Related Headlines

| 09/29/2025 | Parafin secures FF from Cross River Bank |

| 09/19/2025 | Parafin & Gusto partner |

| 09/04/2025 | Parafin partners with accept.blue |

| 12/17/2024 | Parafin raises $100M Series C at $750M val |

| 08/28/2024 | Parafin closes $93M debt facility |

Stories

How the Amazon / Parafin Merchant Cash Advance Deal Came to Be

November 2, 2022Back in December, Parafin, then a fintech startup with 20 employees, submitted a proposal to Amazon to roll out a potential Amazon merchant cash advance product. At the time, Parafin was little known to the general public and its surprise deal with DoorDash wouldn’t even become public until a month later.

The prospect of an MCA would not have been foreign to Amazon given that the company already offers direct business loans, lines of credit through Marcus by Goldman Sachs, and other loans thanks to a successful pilot with Lendistry. But the team behind Parafin were virtual unknowns in the merchant cash advance industry itself. The company’s 3 co-founders, including CEO Sahill Poddar, all hail from Robinhood, the investment app that became wildly popular especially with younger adults over the last several years.

The prospect of an MCA would not have been foreign to Amazon given that the company already offers direct business loans, lines of credit through Marcus by Goldman Sachs, and other loans thanks to a successful pilot with Lendistry. But the team behind Parafin were virtual unknowns in the merchant cash advance industry itself. The company’s 3 co-founders, including CEO Sahill Poddar, all hail from Robinhood, the investment app that became wildly popular especially with younger adults over the last several years.

Coincidentally, more than a dozen people employed by Parafin, including the co-founders, are former Robinhood employees, according to profiles reviewed on LinkedIn. It’s part of a trend, it appears, as other members of their team hail from well known Silicon Valley firms like Lending Club, Stripe, Funding Circle, Google, Amazon, Facebook, StreetShares, and more.

Ultimately, Parafin’s big bet paid off. On Tuesday, November 1st, Amazon announced that the Parafin team was the one it had chosen to debut its official merchant cash advance product.

“Amazon is committed to providing convenient and flexible access to capital for our sellers, regardless of their size,” said Tai Koottatep, director and general manager, Amazon WW B2B Payments & Lending, in the announcement. “Today’s launch is another milestone in strengthening Amazon’s commitment to sellers, and builds on the strong portfolio of financial solutions we already provide. This latest offering significantly expands sellers’ reach and capabilities, and broadens their access to capital in a flexible way—one that helps them control their cashflow, and by extension, their entire business.”

“We founded Parafin with the mission to grow small businesses, and we’re thrilled that we have the opportunity to do that by providing Amazon sellers with this merchant cash advance option,” said Vineet Goel, co-founder of Parafin. “It’s a privilege to count ourselves among Amazon’s suite of financial solutions, and we look forward to making a difference for Amazon.com sellers looking to expand their business.”

The product is already listed on Amazon’s website and was rolled out to some US businesses immediately. It will be available to hundreds of thousands of additional sellers by early 2023, the company claims.

Unique to an Amazon MCA is that funding amounts can start as low as $500 and go up to $10 million.

Amazon’s entrance into the merchant cash advance market coincides wih a unique moment in the product’s history as several states are in the midst of imposing strict regulations on their sale.

Lavu Adds MCA Product Through Partnership With Parafin

October 7, 2022 It’s not just DoorDash that Parafin has partnered up with to provide MCA funding. Last week, the restaurant software company Lavu launched Lavu Capital to help restaurants owners access capital.

It’s not just DoorDash that Parafin has partnered up with to provide MCA funding. Last week, the restaurant software company Lavu launched Lavu Capital to help restaurants owners access capital.

“We are a restaurant software company that focuses on small and medium restaurants,” said Saleem S. Khatri, CEO of Lavu. “Think of your favorite restaurants that have one or two locations that are really really popular, that are ingrained in the community. We do everything from point of sale to online ordering, payment processing, and anything a restaurant would need to start and grow their business.”

Khatri said that one thing they noticed is that these restaurants have a fundamentally hard time getting loans and that led them to connect with Parafin. Parafin’s product is an advance on future sales, not a loan, and their offerings have been simply integrated into Lavu’s technology. Parafin automatically generates an offer for restaurant owners that they can see in their Lavu dashboard.

“…it’s just really beautifully designed,” said Khatri. “It basically says, ‘Hey, you have an offer to borrow up to $5,000. Do you want it yes or no?’ And you just click ‘yes’ and you’re good to go, the money deposits straight into your bank account, and then you have a repayment schedule. And it just pulls it directly from your bank account according to that repayment schedule.”

Khatri says they haven’t really begun to market the product yet and they’ve just started off with a limited base of customers but that the plan is to roll it out to all their customers around the US. They’d even do it with their customers outside of the US if they could, but the tech is not set up to do that just yet.

“This is going to be a feature and an offering that really really benefits our customers because it gets to the heart of what they need, which is they’re in constant need of liquidity, they’re in constant need of kind of tools to run their business better,” Khatri said. “And it just really fits our portfolio of products that we offer to these customers. So the reception has been awesome.”

From the CERN Large Hadron Collider to Funding Working Capital Loans to SMBs

August 20, 2025When AltFinanceDaily stumbled upon a scoop that DoorDash had begun offering merchant cash advances in late 2021, the tech and financing team behind it had not been on anyone’s radar. That company was Parafin which at the time appeared to be a startup comprised of former Robinhood engineers. But the backstory is a bit more wild because its CEO and Co-founder Sahill Poddar previously worked on getting his PhD by discovering the Higgs boson particle at CERN’s Large Hadron Collider. His credentials include a Doctorate (summa cum laude) in Particle Physics at European Council for Nuclear Research (CERN), Geneva, Switzerland and before that he was a Visiting Researcher for the Max-Planck Institute for Nuclear Physics in Germany. But today, at Parafin, his company makes $10 billion in funding offers to small businesses EACH DAY. The company has now funded more than 30,000 businesses since inception.

Turner Novak at The Peel secured Poddar as a guest on how Parafin came to be and it’s a must watch.

Business Finance Companies on Inc 5000 List in 2025

August 12, 2025Here’s where small business finance companies rank on the Inc 5000 list for 2025 (and if we’ve missed you, email info@debanked.com):

| Ranking | Company | 3-Year % Growth |

| 15 | Parafin | 9594 |

| 206 | businessloans.com | 1862 |

| 669 | Pinnacle Funding | 626 |

| 831 | SBG Funding | 508 |

| 1215 | Essential Funding Group | 359 |

| 1240 | Clara Capital | 352 |

| 1417 | Backd | 306 |

| 1705 | Kapitus | 256 |

| 1719 | Channel | 255 |

| 1756 | Fundible | 248 |

| 2027 | 4 Pillar Funding | 214 |

| 2117 | Biz2Credit | 203 |

| 2293 | Byzfunder | 187 |

| 2671 | Critical Financing | 156 |

| 3081 | Lendzi | 131 |

| 3226 | eCapital | 124 |

| 3508 | ApplePie Capital | 111 |

| 3545 | SellersFi | 109 |

| 3901 | Splash Advance | 95 |

| 3973 | Fora Financial | 92 |

| 3993 | Capital Infusion | 91 |

| 4076 | Expansion Capital Group | 88 |

| 4162 | Shore Funding Solutions | 85 |

| 4206 | Direct Funding Now | 83 |

| 4712 | ROK Financial | 63 |

The Largest Sales-Based Financing Providers

May 27, 2025Who are some of the largest sales-based financing providers in the US? The following companies are repaid as a percentage of sales or revenue, in which the payment amount may increase or decrease according to the volume of sales made or revenue received by the recipient:

| Sales-Based Financing Providers |

| Square |

| PayPal |

| Amazon (via Parafin) |

| Walmart (via Parafin) |

| Shopify |

| Intuit |

| Stripe |

| DoorDash (via Parafin) |

The State of Washington has also recently announced it will be offering sales-based financing through a Department of Commerce initiative.

Among those listed above, Square recently published a White Paper on the impact of its sales-based financing.

“Square Loans has opened credit to populations who traditionally have had less access to business loans. As of the third quarter of 2024, approximately 58% of Square Loan customers are women-owned businesses, compared to the industry average of 19%.38 And 15% of Square Loans go to Black/African-owned businesses compared to an industry average of 6.6%, while 14% of loans go to Hispanic/Latinx-owned businesses compared to the industry average of 11.3%.”

TikTok is Now Offering Business Financing

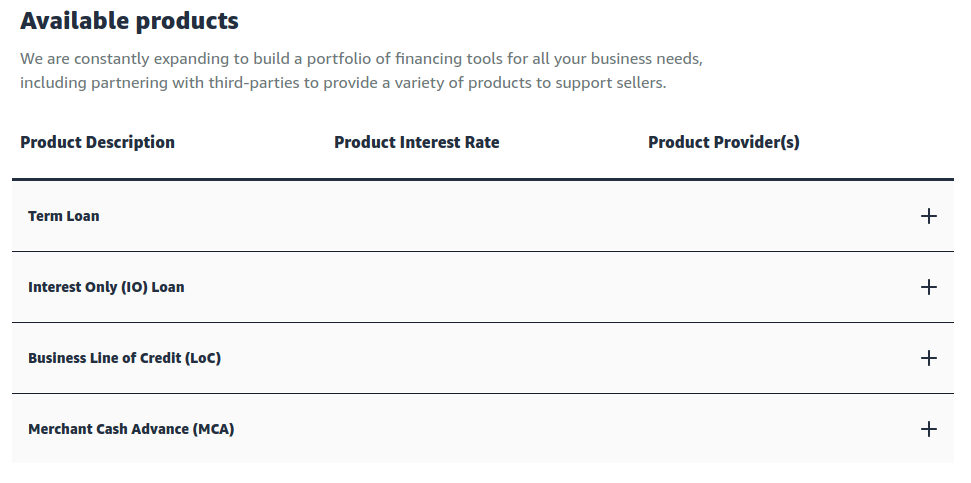

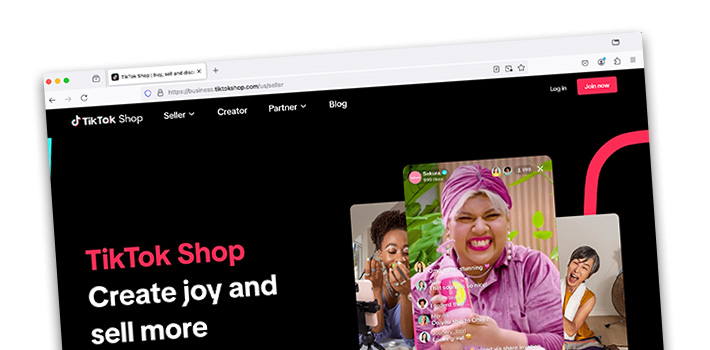

October 7, 2024 Add TikTok to the list of tech platforms offering business loans. TikTok Shop Capital is now “offering sellers access to fast and flexible business financing,” the company states on its website. Unsurprisingly, one of TikTok Shop’s partners is Parafin but the company also lists Storfund and Kanmon as funding partners. Storfund announced its deal with TikTok earlier today and said that its program would be called Daily Advance.

Add TikTok to the list of tech platforms offering business loans. TikTok Shop Capital is now “offering sellers access to fast and flexible business financing,” the company states on its website. Unsurprisingly, one of TikTok Shop’s partners is Parafin but the company also lists Storfund and Kanmon as funding partners. Storfund announced its deal with TikTok earlier today and said that its program would be called Daily Advance.

“TikTok is not a lender or loan broker,” the company website states. “TikTok partners with third-party lenders and financing providers to offer TikTok Shop sellers business financing options.”

The process works different depending on which solution a customer uses. For example, Storfund repayments are automatically debited from TikTok Shop payouts, Parafin repayments are automatically debited from the business bank account associated with TikTok Shop payouts, and Kanmon requires repayment via auto-pay deductions from the business bank account provided during the application process.

The Parafin option does not appear to be a standard merchant cash advance. TikTok says it would actually be a Parafin commercial flex loan issued by Celtic Bank. There is no credit check required for it.

TikTok’s foray into business financing is invite-only. “If a seller has an available pre-qualified and/or pre-approved offer, it will appear within Seller Center under the Finances tab,” the website says.

Walmart Now a Direct Funder in the Merchant Cash Advance Industry

September 15, 2024

Ready to enjoy easy access to cash advance funds and flexible financing options? Fuel your growth on Walmart.com with our suite of options.

– Walmart.com

Walmart, which made headlines recently with third party MCA funders Parafin and Payoneer, is now funding MCAs directly as well. The new programs, known as Capital by Walmart and Capital for WFS (Walmart Fulfillment Services), were recently placed on its Marketplace page. Capital by Walmart promotes the program as being “1 flat fee” and “Repayment deductions based on your future sales.”

Walmart, which made headlines recently with third party MCA funders Parafin and Payoneer, is now funding MCAs directly as well. The new programs, known as Capital by Walmart and Capital for WFS (Walmart Fulfillment Services), were recently placed on its Marketplace page. Capital by Walmart promotes the program as being “1 flat fee” and “Repayment deductions based on your future sales.”

An explainer video that went live on August 1st says that they can fund you themselves or fund you through third parties. Video here:

Further, Walmart’s site states that for their in-house funding, they collect from merchants via their Marketplace payouts each settlement cycle. “In case of insufficient funds in the settlement account, we may debit your bank account,” it says.

A Walmart MCA is invite-only for the time being.

Walmart didn’t raise any mention of its funding programs or partners in its latest fiscal quarterly earnings report but did stress that Walmart Marketplace had grown by 32%.

Amazon Discontinues Its In-House Business Loans

March 9, 2024 After AltFinanceDaily reported that Amazon’s on-balance-sheet business loan receivables had remained steady throughout 2023, the company has abruptly decided to terminate its in-house lending program altogether.

After AltFinanceDaily reported that Amazon’s on-balance-sheet business loan receivables had remained steady throughout 2023, the company has abruptly decided to terminate its in-house lending program altogether.

Through an email confirmed to Fortune, Amazon ended its in-house term loan business on March 6. That same story says that they will continue to work with third party lenders and funders as they have been doing for a while. Some of their partners include Lendistry, SellersFi, and Parafin.

The in-house program had been running since 2011 and was first discovered by AltFinanceDaily in 2013.

While the company was shy about disclosing origination figures, it carried approximately $1.3B in loan receivables on its books throughout last year.

The Amazon news coincides with the announcement that business loan rival Funding Circle has decided to exit the US market. Funding Circle US is currently up for sale.

Wow we sort of called this @amazon sellers pic.twitter.com/MOWsPWxcb1

— Amazon Sellers ASGTG (@AmazonASGTG) March 7, 2024