with our customers to prioritize our development roadmap, consistently delivering updates that enable them to fund smarter, faster, and more efficiently.”

Discover how Cloudsquare Lend can revolutionize your lending operations by visiting https://link.cloudsquare.io/Nbhf.

About Cloudsquare

Cloudsquare, is a robust LOS/LMS platform and premier Salesforce consulting partner specializing in solutions tailored for alternative lending. We pride ourselves on being the provider of choice for ambitious, forward-thinking organizations aiming to elevate their operations to the next level. Cloudsquare’s excellence has been recognized by industry leaders, is listed on the Inc. 5000 as one of America’s fastest-growing companies and is consistently rated as a top service provider on platforms like Salesforce AppExchange, G2, Clutch and Manifest. For more information, please visit https://link.cloudsquare.io/RYuO.

SellersFi Surpasses $1B in Loans Since Inception, Experiences Success Through E-Commerce Funding

June 14, 2024The timing of it all was fortuitous for SellersFi. When the company announced in January that it had secured a partnership with Amazon to provide eligible Amazon sellers with access to credit lines, it was clear that its fresh equity raise and credit facility of up to $300 million were going to be put to use. SellersFi wasn’t the only partner, however, and Amazon still did most of the lending to its own sellers directly, a business it had been in for more than a decade, but it was still a big relationship to have. But then it got better. In March, Amazon announced that it would end its direct lending program and rely entirely on its partners instead. For SellersFi that meant it would have the opportunity to service even more sellers on the platform than before. Since then, SellersFi has quietly surpassed $1 billion in loans since inception.

“What we are seeing now is less competition,” said Ricardo Pero, CEO of SellersFi, in a call with AltFinanceDaily. He partially attributed that to the current interest rate environment which has impacted those with small margins. SellersFi, however, has experienced a lot of success. The company knows the e-commerce space particularly well, the only space it operates in, since its the only US lending platform also approved as a payment service provider member for Amazon. They started their relationship with Amazon as a service provider 3 years ago. While Pero said they have seen “nothing that points to a recession,” their experience suggests that even if one were to happen in the future, consumers would react by seeking out bargains on e-commerce platforms, reinforcing their position as the niche to be in. As readers may recall, a flight to e-commerce is also what happened during the pandemic.

E-commerce, however, is a broad umbrella, and Amazon is not alone in the universe. Millions of businesses rely on various platforms for e-commerce from basic templates with API connections to Shopify and more. Even big box brick and mortar retailers are waking up and rapidly inching their way into e-commerce. Walmart is just one example, which not only accommodates individual sellers on its platform but also offers merchant cash advances to them.

“The competitive landscape is changing for our clients,” Pero said. Pero added that they know what’s going on because they talk to these clients all the time and that even in the e-commerce business there are person-to-person relationships. “Customers mention their account managers by name,” Pero said. “We have a reputation as a partner to these merchants.”

One trend they’ve noticed over the last year or so is their strategy towards borrowing. While merchants have always typically used funds for things like advertising or inventory, the previous low rate environment enabled behavior where merchants could borrow first and then figure out how to spend the funds second whereas now that rates are higher there is a lot more of a deliberative approach to precisely how much they should get and what it will be used for in advance. It’s something they see all the time now and agree with. “You need to plan,” Pero said.

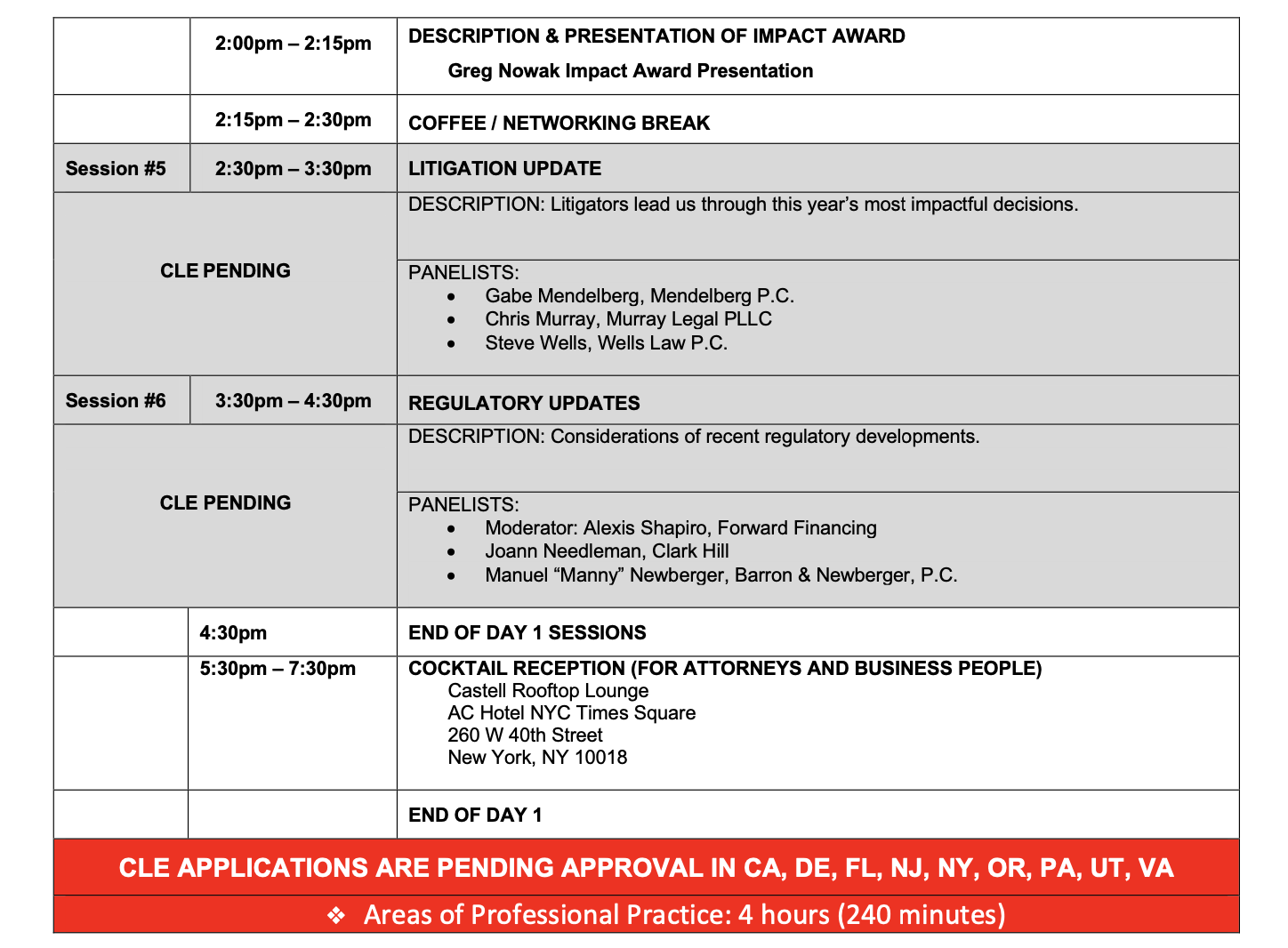

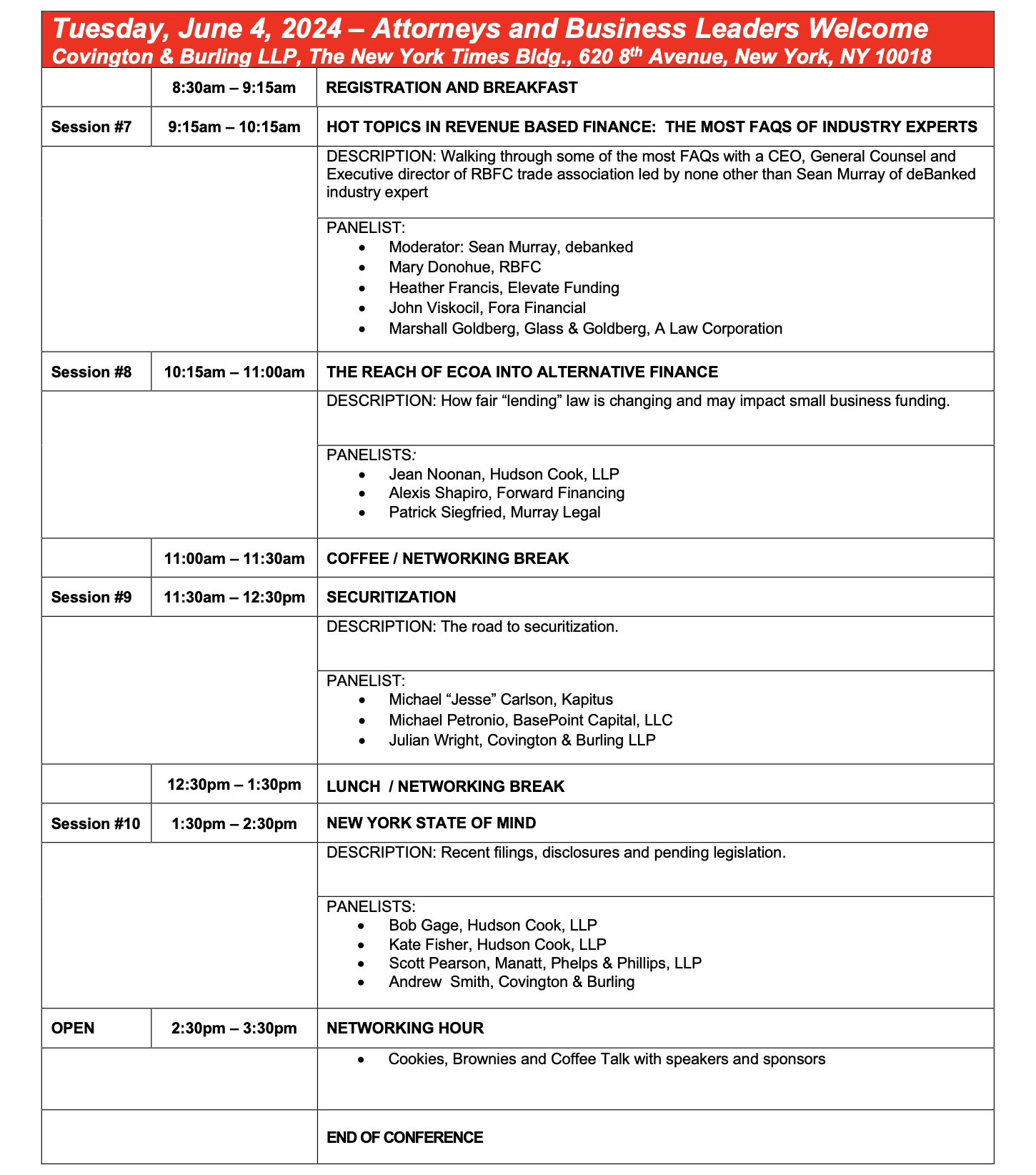

Almost Sold Out – The Industry’s Legal Conference in NYC (AFBA) – Features Big Name Speakers

May 29, 2024 This is the last chance for attorneys and executives interested in the most comprehensive industry legal education to register for the Alternative Finance Bar Association Conference taking place in NYC. While the day of June 3rd is for attorneys only, the evening of June 3rd and the full day of June 4th are open to business people!

This is the last chance for attorneys and executives interested in the most comprehensive industry legal education to register for the Alternative Finance Bar Association Conference taking place in NYC. While the day of June 3rd is for attorneys only, the evening of June 3rd and the full day of June 4th are open to business people!

The outstanding lineup of speakers includes Andrew Smith, a partner at Covington & Burling LLP, who was formerly the Director of the Bureau of Consumer Protection at the FTC, and Bob Zadek, Of Counsel for Buchalter.

A June 4th panel moderated by AltFinanceDaily‘s Sean Murray will feature speakers Heather Francis at Elevate Funding, Mary Donohue at Revenue Based Finance Coalition, John Viskocil at Fora Financial, and Marshall Goldberg at Glass & Goldberg. Tickets are almost sold out.

For questions, email Lindsey@lrohanlaw.com or fitzgeraldmegan19@gmail.com

CFG Merchant Solutions Closes Credit Facility of up to $145 Million to Support Small Business Growth

May 29, 2024NEW YORK, NY. May 29, 2024 – CFG Merchant Solutions, LLC (“CFGMS” or the “Company”), a technology-enabled specialty finance and alternative funding provider, announced the successful completion of a $100.0 million senior credit facility. The credit facility is expandable up to an additional $45.0 million, representing a total capital raise of up to $145.0 million. Proceeds from the funding, secured from a prominent, U.S.-based institutional investor focused on private structured credit, will serve to further fuel the Company’s mission to empower and support the growth of small and medium-sized businesses (SMBs).

Since its founding in 2015, CFGMS has a proven track record of asset performance and profitability, and has funded more than $1.4 billion to over 33,000 SMBs across diverse industries throughout the U.S. With the infusion of additional capital, CFGMS will continue to focus on delivering flexible and accessible financing solutions that empower small businesses to seize growth opportunities, create jobs, and contribute to the overall economic prosperity of the communities they serve.

“We are thrilled to have secured this substantial capital raise, as it reaffirms our commitment to empowering small businesses,” said Andrew Coon, Chief Executive Officer of CFGMS. “We extend our heartfelt gratitude to our investors for their continued trust and support. With this new credit facility, we will be able to reach a wider range of small businesses and provide them with the financial resources they need to thrive.”

Bill Gallagher, President of CFGMS, expressed enthusiasm for the future impact of the capital raise, stating, “This new facility will strengthen our position to ensure our small business clients have access to fast and efficient financing solutions tailored to their unique needs. We are excited to leverage this capital to expand our operations and deepen our commitment to empower U.S. small businesses to succeed.”

Brean Capital, LLC served as the Company’s exclusive financial advisor and sole placement agent in connection with the transaction.

About CFG Merchant Solutions

CFG Merchant Solutions (“CFGMS”) is an independent, technology-enabled alternative funding platform focused on providing capital access to small and mid-sized businesses that have historically been undeserved by traditional financial institutions and may have experienced challenges obtaining timely financing. The Company uses its historical transactional data, proprietary underwriting, predictive analytics, and electronic payment technologies and platforms to assess risk, and provide access to flexible and timely capital.

For additional information about the Company, visit: https://cfgmerchantsolutions.com/.

Contact:

Name: Richard Polgar

Title: Chief Financial Officer

rpolgar@cfgms.com

Dragin Technologies and Ocrolus Announce Strategic Partnership: Enabling the Next Generation of Application Process Automation for Small Business Financing

May 20, 2024

New York, NY – 05/20/24 – Dragin.io, a machine learning process automation tech firm, is thrilled to announce a product integration and strategic partnership with Ocrolus, a leader in AI-driven financial document analysis. This collaboration aims to combine Dragin’s cutting-edge process automation technology with the industry-leading bank statement automation and cash flow analytics products offered by Ocrolus. Together, the new solution offers clients in small business financing unmatched speed, accuracy, compliance, and a robust fraud detection system, providing them with confidence and security in their financial operations.

Mark Ross, CEO of Dragin, expressed his enthusiasm for the partnership: “This is incredibly exciting for the future of the small business financing industry. Dragin specializes in automation solutions that help our clients deliver their offers faster than anyone else in the industry. Partnering with Ocrolus enables us to achieve technological advancements in business financing sooner than expected.”

Dragin’s AI and machine learning (ML) algorithms enable sophisticated data processing, providing actionable insights for offer creation and customization in the business funding deal cycle. This technology empowers underwriters to make informed decisions smarter and more quickly.

This partnership will enable powerful solutions for providers of small business financing, offering:

- Speed and Efficiency: Clients can rapidly analyze bank statement data, accelerating decision-making and reducing the time required for underwriting approvals.

- Compliance and Fraud Detection: Ocrolus’ technology performs comprehensive, AI-driven fraud detection, safeguarding clients against potential risks.

- Accuracy and Reliability: The partnership guarantees high levels of accuracy in data extraction and analysis, minimizing errors and enhancing the reliability of financial assessments.

- A.I. & Machine Learning: Dragin has developed advanced AI and ML models that can parse and classify nearly all document types and fill in missing fields such as industry, leading to a more robust auto-decline system. Integrating Ocrolus’ AI-driven document automation and analytics will bolster Dragin’s overall capabilities in lead prequalification.

“We are incredibly optimistic about this partnership with Dragin,” remarked Sam Bobley, CEO of Ocrolus. “Their focus on improving the efficiency of small business funding processes and commitment to client satisfaction makes them an ideal partner for Ocrolus. We look forward to a successful collaboration that will provide customers with the trusted and accurate data, fraud detection, and analytics they need to confidently make important financial decisions.”

About Dragin

Dragin is a leading fintech solutions provider dedicated to delivering innovative and efficient services to its clients. Founded with a mission to simplify and streamline financial processes, Dragin has developed cutting-edge technology, including A.I. and machine learning, to streamline processing automation which creates actionable insights for offer creation and customization. For more information about Dragin and its automation solutions, please visit https://www.dragin.io

About Ocrolus

Ocrolus is a document AI platform that enables faster and more accurate financial decision-making. The company analyzes documents with over 99% accuracy, regardless of format or quality, supporting hundreds of document types including bank statements, pay stubs, and tax forms. Ocrolus provides a trusted solution to detect fraud, analyze cash flows and income, and streamline decisions for 500+ clients across a number of use cases. Customers such as Enova, PayPal, Rapid Finance, Bluevine, National Funding, and Kapitus leverage Ocrolus automation to build delightful user experiences. To learn more, visit Ocrolus.com.