Capify Appoints Sam Colclough as Head of Technology to Accelerate Growth in the UK & AU Markets

September 17, 2024 MANCHESTER, 17th September 2024 – Capify, a leading online SME lender, is proud to announce the appointment of Sam Colclough as Head of Technology for both the United Kingdom and Australia. Sam joins Capify at an exciting time for the company, which is experiencing a growth trajectory, leveraging a new £100 million (~$130 mil USD) credit line from Pollen Street Capital, recent senior team appointments and an expanded product suite.

MANCHESTER, 17th September 2024 – Capify, a leading online SME lender, is proud to announce the appointment of Sam Colclough as Head of Technology for both the United Kingdom and Australia. Sam joins Capify at an exciting time for the company, which is experiencing a growth trajectory, leveraging a new £100 million (~$130 mil USD) credit line from Pollen Street Capital, recent senior team appointments and an expanded product suite.

Sam brings a wealth of experience and expertise to Capify. With over 20 years of IT leadership experience, Sam will spearhead Capify’s technological and data-driven innovations, empowering the business to continue its growth across the UK and Australia.

“I’m thrilled to join Capify at such an exciting time,” said Sam Colclough. “Technology is a key enabler of growth, and I’m looking forward to working with the team to further enhance our technology, data & artificial intelligence capabilities. By driving innovation and operational efficiencies, we will continue to deliver exceptional value and support to SMEs across the UK and Australia, helping them to grow and thrive.”

Founded in the UK in 2008 during the global financial crisis, Capify has become a vital financial resource for small and medium-sized businesses. Recognised for its commitment to excellence, Capify was awarded SME Lender of the Year (up to £1m) at the UK Credit Awards last year. Originally launched in the United States in 2002, Capify was one of the world’s first online alternative financing companies for SMEs. Since its creation, Capify has supported over 20,000 businesses and funded over £1.2 billion to help SMEs achieve their growth ambitions.

Capify COO/CFO, John Rozenbroek, said: “We are thrilled to have Sam join the team. His impressive track record of leveraging technology to drive business growth aligns perfectly with our mission. As we look to scale further, Sam’s leadership will be crucial in taking our data and technology to the next level, ensuring we remain at the forefront of innovation in the alternative finance space.”

Capify’s appointment of Sam Colclough underscores the company’s commitment to technological growth and innovation, ensuring it remains at the forefront of the alternative finance industry, delivering unparalleled service and support to SMEs in the UK & Australia.

Abut Capify

Capify is an online lender that provides flexible financing solutions to SMEs seeking working capital to sustain or grow their business. Originally started in the US over twenty years ago, the fintech business now operates in the UK and Australia and has served these markets for over 15 years. In that time, it has provided finance to thousands of businesses, ensuring the vibrant and vital SME community can meet the challenges of today and the opportunities of tomorrow.

For more details about Capify, visit:

Capify UK – http://www.capify.co.uk

Capify Australia – http://www.capify.com.au

Media enquiries

Ash Yazdani, Marketing Director

ayazdani@capify.com

Leading Fintech MoneyThumb Acquired by Iron Creek

August 29, 2024San Diego, Calif. (August 29, 2024) – MoneyThumb, a leader in automated document evaluation and fraud detection solutions announced today that it has been acquired by Iron Creek Partners LLC (“Iron Creek”), a private investment firm with a focus on investments in the software, data, communications, and business services industries. Iron Creek led the investment group, which also included Main Street Capital Corporation (NYSE: MAIN). The transaction will provide growth capital to help meet MoneyThumb’s strong industry demand, which has recently produced 100% year-over-year annual growth. The transaction closed on August 19, 2024.

Ryan Campbell, previously heading up MoneyThumb’s business development since 2017, has been named as the new chief executive officer and has joined the investor group. Ryan has played an integral role in leading MoneyThumb’s sales, marketing and business development strategy. Ralph Mayer, the company’s founder will step down as CEO and assume an advisory role and retain his board seat.

Founded in 2014, MoneyThumb is an industry leading underwriting automation software that improves workflows for funders, lenders, and accountants by converting and analyzing pdf financial documents in seconds. The company also helps detect fraud with its AI file tampering detection tool that identifies fraudulent activity in seconds, giving lenders a powerful defense against risk and loan losses.

“This acquisition underscores MoneyThumb’s proven technology and strong industry demand, and supports our long-term growth objectives,” said Ryan Campbell. “This partnership marks an exciting milestone for our company and with the support of Iron Creek, we are well-poised to accelerate our growth, continue to deliver exceptional software solutions for our customers and help lenders manage risk and deliver more capital faster to small businesses.”

“MoneyThumb has built a highly successful business through its algorithm-driven software, product innovation and a meticulous approach to delivering value and service to their customers,” said John Bingaman, Founder and Managing Principal of Iron Creek Partners LLC. “We look forward to working closely with MoneyThumb’s talented team to continue to grow the business and broaden the product suite.”

Financial terms of the transaction were not disclosed.

For more information on MoneyThumb, please visit www.moneythumb.com.

About MoneyThumb

MoneyThumb is an advanced automation software solution that streamlines the lending underwriting process by converting bank statements instantly into actionable data. By exponentially increasing efficiency, accuracy and the detection of fraud – MoneyThumb empowers lenders and accountants to make faster, more informed and accurate decisions. MoneyThumb is headquartered in Encinitas, California, and serves customers globally. For more information visit www.moneythumb.com.

About Iron Creek

Iron Creek is a sector-focused, stage-independent private investment firm based in Santa Fe, NM, seeking attractive investment opportunities primarily in the software, data, communications, and business services industries. Iron Creek seeks to partner with strong management teams and to support its portfolio companies’ growth by leveraging its network of relationships and its sector experience.

About Main Street Capital Corporation

Main Street (www.mainstcapital.com) is a principal investment firm that primarily provides long-term debt and equity capital to lower middle market companies and debt capital to middle market companies. Main Street’s portfolio investments are typically made to support management buyouts, recapitalizations, growth financings, refinancings and acquisitions of companies that operate in diverse industry sectors. Main Street seeks to partner with entrepreneurs, business owners and management teams and generally provides “one stop” financing alternatives within its lower middle market investment strategy. Main Street’s lower middle market companies generally have annual revenues between $10 million and $150 million. Main Street’s middle market debt investments are made in businesses that are generally larger in size than its lower middle market portfolio companies.

Main Street, through its wholly owned portfolio company MSC Adviser I, LLC (“MSC Adviser”), also maintains an asset management business through which it manages investments for external parties. MSC Adviser is registered as an investment adviser under the Investment Advisers Act of 1940.

Media Contact

Tracy Rubin

JCUTLER media group

Tracy@jcmg.com

Lightspeed: MCAs continue to grow with healthy margins

August 1, 2024 Lightspeed Commerce, a global e-commerce platform for merchants, once again talked about its MCA business in the latest quarterly earnings call despite it only accounting for 3% of the company’s overall revenue.

Lightspeed Commerce, a global e-commerce platform for merchants, once again talked about its MCA business in the latest quarterly earnings call despite it only accounting for 3% of the company’s overall revenue.

“[Lightspeed] Capital continues to grow with healthy margins,” said CFO Asha Bakshani. She added that it was very popular with customers but that it was still a nascent product offering for them. They’ve consistently said over the last couple years that they intend to grow this business cautiously, which they have done. The company currently holds $87.5M worth of MCAs on its balance sheet.

“Lightspeed capital offers fast access to capital and an automatic repayment method to Lightspeed Payments,” Bakshani said. “Merchants are leveraging this offering to finance inventory purchases, upgrade equipment, and expand their overall business.”

Ponzi Schemer Continued to Run Ponzi Scheme From Prison Phone

July 22, 2024Don’t syndicate with New Beginning Global Funding LLC, New Beginning Capital Funding LLC, and Lion Heart Capital Group L.L.C.

That’s because these entities were just named in a federal plea agreement as belonging to Johanna Garcia, a now-convicted ponzi schemer currently serving time in Miami’s federal detention center. Readers might remember her as being the mastermind behind a fake MCA company known as MJ Capital Funding. Garcia raked in more than $190 million as part of a fake syndication/investment scheme from thousands of duped investors. The SEC shut the company down in 2021 and she was charged criminally last year.

She did not go down quietly. Apparently after the SEC shut down her entities she simply set up new entities and kept going. When she was finally arrested and jailed awaiting trial she continued the ponzi from the prison phone and email.

In a proffer signed by Garcia, it’s stated that “Garcia and her co-conspirators told investors that their money would be used to fund general contractors who worked on commercial and residential properties through merchant cash advance loans. In truth, bank records show that there was little to no merchant cash advance activity, and the money raised was used to pay off previous investors.”

Garcia, and those that participated in the scheme with her, used MCA as a cover for their scheme. She was not actually known to people in the industry nor actually worked in it.

Capify Appoints Think Business Loans Founder as Director of Strategic Initiatives

July 18, 2024 Capify, a leading SME lender, has appointed Jamie Stewart as Director of Strategic Initiatives. Jamie, the founder and former MD of Think Business Loans, brings extensive experience and SME expertise to Capify. In his role at Think, he successfully oversaw the deployment of over £1 billion in funding to more than 10,000 customers, prior to its sale to Bionic in 2019. Since then, Jamie set up Anidea, a Strategic Consultancy firm.

Capify, a leading SME lender, has appointed Jamie Stewart as Director of Strategic Initiatives. Jamie, the founder and former MD of Think Business Loans, brings extensive experience and SME expertise to Capify. In his role at Think, he successfully oversaw the deployment of over £1 billion in funding to more than 10,000 customers, prior to its sale to Bionic in 2019. Since then, Jamie set up Anidea, a Strategic Consultancy firm.

Jamie’s arrival marks another milestone during a significant growth phase for Capify. Having leveraged a new £100 million credit line from Pollen Street Capital earlier this year, the company has made a succession of senior team appointments recently and is actively developing an expanded product suite.

“I’m thrilled to join the team at Capify as Director of Strategic Initiatives,” said Jamie Stewart. “Capify is a pioneer in the alternative lending space, with a solid foundation and a clear vision for the future. As a forward-thinking entrepreneurial company with a new range of innovative products, Capify is poised for significant growth. I look forward to collaborating with the team to develop new partnerships that will further enhance our ability to provide quick, reliable funding solutions to SMEs.”

Founded in the UK in 2008 during the global financial crisis, Capify has become a vital financial resource for small and medium-sized businesses. Recognised for its commitment to excellence, Capify was awarded SME Lender of the Year (up to £1m) at the UK Credit Awards last year. Originally launched in the United States in 2002, Capify was one of the world’s first online alternative financing companies for SMEs. Since its creation, Capify has supported over 20,000 businesses and funded over £1.2 billion to help SMEs achieve their growth ambitions.

John Rozenbroek, COO/CFO at Capify, commented, “We’re delighted to welcome Jamie to the Capify team. His extensive experience in SME lending and his proven ability to drive strategic growth are exactly what we need as we expand our operations and introduce new products. Jamie’s insight and leadership will be invaluable in achieving our mission to support SMEs with the funding they need to thrive.”

“Jamie’s appointment underscores our commitment to strategic growth and innovation, ensuring it remains at the forefront of the alternative finance industry, delivering unparalleled service and support to SMEs in the UK”.

ABOUT CAPIFY

Capify is an online lender that provides flexible financing solutions to SMEs seeking working capital to sustain or grow their business. Originally started in the US over twenty years ago, the fintech business now operates in the UK and Australia and has served these markets for over 15 years. In that time, it has provided finance to thousands of businesses, ensuring the vibrant and vital SME community can meet the challenges of today and the opportunities of tomorrow.

For more details about Capify, visit:

http://www.capify.co.uk

Media enquiries

Ash Yazdani, Marketing Director

ayazdani@capify.co.uk

eBay Brings Back Revenue Based Financing Product

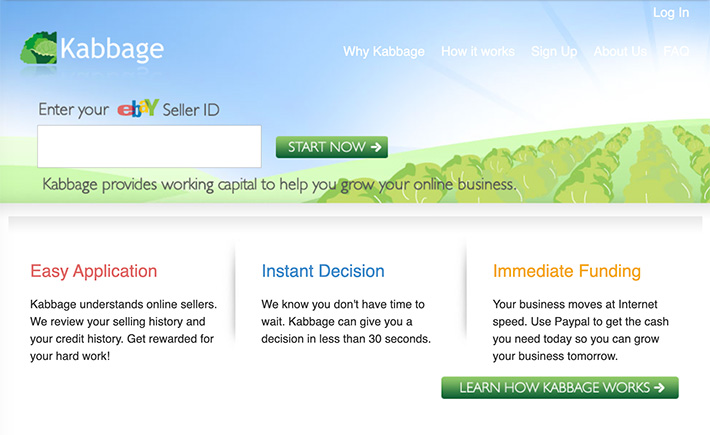

July 12, 2024eBay announced that Liberis had been onboarded as one of its “Seller Capital” partners this week, making it the second official partner after Funding Circle (which was recently acquired). Liberis, homegrown in the UK, expanded to the US in 2020 and offers a revenue based financing product described by eBay as a “Business Cash Advance.” While eBay has partnered with similar companies in the UK for years, eBay customers in the US have seen this before.

In 2010, for example, Kabbage was arguably the first company to offer revenue based financing to eBay customers, which AltFinanceDaily first covered 13 years ago. And they had it all to themselves until PayPal began to muscle its way in with a similar product starting in 2013. Given that eBay owned PayPal, PayPal held a distinct advantage until the two companies split in 2015. Still, PayPal continued to be the default payment service for eBay until 2018.

Kabbage continued to thrive anyway, evolving beyond the platform at least until covid when Kabbage suddenly imploded and was sold to American Express. PayPal’s working capital product also continued to thrive at least until 2023 when it announced a dramatic pullback after elevated charge-offs.

The result is that in 2024, eBay sellers can now look toward getting funding via Liberis.

“As a pioneer in ecommerce and the home to small businesses in more than 190 markets, eBay understands the challenges small businesses encounter in securing fast, flexible and transparent financing,” said Avritti Khandurie Mittal, VP & General Manager of Global Payments and Financial Services at eBay in the official announcement. “eBay Seller Capital is aimed at fueling our sellers’ growth by providing them with tailored financing solutions that meet the unique needs of their businesses. The addition of Business Cash Advance to our suite of offerings in partnership with Liberis enables us to expand capital availability for our sellers on flexible terms – when they need it the most.”

“We understand the unique challenges eBay sellers face when securing financing through traditional means,” adds Rob Straathof, CEO of Liberis. “Through eBay Seller Capital, Liberis will empower sellers with access to fast and responsible financing. We’re thrilled to partner with eBay to support eBay sellers to operate and grow their businesses.”

FundKite Launches Merchant Services Division

July 11, 2024Miami, Florida – July 11, 2024- FundKite, a leading provider of financial solutions for small businesses, today announced the launch of FundKite Merchant Services, a new payment processing division that expands the company’s suite of products, offering low fee merchant services and quick access to their funds.

Small businesses in today’s economic climate are seeking capital, quality payment processing, lower costs, and real time knowledgeable customer support partners – particularly amid an uncertain economic future, tightened cash flow, and limited access to traditional financing.

FundKite Merchant Services provides a comprehensive suite of solutions for small and medium sized businesses, including competitive rates, industry veterans with unparalleled expertise, and top-notch service and support. Supporting all major credit card networks, FundKite Merchant Services equips small business owners with best-in-class payment technology to better facilitate credit and debit card transactions with reduced fees, daily financial reporting, acceptance of other forms of electronic payments through secure, state-of-the-art point of sales systems, check guarantee, and more.

With the new division, FundKite expands on its mission of empowering small businesses with accessible services to simplify their finances and allow them to save on processing costs. Additionally, businesses that choose FundKite Merchant Services benefit from integrated support with customized funding solutions, aiding in the management of cash flow and working capital.

“Given today’s challenging economic climate, high interest rates, strained cash flow and increased difficulty in meeting lending criteria from traditional financial institutions, it’s more crucial than ever to help Main Street American thrive, by offering savings through unique payment solutions and alternative financing options,” said Alex Shvarts, CEO of FundKite. “These businesses are evaluating and upgrading their outdated, legacy payment processing providers. We’re seeing an incredible demand for our products and are proud to offer small businesses a wider suite of solutions, so they not only survive but grow.”

To date, FundKite has processed over 200,000 business funding applications across the country. FundKite’s continued expansion reflects its ongoing mission to serve as a trusted partner for entrepreneurs seeking financing. By offering flexible funding options, personalized service, and prioritizing long-term relationships, FundKite remains dedicated to supporting entrepreneurial ventures across the nation with their revenue-based financing solution, and now merchant services division.

To learn more about FundKite Merchant Services, please visit here.

About FundKite

FundKite is among the fastest-growing fintech companies, introducing a unique approach to the longstanding financing industry. Utilizing a boutique funding style, FundKite provides businesses of all sizes, ranging from local small shops to major global firms, with a flexible array of products and services tailored to fit their individual financial needs. Positioned as one of the fastest-growing firms in the small business funding industry, FundKite offers up to $2,000,000 in working capital for each qualified business.

Media Contact

Fundkite@5WPR.com

Capify Announces New Appointment to Lead Broker Division

March 7, 2024Leading online SME lender, Capify, has appointed Mike Morris to lead its broker business in the UK.

Mike joins Capify after five years with Funding Circle, most recently as Head of Business Development, where he was responsible for leading the lender’s broker network.

With nearly 20 years experience in the finance industry, including time at Close Brothers retail finance, Mike will focus on the growth and expansion of Capify’s introducer relationships and its marketplace offering.

“I’m hugely excited to join Capify to build out its broker programme and exponentially grow this channel for one of the first online SME lenders in the UK market,” said Mike.

“Capify occupies a vital place in the funding landscape – offering much-needed fast, flexible and responsible solutions for businesses. We’re focused on ensuring that introducers understand our offering and how we can help their clients. Our growth will then be realised by launching new products that go up and down the credit spectrum, providing the best possible service to enable the brokers, and ultimately the clients they represent, to get the funds they need to thrive in the current climate. Our goal is to have an offering for all types of businesses so we can be a one-stop shop for brokers and their clients. I look forward to Capify announcing these new offerings in the near future.”

Capify was launched in the UK in 2008, against the backdrop of the global financial crisis, when many small and medium-sized businesses were struggling to access funding from banks. Last year it was named the UK Credit Awards SME Lender of the Year (up to £1m). The company was founded initially in the United States in 2002 making it one of the world’s first online alternative financing companies for SMEs globally.

John Rozenbroek, COO/CFO at Capify, said: “We’re absolutely delighted to welcome Mike to the Capify team. Brokers play an integral role in helping businesses understand the complex funding landscape and the types of finance that are best suited to their needs. His appointment underlines our commitment to introducers and marks an exciting new stage in Capify’s continued growth.”

ABOUT CAPIFY

Capify is an online lender that provides flexible financing solutions to SMEs seeking working capital to sustain or grow their business. Alongside its sister company, Capify Australia, the fintech businesses have been serving their respective markets for over 15 years. In that time, it has provided finance to thousands of businesses, ensuring the UK’s vibrant and vital SME community can meet the challenges of today and the opportunities of tomorrow.

For more details about Capify, visit: http://www.capify.co.uk

Capify Contact:

Ash Yazdani, Marketing Director

ayazdani@capify.co.uk

Media enquiries

Sam Gallagher, Director

sam.gallagher@1473media.com