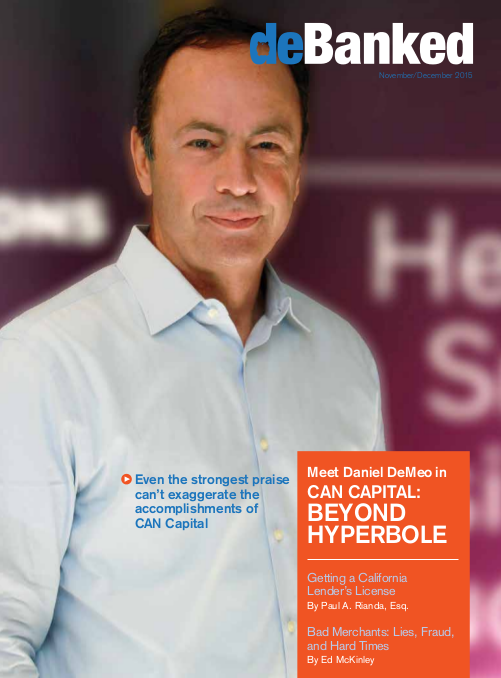

CAN Capital: Beyond Hyperbole

December 11, 2015 It’s usually risky to say “first,” “largest” or “best,” but CAN Capital invites those superlatives and more.

It’s usually risky to say “first,” “largest” or “best,” but CAN Capital invites those superlatives and more.

Asked whether the company’s the biggest in the alternative funding business, CEO Dan DeMeo hedges only a little with qualifiers like “might” or “probably” before proudly announcing that the company has provided access to more than $5.5 billion in working capital through 163,000 fundings to merchants operating in over 540 different kinds of businesses.

Glenn Goldman, the company’s CEO from 2001 to 2013 and now Credibly’s chief executive, doesn’t mince words about his former employer when he calls CAN Capital the biggest and most profitable small business alternative finance company in the U.S.

Cofounder and Chairman Gary Johnson proclaims without hesitation that CAN Capital was the first alternative small business finance company. His wife and cofounder, Barbara Johnson, came up with the idea of the Merchant Cash Advance in 1998 when she had trouble raising funds to promote her business, he said.

CAN Capital developed the first platform to split card receipts between the merchant and funder, and it gave birth to the idea of daily remittances, Johnson continued. Within a few years of its founding the company was turning a profit, another first in alternative finance, he claimed.

The innovation continued from there, according to Andrea L. Petro, executive vice president and division manager of Lender Finance, a division of Wells Fargo Capital Finance. She cited a couple of possible firsts she’s witnessed in her dealings with CAN Capital.

When CAN Capital received a loan from Wells Fargo in 2003, it may have been the first sizeable placement in the alternative finance industry by a major traditional financial institution, Petro said. In 2010, CAN Capital was among the first alternative funders to offer direct loans, she noted.

Petro stopped short of characterizing CAN Capital as the best in the alternative finance business, but she praised the company’s management and lauded its systems for underwriting and monitoring funding. “They continually upgrade their systems, upgrade their software, upgrade their people,” she said.

Calling CAN Capital one of the best comes naturally to Kevin Efrusy, a partner at Accel Partners and a CAN Capital board member. Accel saw opportunity in alternative finance because banks were reluctant to lend at the same time that an explosion of data on small businesses was informing the underwriting process. When Accel sought a position in the industry, it contacted CAN Capital, he said.

“Frankly, CAN Capital didn’t need or want our money,” Efrusy said. “We approached them.” Five years ago, Accel convinced CAN Capital that additional resources could help the company grow, and it bought a stake in the company.

With so many extolling the virtues of CAN Capital, AltFinanceDaily asked DeMeo for a look at the thinking that underlies the success.

PLOTTING STRATEGY

CAN Capital pursues a strategy that DeMeo visualizes as a honeycomb. In the center cell, he places the objective of “helping small businesses succeed.” The compartmental element above that provides a place for the goal of serving as “the preferred provider of financial solutions to small business,” he said. The company’s cultural values, summarized as “Care, Dare and Deliver,” reside in the compartment below the center cell as table stake underpinnings, he added.

DeMeo also describes the company as driven by four strategic planks: “1) Expand the market, 2) broaden the product set, 3) deepen relationships with customers, and 4) achieve operating excellence,” he said.

What does success look like to the company? To DeMeo, it’s dramatic growth in the number of customers, resulting in increased revenue, a more valuable company and better career opportunities. “Digital automation and customer experience are at the center of those efforts,” he said.

CAN Capital operates with a “huge appetite for ‘test and learn,’” according to DeMeo. “That’s how we keep innovation alive,” he said.

And the result of all that? The company has increased fundings by 29 percent (CAGR) and revenue by 24 percent (CAGR), with corresponding growth in earnings, DeMeo said. It has also grown its digital business by 600 percent since 2014, he noted.

AT THE WHEEL

AT THE WHEEL

DeMeo, the man at the top of CAN Capital, joined the company in 2010 as chief financial officer and became CEO early in 2013. He was previously CFO at 1st Financial Bank, and also served as CFO for JP Morgan Chase’s consumer and small business unit. DeMeo also was chief marketing officer and ran business development head for GE Capital’s consumer card unit. His career began at Citibank, where he held senior roles in marketing and customer analytics.

“I was very fortunate to work for some pedigree companies earlier in my career,” DeMeo said. “Those companies emphasized market based training and development, and I worked with very smart and hardworking people. I also had great experience in unsecured lending.” His formative years left him with great appreciation for “behavioral analytics and the quantitative, information-based approach to business finance.”

Experience convinced him, as a CEO, the importance of attention to the balance sheet and income statement. It’s vital to combine that with innovation and growth orientation, DeMeo said. He seeks to lead, inspire and motivate employees, he emphasized.

DeMeo grew up in Atlantic City, NJ, with parents who valued hard work, education and maximizing opportunity. His wife and three children have supported him in his career despite the long hours and dedication necessary for success.

At CAN Capital DeMeo has faced the challenge of managing the business through internal and external cycles. Running the company often comes down to balancing what customers want with what makes economic sense, he said. “Pigs eat, and hogs get slaughtered,” he maintained. “You can’t get too greedy.”

DeMeo runs the company without the help of a President or Chief Operating Officer. While DeMeo serves as the public face of the company, he also devotes himself to every aspect of operations, he said.

WHAT’S IN A NAME?

Although CAN Capital’s drive for technological innovation and its measured approach to fundings have remained constant, the company has renamed itself several times to fit changing times.

In November 2013, it rebranded itself publicly as CAN Capital, and the company now provides access to business loans through CAN Capital Asset Servicing Inc, and Merchant Cash Advances through CAN Capital Merchant Services.

With the CAN Capital rebranding, it dropped the umbrella name of Capital Access Network. At the same time, it retired the AdvanceMe, New Logic Business Loans and CapTap names.

Most of the company’s old names applied to products or distribution channels, DeMeo said. The company had added them when it presented a new product, such as loans, or introduced a way of going to market, like end-to-end digital technology.

Consolidating the names reflected the company’s decision to put its direct marketing efforts on equal footing with business generated by partner companies, DeMeo said. Having just one name would result in a more efficient approach to building a stronger brand, he noted.

“The opportunity is to create one brand, multiple products and omni channel distribution under one company,” he said. “For a company our size, it would be hard to create brand awareness if you had to put significant promotional support behind every one of those sub brands.”

CAN Connect is a sub-brand that has survived. “That’s not a product name or distribution channel name,” DeMeo said. “It’s the technology suite we use to connect with partners so that we can exchange information in real time.”

CAN Connect is a way to speed up the process and eliminate friction for customers and partners. For example, a partner is able to link their CRM directly into CAN Capital’s decision engine, eliminating manual steps in submitting and generating offers. For partners with a customer-facing portal, CAN Connect enables an offer to be made available in real time to a small business owner, taking advantage of data sharing APIs to tailor the marketing message to fit the prospective customer’s needs.

Attention to detail pays off in repeat business for CAN Capital, in DeMeo’s view. “Almost 70% of our merchants return for another contract,” he said

THE GENESIS

By all accounts, CAN Capital is a company born of necessity. Barbara Johnson, who had the brainstorm that became CAN Capital, was running four Gymboree playgroup franchises in Connecticut and needed funds to finance summertime direct marketing efforts for fall enrollment.

But her company didn’t have much in the way of assets to pledge, so banks weren’t interested in providing funds. Why, she reasoned, couldn’t she just borrow or receive an advance against the credit card receipts she knew would flow in when the kids came back in the autumn? Thus, she gave birth to an industry.

Barbara Johnson and her husband, direct marketing executive Gary Johnson, cofounded the company as Countrywide Business Alliance and put up their own money to build a computerized platform to split card revenue, Gary Johnson said.

Then they persuaded a card processor to partner with them. Once they were operating and had signed their first customer, venture capital began flowing their way to grow the business. These days, the Johnsons remain major shareholders.

“What made it an interesting concept was how huge the market potential was,” Gary Johnson said. “That’s what the attraction still is today.” Although Merchant Cash Advances may now seem commonplace, they were startling at first, he said. “When we first went out in the marketplace, everybody thought it was a crazy idea,” he noted.

The company earned patents on processing related to Merchant Cash Advances and daily remittances, Gary Johnson said. At first, the patents deterred potential competitors from entering the business, but the company was unable to defend the patents successfully in court. Rivals then entered the fray.

Just the same, the company became profitable early on through “deliberate decision-making, having the right people in place and being bigger than everybody else,” he said.

Much of the company’s early business came through firms that provide merchants with transaction services, and that remains the case today, DeMeo said. Many were placing point of sale terminals in stores and restaurants to accept credit cards, and working capital became an upsell or cross-sell, he noted.

The large base of business CAN Capital built with merchant services companies means it will always be an important channel for the company. Recently, new merchant sign-ups have come from more diverse channels, including cobranded and referral partners, and the fast-growing direct marketing channels.

From the beginning, the merchants receiving capital used it to grow their businesses, DeMeo said. “That feeds the whole economic system and creates jobs,” he said.

TODAY’S NUTS AND BOLTS

TODAY’S NUTS AND BOLTS

Daily remittances give CAN Capital nearly constant insight into how well customers are performing, which enables the company to discover potential issues quickly and take action. Such close monitoring also provides the company with enough information to enable funding opportunities that competitors might pass up, DeMeo said.

“The basis for our decisions is how the business performs and business-specific indicators, such as capacity and consistency, versus looking at the personal credit history of the business owner,” DeMeo noted.

Having that data also helps the company create models it can use to serve other businesses in the same classification, DeMeo said. “It’s poured into machine learning for future decisioning,” he maintained. “It’s a cool concept, right?”

The company’s 450 or so employees work in several locations. Three hundred of the total are attached to the office in Kennesaw, GA, the region where the company first set up operations. To this day, that’s where the company conducts most of its business, DeMeo said.

About 25 employees work in technology and operating support in offices in Salt Lake City because the area offers a strong talent pool and provides the company with additional time zone coverage, DeMeo said.

Some of the company’s former executives came from Western Union, which had a presence in Costa Rica. About a hundred employees are now stationed there, working on technology, maintenance and development. That location also houses back-office redundancy for the company, too.

On Manhattan’s 14th Street, the company has 30 or so employees, who include digital engineers, marketing and business development teams, the human resources lead, the chief financial officer, the chief legal officer, and the chief executive officer. The company moved its executive office there from Scarsdale, NY to take advantage of the digital boom, he said, adding that, “Google’s right around the corner.”

On Manhattan’s 14th Street, the company has 30 or so employees, who include digital engineers, marketing and business development teams, the human resources lead, the chief financial officer, the chief legal officer, and the chief executive officer. The company moved its executive office there from Scarsdale, NY to take advantage of the digital boom, he said, adding that, “Google’s right around the corner.”

Compared with most companies in alternative finance, CAN Capital has little venture capital as part of its ownership structure, DeMeo said. “It’s a self-sustaining business. We’re not forced to approach the capital market to cover our burn rate. We’re cash-flow positive.” Competitors have to borrow to fund their growth, he noted.

The company has taken on infusions of debt financing, not equity financing. In the latter, a company is selling part of itself, DeMeo said. “We raised $650 million from a syndicate with five new banks and 10 banks in total.” The company completed a securitization of $200 million the year before, he said.

CAN Capital recently introduced the new TrakLoan product that has no fixed maturity date, with daily payments that are based on a fixed percentage of card receipts. This way, payments ebb and flow with the merchant’s card sales. CAN Capital is also testing “bank-like” installment loans of as much as $500,000 with a payback period of up to four years.

And there’s nowhere to go but up, in the view of CAN Capital executives. With a market of 28 million small American merchants and penetration of between 5 and 10 percent, they see plenty of potential to keep earning superlatives.

Stop Being A Sub-Broker

December 10, 2015 In an industry with increasing competitive forces putting downward pressures on offer pricing, while simultaneously driving up demand for particular marketing channels (like SEO and quality data) which increases marketing costs, we are seeing massive downward pressures on profits. With this phenomenon occurring, you would have to wonder why in the world would anyone continually operate as a sub-broker today (willingly)? Are there any particular benefits to this, or is it just flat out non-sense? I wanted to explore this topic head on as we wrap up The Year Of The Broker.

In an industry with increasing competitive forces putting downward pressures on offer pricing, while simultaneously driving up demand for particular marketing channels (like SEO and quality data) which increases marketing costs, we are seeing massive downward pressures on profits. With this phenomenon occurring, you would have to wonder why in the world would anyone continually operate as a sub-broker today (willingly)? Are there any particular benefits to this, or is it just flat out non-sense? I wanted to explore this topic head on as we wrap up The Year Of The Broker.

THE VAST MAJORITY OF THE TIME, IT MAKES LITERALLY NO SENSE

There are times when I believe being a sub-broker makes some level of sense, but in my opinion those times (looking at our industry specifically) are very rare and most of the time being a sub-broker makes literally no sense based on the setup. The usual setup for a sub-broker is the same as a broker, which means you are going to be required to go out and spend money on marketing or other forms of lead generation to attract applicants.

Once you get those applications, you would forward them to the brokerage house so they can “close” the deal. A lot of sub-brokers believe this is some sort of grandiose deal, allowing them to as they say “free up time” to do other things. But this line of thinking makes literally no sense, because you have already done 98% of the work, which in our industry is just the consistent generation of high quality leads. Once you have done that and are doing that consistently, emailing the package over to a funder and chasing paperwork is the easiest part.

Why would you take only 25% – 50% of the commission structured on a deal, as well as most likely lose your ongoing renewal compensation, when you can instead take 100% of the commission, control your renewal portfolio and make renewal compensation going forward, which is the lifeblood of our industry?

LIES, LIES AND MORE LIES

Sub-brokers need to stop falling for the lies of larger brokerage houses which include the following:

“We are closers, you aren’t a closer, so let us handle it!”

This is rubbish. In our industry we don’t close, we are match-makers. The merchant comes to us looking for working capital, we pre-qualify their current standing and recommend a potential solution. If the merchant disagrees with the potential solution and we have nothing else that would work, the discussion ends. If the merchant agrees to the estimates and the product overview, we collect an application package to submit it to the funder that we believe can do an appropriately-priced deal. As long as we can get approval inline with expectations, everything moves forward on its own accord.

“We have access to special underwriting, platforms and pricing that you don’t have access to!”

More rubbish. When lenders get an A-paper deal, they give you A-paper quotes. When they get a B/C-paper deal, you get B/C-paper quotes. Look to establish a good relationship with a funder/lender. Let them know upfront that you are a small office so a smaller amount of volume will be coming through you. As long as you don’t have a high default rate, you will have access to the same systems, underwriters, base pricing, and innovative products of the funder/lender that the larger brokerage House has.

“We have access to special industry knowledge that you don’t have access to!”

More rubbish. With sources like AltFinanceDaily and other popular forums, the industry has been exposed. Everything you need to know, learn and be trained on has been covered. Also the assortment of direct funder and lender blogs/websites, media publications, and all of the like covering the industry, there’s no special industry knowledge that you can’t go out and attain on your own.

YOU MIGHT NOT EVEN GET PAID

Being a sub-broker might put you in a position of not even getting paid on new deal revenue as promised, as the large (or more experienced) brokerage is fully aware of your inability to truly challenge them legally or professionally.

- Sue If You Want, It Won’t Make A Difference: You can sue the broker for the $5,000 or so that they didn’t pay you on a couple new deals in Small Claims Court. But even though you can obtain a judgment, collecting on that judgment will be nearly impossible.

- Complain Online If You Want, It Won’t Make A Difference: You can also choose to damage their reputation online through posting various negative reviews, but do you think they will care? Go on the RipOffReport all you want, the largest merchant processing ISOs are all over those reports and that doesn’t do anything to stop their growth. The organizations getting these negative reviews will just say, “we serve thousands of clients and when you are as large as us, you are bound to have unhappy customers.” And that’s exactly what the brokerage house will say to their prospective merchants who bring up these negative review listings that you made.

BUT DOES BEING A SUB-BROKER “SOMETIMES” MAKE SENSE?

On very rare occasions do I believe being a sub-broker makes sense, and it includes if there’s some sort of initial training period and if the larger brokerage has significant marketing competitive advantages.

Training

So if you have zero experience, can’t spell Merchant Cash Advance, and believe you could benefit from a 6 month period with an established broker to show you the ropes, then being a sub-broker for a short period of time could make sense. However, I still believe that with the industry being exposed the way it is, you can train yourself and have to deal with insane non-compete agreements.

Marketing Competitive Advantages

So as a small shop, your marketing budget might be limited to $1k a month, whereas the larger brokerage is spending $20k a month and in a perfect world, might give you a deal where you can work with them without being required to generate your own leads.

They’ll claim to supply everything in terms of your dialer and warm leads, with funder networks already established. So all you have to do is come in, sit down, pick up the telephone, and sell all day to the warm leads coming in from their $20k in marketing. You don’t have to do any cold-calling. So you might be getting 50 leads a week that you convert to 12 applications, which you then convert to 4 new deals. If the average funding is $30k, then that’s $120k in funding with let’s say an average 6% commission that you would split 50/50 (3%/3%), giving you $3,600 per week which is $14,400 per month.

But we don’t live in a perfect world, now do we? Do you honestly believe the structure will be established as promoted? Such as more and more of the 50 leads you receive per week turn into mainly start-ups that don’t qualify for anything. Or, most weeks you don’t receive any warm leads at all, and are required to call UCCs, aged leads, or random listings out of the Yellow Pages, which are all horrible marketing mediums.

EITHER YOU GET IN ALL OF THE WAY, OR MAYBE YOU SHOULD GET OUT

If you are going to be in this industry, then properly set up your office, marketing plan, business plan, funder network and work your own deals. Get 100% of commission structured on new deals and control your renewal portfolio (the lifeblood of our business). If you are going to operate as a sub-broker, for the most part you are going to get a raw deal as we don’t live in a perfect world. We live in a world full of inefficiencies, “rah-rah” sales motivational speeches, and promises that don’t get kept.

Bad Merchants: Lies, Fraud, and Hard Times

December 4, 2015 Critics seldom tire of bashing alternative finance companies, but bad behavior by merchants on the other side of the funding equation goes largely unreported. Behind a veil of silence, devious funding applicants lie about their circumstances or falsify bank records to “qualify” for advances or loans they can’t or won’t repay. Meanwhile, imposters who don’t even own stores or restaurants apply for working capital and then disappear with the money.

Critics seldom tire of bashing alternative finance companies, but bad behavior by merchants on the other side of the funding equation goes largely unreported. Behind a veil of silence, devious funding applicants lie about their circumstances or falsify bank records to “qualify” for advances or loans they can’t or won’t repay. Meanwhile, imposters who don’t even own stores or restaurants apply for working capital and then disappear with the money.

“People advertise on craigslist to help you commit fraud,” declared Scott Williams, managing member at Florida-based Financial Advantage Group LLC, who helped start DataMerch LLC to track wayward funding applicants. “Fraud’s a booming business, and every year the numbers seem to increase.”

Deception’s naturally on the rise as the industry continues to grow, according to funders, industry attorneys and collections experts. But it’s also increasing because technology has made it easy for unscrupulous funding applicants to make themselves appear worthy of funding by doctoring or forging bank statements, observers agreed.

Some fraud-minded merchants buy “novelty” bank statements online for as little as $5 and fill them out electronically, said David Goldin, president and CEO of Capify, a New York-based funder formerly called AmeriMerchant, and president of the SBFA, which in the past was called the North American Merchant Advance Association.

To make matters worse, dishonest brokers sometimes coach merchants on how to create the forgeries or modify legitimate records, Goldin maintained. Funders have gone so far as to hire private investigators to scrutinize brokers, he said.

But savvy funders can avoid bogus bank statements, according to Nicholas Giuliano, a partner at Giuliano, McDonnell & Perrone, a New York law firm that handles collections. Funders can protect themselves by remaining skeptical of bank records supplied by applicants. “If the merchant cash advance company is not getting them directly from the source, they can be fooled,” Giuliano said of obtaining the documents from banks.

Another attorney at the firm, Christopher Murray, noted that many funders insist upon getting the merchant’s user name and password to log on to bank accounts to check for risk. That way, they can see for themselves what’s happening with the merchant.

Besides banking records, funders should beware of other types of false information the can prove difficult to ferret out and even more difficult to prove, Murray said. For example, a merchant who’s nine or ten months behind in the rent could convince a landlord to lie about the situation, he noted. The landlord might be willing to go along with the scam in the hope of recouping some of the back rent from a merchant newly flush with cash.

Merchants can also reduce their payments on cash advances by providing customers with incentives to pay with cash instead of cards or by routing transactions through point of sale terminals that aren’t integrated onto the platform that splits the revenue, said Jamie Polon, a partner at the Great Neck, N.Y.-based law firm of Mavrides, Moyal, Packman & Sadkin, LLP and manager of its Creditors’ Rights Group. A site inspection can sometimes detect the extra terminals used to reduce the funder’s share of revenue, he suggested.

In a ruse they call “the evil twin” around the law offices of Giuliano, McDonnell & Perrone, merchants simply deny applying for the funding or receiving it, Giuliano said. “Suddenly, the transaction goes bad, and they deny they had anything to do with it,” he said. “It was someone who stole the merchant’s identity somehow and then falsified records.”

In other cases, merchants direct their banks not to continue paying an obligation to a funder, or they change to a different bank that’s not aware of the loan or advance, according to Murray. They can also switch to a transaction processor that’s not aware of the revenue split with the funder. Such behavior earns the sobriquet “predatory merchant,” and they’re a real problem for the industry, he said.

Occasionally, merchants decide to stop paying off their loans or advances on the advice of a credit consulting company that markets itself as capable of consolidating debt and lowering payments, Giuliano said. “That’s a growing issue,” agreed Murray. “A lot of these guys are coming from the consumer side of the industry.”

The debt consolidator may even bully creditors to settle for substantially less than the merchant has agreed to pay, Murray continued. Remember that in most cases the merchants hiring those companies to negotiate tend to be in less financial trouble than merchants that file for bankruptcy protection, he advised.

“More often than not, they simply don’t want to pay,” he said of some of the merchants coached by “the credit consultants.” They pay themselves a hundred thousand a year, and everyone else be damned. You continue to see them drive Humvees.”

Merchants sometimes take out a cash advance and immediately use the money to hire a bankruptcy attorney, who tries to lower the amount paid back, Murray continued. However, such cases are becoming rare because bankruptcy judges have almost no tolerance for the practice and because underwriting continues to improve, he noted.

Still, it’s not unheard of for a merchant to sell a business and then apply for working capital, Murray said. In such cases, funders who perform an online search find the applicant’s name still associated with the enterprise he or she formerly owned. Moreover, no one may have filed papers indicating the sale of the business. “That’s a bit more common than one would like,” he said.

In other cases the applicant didn’t even own a business in the first place. “They’re not just fudging numbers – they’re fudging contact information,” said Polon. “It’s a pure bait and switch. There wasn’t even a company. It’s a scheme and it’s stealing money.”

Whatever transgressions the merchants or pseudo-merchants commit, they seldom come up on criminal charges. “It is extremely, extremely rare that you will find a law enforcement agency that cares that a merchant cash advance company or alternative lender has been defrauded,” Murray said. It happens only if a merchant cheats a number of funders and clients, he asserted. “Recently, a guy made it his business to collect fraudulent auto loans,” he continued. “That’s a guy who is doing some time.”

However, funders can take miscreants to court in civil actions. “We’re generally successful in obtaining judgments,” said Giuliano. “Then my question is ‘how do you enforce it?’ You have to find the assets.” About 80 percent of merchants fail to appear in court, Murray added. Funders may have to deal with two sets of attorneys – one to litigate the case and another to enforce the judgment. Even merchants who aren’t appearing in court to meet the charges usually find the wherewithal to hire counsel, he said.

Funders sometimes recover the full amount through litigation but sometimes accept a partial settlement. “Compromise is not uncommon,” noted Giuliano. Settling for less makes more sense when the merchant is struggling financially but hasn’t been malicious, said Murray.

To avoid court, attorneys try to persuade merchants to pay up, said Polon. “My job is to get people on the phone and try to facilitate a resolution,” he said of his work in “pre-litigation efforts,” which also included demand letters advising debtors an attorney was handling the case.

But it’s even better not to become involved with fraudsters in the first place. That’s why more than 400 funding companies are using commercially available software that detects and reduces incidence of falsified bank records, said a representative of Microbilt, a 37-year-old Kennesaw, Ga.-based consumer reporting agency that has supplied a fraud-detection product for nearly four years.

But it’s even better not to become involved with fraudsters in the first place. That’s why more than 400 funding companies are using commercially available software that detects and reduces incidence of falsified bank records, said a representative of Microbilt, a 37-year-old Kennesaw, Ga.-based consumer reporting agency that has supplied a fraud-detection product for nearly four years.

“Our system logs into their bank account and draws down the various data points, and we run them through 175 algorithms,” he said. “It’s really a tool to automate the process of transferring information from the bank to the lender,” he explained.

The tools note gross income, customer expenditures, loans outstanding, checks returned for non-sufficient funds and other factors. Funders use the portions of the data that apply to their risk models, noted Sean M. Albert, MicroBilt’s senior vice president and chief marketing officer.

Funders pay 25 cents to $1.25 each time they use MicroBilt’s service, with the rate based on how often they use it, Albert said. “They only pay for hits,” he said, noting that they don’t charge if information’s not available. Funders can integrate with the MicroBilt server or use the service online. The company checks to make sure that potential customers actually work in the alternative funding business.

MicroBilt is testing a product that gathers information from a merchant’s credit card processing statement to analyze ability to repay excessive chargebacks reflected in the statements could spell trouble, and seasonality in receipts should show up, he noted.

Additional help in avoiding problem merchants comes from the Small Business Finance Association, which maintains a list of more than 10,000 badly behaving funding applicants, said the SBFA’s David Goldin. The nearly 20 companies that belong to the trade group supply the names.

SBFA members, who pay $3,000 monthly to belong, have access to the list. According to Goldin, the dues make sense because preventing a single case of fraud can offset them for some time, he maintained. Besides, associations in other industries charge as much as $10,000 a month, he added.

Another database of possibly dubious merchants, maintained by DataMerch LLC, became available to funders in July, according to Scott Williams, who started the enterprise with Cody Burgess. It became integrated with the AltFinanceDaily news feed by early October, causing the number of participating funders to double to a total of about 40, he said. The service is free now, but will carry a fee in the future.

It’s not a blacklist of merchants that should never receive funding again, Williams emphasized. Businesses can return to solvency when circumstances can change, he noted. That’s why it’s wise to regard the database as an underwriting tool. In addition, merchants can in some cases add their side of the story to the listings.

Funding companies directly affected by wayward merchants can contribute names to the list, Williams said. About 2,500 merchants made the list within a few months of its inception, he noted. “We’re super happy with our numbers,” he said of the database’s growth.

Many merchants find themselves in the database because of hard times. Of those who land on the list because of fraud, perhaps 75 percent actually own businesses and about 25 percent are con artists applying for funding for shell companies, Williams said.

So far, only direct funders – not brokers or ISOs – can get access to the database, he continued, noting that DataMerch could rethink the restriction in the future. “We don’t want hearsay from a broker who might not know the full scope of the story,” he said.

DataMerch might grant brokers and ISOs the right to read the list to avoid wasting time pitching deals to substandard merchants, but the company does not intend to enable members of those groups to add merchants to the database, Williams said.

Williams sees a need for the new database because smaller companies can’t afford belonging to the SBFA. The association also tracks deals about to become final, which could prevent double-funding but makes some users uncomfortable because they don’t want to disclose their good merchants, Williams said.

Although dishonesty’s sometimes a factor, merchants often go into default just because of lean times, Jamie Polon, the attorney, cautioned. A restaurant could close, for example, because of construction or an equipment breakdown. “Were they not serving dinner anymore, or was there something much deeper going on?” he said. Fraud may play a role in 10 percent to 20 percent of the collections cases his law firm sees, he noted. More than 95 percent blame their troubles on a downturn in business, and the rest claim they didn’t understand the contract, he said.

Although dishonesty’s sometimes a factor, merchants often go into default just because of lean times, Jamie Polon, the attorney, cautioned. A restaurant could close, for example, because of construction or an equipment breakdown. “Were they not serving dinner anymore, or was there something much deeper going on?” he said. Fraud may play a role in 10 percent to 20 percent of the collections cases his law firm sees, he noted. More than 95 percent blame their troubles on a downturn in business, and the rest claim they didn’t understand the contract, he said.

To understand the downturn, it’s important to amass as much information about the merchant as possible, said Mark LeFevre, president and CEO of Kearns, Brinen & Monaghan, a Dover, Del.-based collections agency that works with funders. That information sheds light on a merchant’s ability to repay and could help determine what terms the merchant can meet, he said.

Timeliness matters because the sooner a creditor takes action to collect, the greater the chance of recouping all or most of the obligation, LeFevre maintained. When distress signals arise – such as closing an ACH account or a spate of unreturned phone calls – it’s time to place the merchant with a collections expert, he advised.

LeFevre’s company also traces a troubled merchant’s dwindling assets to help the funder receive a fair share. Funders can sometimes recover all or most of what they pay a collection agency by imposing fees on the merchant, he noted.

Pinning the collection fees to merchants in default makes sense because that’s where the guilt often resides, observers said. It’s part of balancing the bad behavior equation, they agreed.

Building An Alternative Lending Sales Profile

November 24, 2015 Merriam-Webster dictionary defines the word, independent, in a number of different ways, but one of the definitions provided relates this word to the concept of freedom. Most of us operate in this industry on an independent basis, which gives us a significant level of freedom that revolves around not having a boss, freedom to set our own schedules, freedom from being down-sized, freedom from office politics, but more importantly:

Merriam-Webster dictionary defines the word, independent, in a number of different ways, but one of the definitions provided relates this word to the concept of freedom. Most of us operate in this industry on an independent basis, which gives us a significant level of freedom that revolves around not having a boss, freedom to set our own schedules, freedom from being down-sized, freedom from office politics, but more importantly:

- freedom to craft our own business plans

- freedom to target our own market segments

- freedom to decide what we will sell

- freedom to create our own products

- freedom to negotiate our own market pricing

- … and freedom to innovate

With such high levels of freedom, you have to wonder why a lot of brokers in our industry don’t exercise such liberties? Why do we sell the same products (cash advances and alternative business loans)? Why do we use the same marketing tactics (UCCs and aged leads)? Why do we market, promote and sell to the same merchants (UCCs)? Why do we use the same “pitch”? Why do we submit to the same funders?

If we are truly independent contractors, why do we all look, act and sound the same?

As we continue The Year Of The Broker, I wanted to begin a discussion on a concept that integrates your capability of independent expression. It’s the concept of constructing an alternative financing sales profile. It allows you to display your level of true independence by pre-qualifying your prospective clients and recommending solutions that are different from the pack of brokers recommending the same “me too” solutions, seeking to submit the merchant to the same “me too” funders.

ARE YOU A “BROKER” OR NOT?

Are you paid only when you broker (fund) a deal?

If so, the generation of a financing lead or application in and of itself, doesn’t produce value as it doesn’t create revenue. Revenue is only created when you successfully broker a deal, which is to match a merchant with alternative funding needs and with a particular terms/conditions comfort range, with products funded by lenders whose pricing lines up with the particular comfort level of your prospective client.

As a broker, you are much more than a salesperson, you are more of a match-maker, an arbitrator, and an consultant. You can’t consult someone if you don’t know their current situation for one, and two, you can’t consult someone unless you have the resources to prescribe appropriate solutions.

See yourself more as a doctor than a salesperson, where as a salesperson has one or two products that he’s looking to “push” on a prospect using various tactics such as cost cutting and overcoming objections, a doctor isn’t trying to “push” anything out of the gate without firstly diagnosing the client through a series of questions. After said questions have been inquired and answers provided, the doctor creates a “profile” of said client and through his wealth of medication, he prescribes a couple of solutions to assist the client.

To help increase your chances of brokering (funding) your deals, you want to increase your level of pre-qualification and increase your level of product offerings, both of which will allow you to create firstly an alternative financing sales profile of your client, and then secondly allow you to go into your wealth of alternative financing products to prescribe an array of products.

EFFICIENT PRE-QUALIFICATION

Going forward, make sure to do serious pre-qualification to create an estimated risk profile as well as an estimated sales profile. You want to know all of the following: their credit, time in business, annual sales, cash flow situation, level of profitability, type of assets, outstanding commercial debt, any current tax or judgment liens, recent bankruptcies, and current status of commercial mortgage or commercial lease agreements.

From this information you are able to create an Alternative Financing Sales Profile along with an occupying Risk Profile for each product you will soon be recommending, to know which lender within that product category is best to serve your client.

YOUR WEALTH OF ALTERNATIVE FINANCING RESOURCES

So for example, say we have a restaurant owner that’s in need of $250k in working capital for expansion. You shoot him over the pre-qualification survey and receive the following: 700 FICO, 5 years in business, $1 million sales, zero NSFs/Overdrafts for 6 months, $10k average bank balances over the last 6 months, company has been profitable for the last 3 years, no tax liens, no judgment liens, no bankruptcies, current on commercial lease payment, outstanding debt that includes $25k on a credit card with $50k outstanding on a bank loan. The merchant’s commercial assets includes business equipment, free and clear, with appraised value of $150k.

As an alternative financing broker, you should have access to more than just merchant cash advances and alternative business loans, you should also have access to: merchant processing, equipment leasing, asset based lines of credit, inventory loans, SBA loans, business credit cards, factoring, purchase order financing, commercial mortgages and real estate hard money loans.

So based on the answers to the pre-qualification survey completed by the restaurant owner, in conjunction with his total financing needs, you might be prescribing an SBA loan, a merchant cash advance, and a sale-leaseback.

- You would seek to get him an SBA loan first and let’s just say he only gets approved for $50,000. So you guys complete the process to fund the SBA loan.

- Next, you would look at doing either a merchant cash advance for let’s say another $100,000 using split funding. You notice that his current processing rates are a little higher than market average pricing for Restaurants and show him a savings analysis with your interchange plus pricing structure with a 10BP mark-up that should be saving him $400 a year which is $1,200 over three years. So in the process of this you also convert his merchant processing over to one of your processing platforms that can handle split funding. Now you have raised $150,000 of the $250,000 funding goal that the merchant has in mind.

- Finally, you would look at doing a sale-leaseback on his pre-owned equipment that’s appraised for $150,000. With a 70% LTV, this comes to $105,000 in funding. Now you have successfully funded the merchant over $250,000 and in the process closed three different alternative funding products as well as converted over his merchant processing at the same time.

In an upcoming article, I will continue this discussion on pre-qualification by going into information on how this level of efficiency includes the creation of Risk Profiles that allow you to limit your submissions to your funders/lenders as to not clog up their underwriting pipelines with unnecessary submissions. It allows you to focus on submitting 10 applications and funding 5, instead of submitting 50 applications and funding 5.

The Quiet Innovator: Meet Dean Landis

November 1, 2015 Have you ever wondered who helped evolve our industry from the boutique “credit card factoring” of yesteryear, to today’s multi-billion dollar Alternative Lending industry? Credit Cash LLC may not be the best known MCA company out there. However, over its ten-year history, its innovations have become industry mainstays. Founded by, Dean Landis, an established asset based lender in 2005, Credit Cash has always focused on larger deals to better credits; but is also largely responsible for many of the important changes that have improved our industry over the years.

Have you ever wondered who helped evolve our industry from the boutique “credit card factoring” of yesteryear, to today’s multi-billion dollar Alternative Lending industry? Credit Cash LLC may not be the best known MCA company out there. However, over its ten-year history, its innovations have become industry mainstays. Founded by, Dean Landis, an established asset based lender in 2005, Credit Cash has always focused on larger deals to better credits; but is also largely responsible for many of the important changes that have improved our industry over the years.

Its first, and only slogan, “Our rates are so low, they’re actually loans,” was telling from the start. Well before On Deck and others made loans an alternative to advances, Credit Cash had determined that to attract larger and better credits, rates had to be far lower. With lower rates, a loan structure was more practical in lieu of the then existing true sale structure (innovation #1).

When Dean, Credit Cash’s founder, came up with his concept, he posed it to some of the existing industry leaders. While all were supportive, none thought that the product worked well with the low rates Landis was proposing. Back then, with underwriting a bit more primitive, default rates were typically higher than they are today. A competitor urged Credit Cash to license its underwriting and split funding operation.

What the others didn’t appreciate is that Credit Cash was going to use its decades of asset based lending experience to create a whole new method for providing working capital to SMEs. Dean represents the third generation of his family to own and manage a specialty finance company. His asset based lending firm, Entrepreneur Growth Capital, is one of the best known and highly regarded national commercial finance companies serving small and lower middle market borrowers. First, these would not be purchases of future revenue or credit card receipts. Landis didn’t believe that was actually a tangible object that could be bought and sold. Thus, he chose the loan structure and with it, fixed daily payments (innovation #2).

Next, while most of the MCAs at the time were solely using split funding, Credit Cash required the setup of a lockbox (innovation #3). This allowed each client to keep its on processor (innovation #4), but also gave Credit Cash more control over cash flow as all credit card receipts went through the lockbox, not just a percentage.

Next, while most of the MCAs at the time were solely using split funding, Credit Cash required the setup of a lockbox (innovation #3). This allowed each client to keep its on processor (innovation #4), but also gave Credit Cash more control over cash flow as all credit card receipts went through the lockbox, not just a percentage.

At this time in the industry’s evolution, all advances were based on credit card revenue, so clients were typically in food service, hospitality or retail. Early on, Credit Cash got a request from a Burger King franchisee. It was a good prospect, but there wasn’t enough credit card revenue to meet the fixed daily payments. That is when the idea of using an ACH to debit clients’ banks accounts was born (innovation #5). From there, it wasn’t long until both Credit Cash and others realized that this type of lending deserved a far larger audience than the existing marketplace. In fact, whereas restaurants used to be over 50% of Credit Cash’s business, it is now less than 25%.

One other change was in how Credit Cash treated renewals. At the time, clients were required to essentially buy back their existing advances in order to get more funding, thus increasing their costs. Credit Cash not only avoided this practice, but began offering early termination discounts (innovation #6).

Landis claims he is as surprised as anyone at the industry’s growth. While entering its 11th year, Credit Cash has intentionally not grown nearly as much as the other industry veterans. Credit Cash has always been a quality over quantity shop. In fact, they still do all of their underwriting by hand. As their average loan is over $500,000, Landis is hesitant to rely on computers and algorithms. Dean is interested in continuing to build a strong portfolio of borrowers who require additional capital with a creative approach. “Our borrowers appreciate that we are able to think outside of the box and take a hands on approach to underwriting and servicing their loans.”

As for growth, Landis jokingly admits that Credit Cash is often ISOs’ last choice. “Because our rates are so low, so is our commission structure. An ISO may make more money by funding a prospect elsewhere. Although because of the Credit Cash’s ability to fund much larger loans, it is not unheard of for an ISO to earn $100,000 or more from a closed, single transaction.” However, with larger loans, come stronger credits and more savvy borrowers. Landis continues to smile when stating that “a typical Credit Cash borrower would rarely take an MCA at the market rates.” However, ISOs continue to send Credit Cash deals as a funded deal, is better than no deal at all.

A Student Cash Advance?

October 27, 2015 Some interesting legislation was introduced last Tuesday by Senator Marco Rubio. The bill entitled “Investing in Student Success Act of 2015” would allow individuals to enter into Income Share Agreements that bear some of the characteristics of merchant cash advances. The bill defines an Income Share Agreement as,

Some interesting legislation was introduced last Tuesday by Senator Marco Rubio. The bill entitled “Investing in Student Success Act of 2015” would allow individuals to enter into Income Share Agreements that bear some of the characteristics of merchant cash advances. The bill defines an Income Share Agreement as,

[A]n agreement between an individual and any other person under which the individual commits to pay a specified percentage of the individual’s future income…in exchange for payments to or on behalf of such individual for postsecondary education, workforce development, or other purposes.

Sound familiar?

The bill goes on to state other aspects of a Income Share Agreement: “the agreement is not a debt instrument, and…the amount the individual will be required to pay under the agreement…may be more or less than the amount provided to the individual; and…will vary in proportion to the individual’s future income…” That last part differs from merchant cash advances in that there is no cap on the total amount an individual could be required to pay pursuant to an Income Share Agreement.

There are, however, a number of restrictions contained in the bill. The total percentage of income a person may be required to pay under an agreement—the split—may not exceed 15%. If a person’s income dips below $15,000 in any year, that person would not be required to pay any portion of their income. Also, the agreement may not exceed a term of 30 years, though the agreement may be extended for a term equal to the number of years the person was not required to pay because their income did not exceed $15,000.

Many states have enacted bans on income assignment agreements that would seem to prohibit the type of agreement proposed by the legislation. To address these laws, the bill contains a preemption provision: “Any income share agreement that complies with the requirements of [the bill] shall be a valid, binding, and enforceable contract notwithstanding any State law limiting or otherwise regulating assignments of future wages or other income.”

Additionally, because there is potential that a funder could receive an amount from an individual in a time period that would translate to a rate that exceeds state usury laws (as some merchant cash advances do, depending on the business’ performance) the bill also provides for preemption of state usury laws: “Income share agreements shall not be subject to State usury laws.”

So will Student Cash Advances be the next big thing in educational finance? Maybe, maybe not. For now, the bill has been referred to the Senate Finance Committee for further review.

You can read the full text of the bill here.

Yellowstone Capital and Green Capital Join Family of Companies Under New Brand, Fundry

October 1, 2015AltFinanceDaily has confirmed that Yellowstone Capital has restructured through the formation of a new parent company, Fundry. Green Capital is also another subsidiary under the Fundry umbrella.

With Yellow and Green together, the business financing industry just got a little bit more colorful.

Yellowstone’s CEO Isaac Stern and President Jeff Reece have become Fundry’s CEO and President respectively.

“We have a solid foundation and a very successful business model,” Stern said. “But to maintain a position of leadership in this industry, we need to grow and we are evolving.”

Yellowstone Capital has been the subject of several news stories lately, most recently by being approved for up to $3.3 million in tax credits to move their business from New York to New Jersey.

In April, it was revealed that Stern had led a management buyout backed by a private family office that made Stern the only remaining co-founder to retain an equity stake. And in June, the industry learned that the company had originated more than $1.1 billion in deal flow since inception, ranking them high above many of their more well-known peers.

The funding leaderboard which debuted in AltFinanceDaily’s May/June magazine issue and was broadcast to attendees at the 2nd Annual AltLend conference in New York City, was in many ways a turning point for the industry.

“I would think there are many more branded funders that would have made the list but didn’t,” said Arty Bujan, Managing Member of Cardinal Equity. “Most shocking is Paypal’s $500 million.”

Richard Battista, Vice president of Business Development at theLendster commented on the eye-opening figures of the industry’s largest players in general. “This is a reflection of the explosive growth that the industry is experiencing at the present time,” Battista said. There is a huge demand for funding from small businesses, who have consistently expressed interest in trying out new funding options.”

Perhaps the story of Yellowstone Capital’s rise can best be explained by Grant McCracken’s Five Stages of Disruption Denial. McCracken, who is a Canadian anthropologist and author, known for his books about culture and commerce, explained the theory behind these five stages in the Harvard Business Review in April, 2013. They are Confusion, Repudiation, Shaming, Acceptance, and Forgetting.

Yellowstone Capital confused their competitors when they were first founded in 2009 by substituting split-processing payments for ACH to high-risk merchants. Very few people within the industry understood why they were using the ACH network over relationships with credit card processors that everyone else relied on.

That of course led to the repudiation stage where people thought they were crazy and that their model wouldn’t work and segued into shaming where the concept of providing working capital to high-risk businesses was perceived to be something that no one should do.

Through it all, Stern and his team believed many of America’s small businesses were still being overlooked and underserved despite non-bank financing and online lending growing by leaps and bounds.

“At what point do we stop helping small business?” Stern said to AltFinanceDaily in response to an inquiry about whether or not some businesses are simply unfundable.

Today, we are in between the Acceptance and Forgetting stages. The ACH debit methodology has almost entirely replaced split-processing and dozens of funding providers claim to specialize in high-risk deals, the very same kind that the industry years ago didn’t understand and resisted.

Yellowstone Capital will serve as Fundry’s ISO relationship arm while Green Capital will serve merchants directly.

“2015 is our biggest year yet, but we really see it as a year of block and tackle work to set up for what needs to be done in 2016 and beyond,” said company president Jeff Reece.

“Yellowstone’s success will simply become the baseline for what Fundry is about to do.”

Federal Reserve Publishes Results of Alternative Lending Focus Groups

August 26, 2015 Alternative lenders have a lot of work to do!

Alternative lenders have a lot of work to do!

In a study conducted by the Federal Reserve which included focus groups moderated by the Nielsen Company, small business owners that had not heard of online lenders or had not used them, expressed extreme skepticism about their legitimacy. Among the negative responses were words such as shady, scam, identity theft, high APRs, ridiculous, wild west and unregulated, among others.

The focus groups, while small, had to meet a minimum criteria to be eligible:

- Have 2 to 20 employees

- Have annual revenues between $200,000 and $2 million

- Be the financial decision maker

- Not be a new business

Only 44 people participated.

There were both bright and dark spots in the findings, with one of the bright spots being that people’s attitudes became more positive about online lenders once they started to actually navigate the websites of several big industry players.

While the extent of the research is significant for any lender trying to get into the mind of a small business owner, there was a section in particular that warrants closer attention. In a mock comparison, participants were asked to compare three unnamed financial products, with one supposedly representing the characteristics of a merchant cash advance based on future credit card sales, another on a daily debit business loan, and the last a traditional bank loan.

Respondents generally reported that they understood these offers and were not confused by them.

Unfortunately, the researchers assigned some gut-wrenching characteristics to the structure of the product alleged to represent merchant cash advances (Product A).

The offer was a loan of $40,000 to pay back $52,000 in future credit card sales via a 10% processing split and participants were asked to guess the interest rate over one year. The question received all kinds of confused answers such as 5%, 9.8%, 15%, and others that made little sense.

The offer was a loan of $40,000 to pay back $52,000 in future credit card sales via a 10% processing split and participants were asked to guess the interest rate over one year. The question received all kinds of confused answers such as 5%, 9.8%, 15%, and others that made little sense.

Since the researchers presented the theoretical product as a loan, not a sale, they have potentially tainted the inferred conclusions about the transparency of future receivable transactions. Given the strong authority associated with the Federal Reserve and Nielsen, there is a troubling implication that the findings about a hypothetical loan could be used as a basis to make future regulatory decisions about unrelated products like receivable purchases.

Ironically, the diversity of wrong answers to the interest rate question could lead one to this conclusion though, that APRs wouldn’t necessarily be a transparency cure.

If business owners don’t understand what Annual Percentage Rates represent, then it might not be a very good medium to make comparisons. This argument is actually reinforced by the study’s own research since two of the three products were presented without the confusion of interest rates and “participants initially reported the three were easy to compare and that they had all the information they needed to make a borrowing decision.”

In regards to the traditional bank loan, one business owner is actually quoted as saying, “I am not sure what they mean by my ‘effective APR.'”

While value can be gleaned from the results of such a small sample size of 44 business owners, it’s obvious that the researchers influenced the participants answers on how they assessed the cost of merchant cash advances in particular.

- A transaction typically structured as a sale was presented to participants as a loan.

- A predetermined time frame of 1 year was provided to participants when they were asked about interest rates even though purchase transactions have no time frame.

The merchant cash advance product presented in the focus groups has just about no similarities to the purchase transactions that exist in real life.

What are your thoughts on this report and particularly the way merchant cash advance is framed in it? You can download the full report, including the focus group questionnaire here.