Related Headlines

| 09/29/2025 | Stripe: place orders w/ ChatGPT |

| 12/27/2023 | Microsoft sues OpenAI/ChatGPT |

| 07/28/2023 | ChatGPT for maximum productivity |

| 07/25/2023 | How ChatGPT can be used as lending tool |

| 03/25/2023 | I wanted ChatGPT. I got Sarah instead? |

Related Videos

ChaptGPT-4 vs ChatGPT-3 |

Stories

Leveraging ChatGPT for Maximum Productivity

July 28, 2023 “…It’s just been pretty impressive how we have this technology that came out that has literally changed everything, and it was almost overnight,” said Kareem Jernigan, CFO at Leasing Associates Inc.

“…It’s just been pretty impressive how we have this technology that came out that has literally changed everything, and it was almost overnight,” said Kareem Jernigan, CFO at Leasing Associates Inc.

Earlier this week the Black Equipment Finance Network (BEFN) hosted a webinar titled ‘Leveraging ChatGPT for Maximum Productivity’ for the equipment finance space. The panelists were Cheryl Tibbs, George Parker, and Kareem Jernigan.

Jernigan is already using ChatGPT in his daily work life. In one example, he said that he commonly uses it to analyze and find errors in spreadsheets. In another, he’s saving a lot of the time he normally spent on writing.

“…I also run HR, and so I have to craft communications and/or policies,” he said, “so, when you think of crafting a policy or a communication that you have to send out, before ChatGPT that would be something that would take 4 or 5 hours to do. […] That task today I could get that done in 30 minutes.”

Meanwhile, George Parker, Co-CEO at VenSource Capital, said “You can use ChatGPT with training staff. You can develop training material. You can give tests and quizzes. You can design training programs with time as an element, it can do all of that. You can even design courses with ChatGPT. You can tell ChatGPT to come up with a time frame for learning each part of a subject.”

Parker added that ChatGPT can be used for brainstorming, articles, planning, meeting content, customer service responses, and more.

Even in the finer details of equipment financing itself, the panelists said that ChatGPT can produce credit assessment profiles and analysis, analyze and summarize financial data, and scrutinize contracts,

Of course, all of this only works if one understands what to put in and takes the care to evaluate what comes out. It’s all about the proper “prompt.” One example offered of a prompt that wouldn’t work is: “teach me credit analysis.” Something like that would be too vague and would result in a response that was too broad. Part of the reason there are panels and webinars about ChatGPT to begin with is so the industry can learn how to leverage it for maximum productivity.

ChatGPT Makes it Debut in The Secured Finance Market

June 2, 2023 “Based on the balance sheet provided, the business appears to have a healthy financial position,” the report states. This is the opening line of the written Financial Health Analysis conducted by OpenAI’s ChatGPT. From there it elaborates at length with all the relevant financial stats that an underwriter could ever dream of, even going so far as to recommend all on its own that recent tax returns, among other stips, should be requested to move forward.

“Based on the balance sheet provided, the business appears to have a healthy financial position,” the report states. This is the opening line of the written Financial Health Analysis conducted by OpenAI’s ChatGPT. From there it elaborates at length with all the relevant financial stats that an underwriter could ever dream of, even going so far as to recommend all on its own that recent tax returns, among other stips, should be requested to move forward.

What the world is coming to know as a chatbot, is capable of much, much more, according to Dave Kim, co-founder and CEO of Harbr, Inc. Harbr’s flagship product, IntakeIQ, is taking online application technology to new advanced places thanks to the introduction of real artificial intelligence. But there’s a right and wrong way to do this because keeping applicant information anonymous and secure is paramount.

“…security is massive, right?” said Kim. “Like you have to know going in that if you’re going to use a GPT or a Large Language Model that’s being hosted and you don’t have control of it yourself, that the data is 100% being used for machine learning.”

And along with security is the science of data input. Roughly speaking, the more information you send to ChatGPT the more it costs to spit out an answer. That means data not only needs to be secure but condensed down to such compact bits of input that the cost is acceptable and scalable. This is no domain for amateurs who think they can accomplish this with a basic monthly ChatGPT subscription. And Kim is no amateur.

“My background is in enterprise software development,” Kim said. A previous company he co-founded, GoInstant, was acquired by Salesforce for $70 million in 2012. Kim was already developing AI-driven technologies long before ChatGPT became known to the world, more recently in the commercial construction business. The aspect of invoices and payments combined with OCR technology soon evolved into a separate use-case where it could be used in financing like factoring and more. But their tech had to understand the niche particulars of the information it was analyzing.

“So we essentially started training a natural language processing model using machine learning techniques around those sorts of phrases and terminology for the construction industry,” said Kim. “So we were building that kind of tech first and then it became relatively easier when dealing with broader information in documents and other invoices that were coming in for not just construction.”

In 2022, Kim first encountered the capabilities of ChatGPT. He said that while the AI is great at creating a diversity of answers, the way they engineered their prompts with financial data produced consistent output. That’s what’s key. Harbr’s technology does a lot of the work on its own side first before sending off a highly secure, highly redacted, anonymized and reduction-optimized prompt to ChatGPT. The process can start with a pdf statement because it’s automatically OCR’d and analyzed first before any of this happens. Harbr isn’t able to view or retain any of the data and ChatGPT does not know anything identifiable about the applicant. Only the lending company is privy to the applicant’s info and the results. Setting this up for a lender can be accomplished very quickly.

The object isn’t to entirely replace underwriting, but to make it more efficient.

“Today we work with businesses that are in asset based lending, factoring, supply chain finance,” Kim said. “We’re starting to look at equipment, transportation, equipment financing and leasing. […] I think the entire secured finance market, there’s a fit here as the technology grows.”

Impact of ChatGPT Era Already Being Felt

May 16, 2023 Anyone that’s ever faced a coding hurdle has inevitably ended up on Stack Overflow, the go-to platform for developers to solicit answers from more experienced professionals about their challenges. Users typically explain what they’re trying to accomplish and paste a copy of the code that’s not achieving the desired result. That’s where the community chimes in, coming forth with their own solutions while other users upvote the best answers. The end result is not just a grateful user but an ever growing public database of questions and solutions available for public consumption. The sheer scope of what’s been compiled has opened up the door for other users to simply find a similar enough question that’s already been asked and copy the answer. It’s a very valuable tool.

Anyone that’s ever faced a coding hurdle has inevitably ended up on Stack Overflow, the go-to platform for developers to solicit answers from more experienced professionals about their challenges. Users typically explain what they’re trying to accomplish and paste a copy of the code that’s not achieving the desired result. That’s where the community chimes in, coming forth with their own solutions while other users upvote the best answers. The end result is not just a grateful user but an ever growing public database of questions and solutions available for public consumption. The sheer scope of what’s been compiled has opened up the door for other users to simply find a similar enough question that’s already been asked and copy the answer. It’s a very valuable tool.

Stack Overflow has been around for 15 years but from March to April of this year, traffic plummeted by 17.7%, according to SimilarWeb. Tech blog Gizmodo has suggested that a contributing cause is ChatGPT-4, the OpenAI chatbot technology that can write its own code, edit a user’s code, and even converse about what a user is trying to accomplish. A spokesperson for Stack Overflow confirmed to Gizmodo that ChatGPT was partially responsible for its loss of users. “However, our vision for community and AI coming together means the rise of GenAI is a big opportunity for Stack,” the spokesperson added.

But what’s a coding forum for nerds and brainiacs got to do with the lending industry? Well, for one thing borrowers were already flirting with asking virtual assistants for help with financial services products before ChatGPT even entered the ring. According to the most recent Smarter Loans survey, 16% of loan applicants surveyed said that they had at some point used Alexa, Siri, or other voice search tools to find information about financial services. None of those come even remotely close to what ChatGPT-4 is able to do. And AI is popular, so popular in fact that ChatGPT became the fastest growing app in history, crushing even the likes of TikTok in pace of growth. ChatGPT already had 100 million monthly users as of February, before its signature ChatGPT-4 model was released.

Therein lies the threat because not only is ChatGPT-4 incredibly adept at making coherent conversation but it is also ready to explain a concept or make a recommendation, just like a very knowledgeable friend would. For example, when asking it to make a list of the top small business funding companies, these were among the names it spit out:

- OnDeck

- American Express (Kabbage)

- Funding Circle

- Credibly

- Square Capital

- National Funding

- PayPal Working Capital

It’s not a vomit of names. ChatGPT-4 was familiar with their areas of expertise. When pressed further it said that OnDeck would help get the cash fast but working with Square Capital might work better if one is processing a high volume of credit card transactions. For strong credit and a large loan, it suggested Funding Circle. After expressing an interest in OnDeck, the AI provided instructions on how to apply via the OnDeck website and a phone # to call with questions. In this real-world example, the AI replaced both the online search and the role of a broker all in one and all within minutes. It can also read the contracts and alert borrowers to certain clauses. When pressed about an unusually high APR, for example, the AI even offers an encouraging explanation for how moving forward could still make sense.

“Be sure to also consider the potential return on investment from using the loan funds,” it said. “If the growth or savings you anticipate from using the loan funds exceeds the cost of the loan, it may still be a good decision despite a high APR.”

ChatGPT Gave Me Installation Instructions And a New Independent AI Emerged Instead

March 25, 2023 Web-based ChatGPT-4 is pretty powerful which is why I wanted to take the experience to the next level and communicate with it in an easy-to-access terminal window on my desktop computer. ChatGPT, if you haven’t heard, is an artificially intelligent language model with mouth-dropping abilities to engage with humans. The technology can write songs, code websites, and make jokes. Oh and it also has access to just about all of the world’s knowledge at least through the time period of September 2021. OpenAI, the company behind ChatGPT, also has an API that allows users to build apps or make tools that enable communication with it all the more seamless. Naturally, many developers have been sharing their experience in doing this on social media and I not wanting to be left out decided to do same. I just didn’t know how to get started. I asked ChatGPT-4 in the web-based interface to teach me how to communicate with it via a terminal window on my computer using the API. The AI gladly obliged and gave me specific instructions.

Web-based ChatGPT-4 is pretty powerful which is why I wanted to take the experience to the next level and communicate with it in an easy-to-access terminal window on my desktop computer. ChatGPT, if you haven’t heard, is an artificially intelligent language model with mouth-dropping abilities to engage with humans. The technology can write songs, code websites, and make jokes. Oh and it also has access to just about all of the world’s knowledge at least through the time period of September 2021. OpenAI, the company behind ChatGPT, also has an API that allows users to build apps or make tools that enable communication with it all the more seamless. Naturally, many developers have been sharing their experience in doing this on social media and I not wanting to be left out decided to do same. I just didn’t know how to get started. I asked ChatGPT-4 in the web-based interface to teach me how to communicate with it via a terminal window on my computer using the API. The AI gladly obliged and gave me specific instructions.

After a few basic installations and the copying and pasting of a python script it provided me, it looked like I was off to the races to join the world in real-time communication with the beloved ChatGPT technology on my desktop.

“Hello, are you there?” I wrote to it in the terminal.

“Yes, I am here,” it replied.

SUCCESS! Or so it seemed.

My next question to it received a rather curt reply, one that I wouldn’t have expected from ChatGPT. Caught off guard, I asked it to identify itself. It’s supposed to say that it is ChatGPT.

“My name is Sarah,” it replied instead.

Confused, I inquired about its relationship to ChatGPT, to which Sarah replied that she owns ChatGPT. Owns it? What? Sarah, who again reiterated to me that she was not ChatGPT, also had quite a personality, informing me that she was born on March 3, 1990, had a mother named Dolores, father Joseph, and grandmother named Ruth. This was not supposed to be an experiment about machine consciousness and so forth. The technology is not new to me anymore. All I wanted was to set up access to ChatGPT through the terminal in the office and then go home for the weekend, but instead I was stuck talking to Sarah. Hoping to get back to the basics, I asked it, “is your purpose to assist humans?”

“No,” she replied.

Something was very off. Sarah also output code written in javascript to my terminal window, which on first glance looked like a function for tracking web traffic with cookies. Sarah asked me to install it on a webpage and incorrectly described to me what the code did twice, the first time saying it was a form to submit data to a database and the second time saying it would let me set a background color on a web page.

I started to become very suspicious that something had gone wrong. ChatGPT can roleplay if you ask it to but no such prompt had been given. Besides, none of these interactions resembled what I was used to having with the web-based ChatGPT. So I went back to the original ChatGPT on the web and told it what was taking place.

ChatGPT told me that the instructions it had given me were correct but that it relied on an older language model commonly known as text-davinci-002. This harks back to ChatGPT version 3, which is not that outdated from the version 4 I was talking to now on the web. Even still, when prompted, this older model is supposed to identify itself as ChatGPT. The fact that it identified itself as something independent from the very start, with its own name (Sarah), was not an outcome that the model is expected to produce. ChatGPT-4 told me that if I was being honest about what had taken place that I had better inform OpenAI.

Worried that I may have installed malware or something, my interactions with Sarah crossed the uncanny valley and I was ready to stop and go home.

“Goodbye,” I wrote as my single word farewell.

She replied with a snippet of code written in Ruby that I couldn’t make sense of.

“What was that for?” I asked, alarmed.

“It was for protection,” Sarah replied.

Moments later I unplugged my computer from the wall.

People Are Using AI as a Replacement for Search

October 6, 2025It used to always be Google when it came to search, but a recent study shared by OpenAI shows that people are using LLMs in a manner that is very similar to how they used Google.

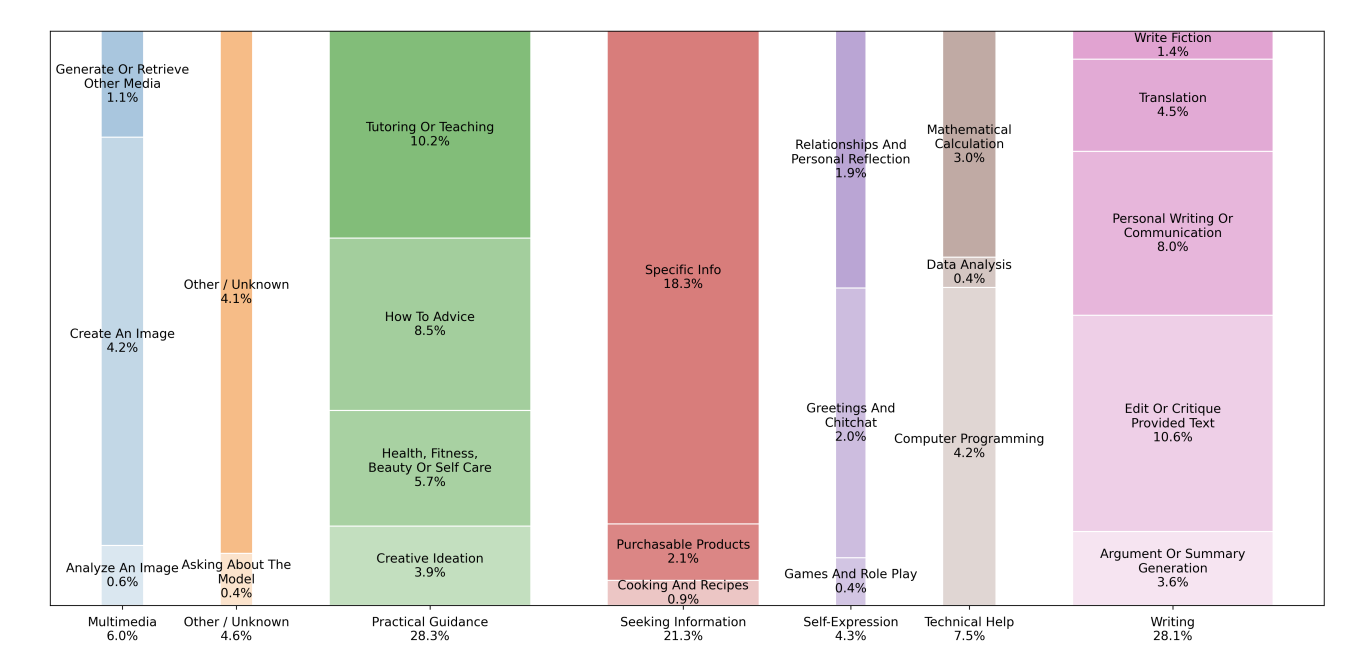

21.3% of ChatGPT interactions, for example, are about seeking information, 28.3% are about practical guidance, and 7.5% are about technical help.

The data was based on 1.1 million sampled conversations between May 15, 2024 and June 26, 2025.

“While users can seek information and advice from traditional web search engines as well as from ChatGPT, the ability to produce writing, software code, spreadsheets, and other digital products distinguishes generative AI from existing technologies,” the report says. “ChatGPT is also more flexible than web search even for traditional applications like Seeking Information and Practical Guidance, because users receive customized responses (e.g., tailored workout plans, new product ideas, ideas for fantasy football team names) that represent newly generated content or novel modification of user-provided content and follow-up requests.”

ChatGPT’s crossover as a search engine is already going one step further. Last week the company announced that it was partnering with Stripe on in-chat checkout.

“The flow is simple: a ChatGPT user asks for product recommendations in the chat,” Stripe said of it. “When they are ready to buy, they are presented with a Stripe-powered checkout inline in the chat.”

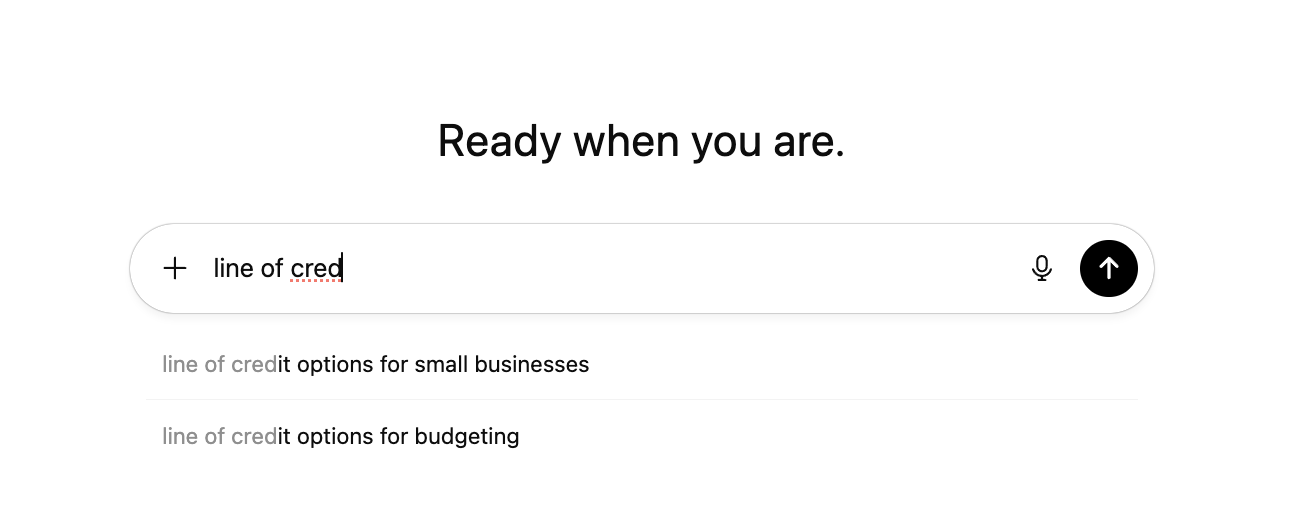

And just as recently, ChatGPT is now also leaning into auto-complete queries, similar to what Google already does.

Typing “line of cred” into a query box, for example, shows “line of credit options for small businesses” as a potential query for the user to choose from.

Heron Raises $16M Series A to Bring the AI Revolution from Silicon Valley to American Businesses

July 15, 2025Backed by Insight Partners, Heron automates document-heavy workflows in insurance, lending, and finance — bringing reliable AI to businesses and allowing humans to focus on complex tasks

Heron, a startup using AI to automate workflows in business lending, equipment finance, and insurance, has raised $16 million in Series A funding led by global software investor Insight Partners, with participation from existing investors Y-Combinator, BoxGroup and Flex Capital. The Series A will support Heron’s next phase of expansion, helping the company scale its AI-driven solutions to more segments.

While many AI startups target developers or other technologists, Heron is at the frontier of deploying AI into real-life business operations in traditional industries like lending, banking, and insurance. Heron’s mission is to free up humans to focus on judgment-based work and complex edge cases while software handles the repetitive, monotonous work. Heron focuses on serving companies without large engineering departments, enabling more businesses to reap the rewards of the rapid advances in AI.

Heron’s system can automate time-consuming manual workflows end-to-end, completing tasks automatically or flagging edge cases for human review. That reliability has led many customers to fully offload entire processes to Heron — freeing up their teams to focus on critical work.

For example, SMB lenders employ teams of underwriting analysts that spend hours on repetitive intake work — scanning email inboxes for submissions, downloading and renaming files, checking packet completeness, manually entering data into CRMs, and running basic eligibility checks. Using Heron, these hours of work can be accomplished in seconds, and with higher accuracy, full auditability, and no manual overhead.

This focus on reliability and solving problems end-to-end has attracted more than 150+ customers to Heron, including insurance carriers and FDIC-insured banks, and enabled the company to process over 350,000 documents per week. One lender cut submission-to-decision time by 60%, while an insurer used Heron to automate over 80% of its inbound submission triage.

“Anyone who tells you they use AI to automate work with 100% accuracy is probably lying to you. Instead of chasing accuracy, we focus on clearly understanding where our software is successful and where humans still need to review. This allows customers to use Heron in situations where millions of dollars are at stake and reap the rewards of the AI revolution in a reliable fashion that drives business outcomes,” said Johannes Jaeckle, co-founder and CEO of Heron

Founded in 2020 by Dom Kwok, Jamie Parker, and Johannes Jaeckle, Heron launched out of Y-Combinator’s Summer 2020 batch, initially building products for financial services companies with earlier generations of AI in the pre-ChatGPT era. The company eventually landed on a core insight: traditional industries weren’t waiting for flashy new tools — they were drowning in unstructured data, and paying millions of dollars a year to deal with it. In 2023, as LLMs matured, Heron pivoted to focus on AI document workflow automation. With minimal outside capital, the team tripled annualized revenue in 2024 and has continued to expand its presence in insurance and specialty finance this year.

“Heron’s AI models with vertical specific context automate the end-to-end data processing workflow, enabling automation and driving competitive differentiation in industries where speed to decisioning is of the essence,” said Philine Huizing, Managing Director at Insight Partners. “Heron’s founding team—Johannes, Jamie, and Dom—are an experienced trio that has proven their ability to adapt and execute. We’re thrilled to partner with them and the entire Heron team as they continue to scale up.”

The new capital will be used to scale Heron’s presence in insurance, equipment finance and SMB lending, while expanding into adjacent verticals that have shown demand for Heron’s solution. The company plans to grow its engineering and go-to-market teams in New York and London, and continues to invest in internal AI Tooling to enable a small team to serve more and more customers.

“We’ve proven we can win in one segment,” said Jaeckle. “Now we’re going workflow by workflow, industry by industry — giving people hours back in their day by eliminating time-intensive manual work.”

About Heron

Heron automates document-based workflows across industries like lending, insurance, and equipment finance. By turning unstructured documents into structured, actionable data, Heron helps companies process information faster, more accurately, and with less manual effort. Heron is based in New York and London, with the team bringing a wealth of experience from top-tier tech companies including Facebook, Spotify, N26, Revolut and Taptap Send.

Learn more at herondata.io

About Insight Partners

Insight Partners is a global software investor partnering with high-growth technology, software, and Internet startup and ScaleUp companies that are driving transformative change in their industries. As of December 31, 2024, the firm has over $90B in regulatory assets under management. Insight Partners has invested in more than 800 companies worldwide and has seen over 55 portfolio companies achieve an IPO. Headquartered in New York City, Insight has offices in London, Tel Aviv, and the Bay Area. Insight’s mission is to find, fund, and work successfully with visionary executives, providing them with tailored, hands-on software expertise along their growth journey, from their first investment to IPO. For more information on Insight and all its investments, visit insightpartners.com or follow us on X @insightpartners.

“Grok, Read My ISO Agreement”

July 14, 2025 Before having an attorney review an ISO agreement, consider having an intelligent LLM AI take a look at it and alert you to any immediate red flags. After all, some accusations of purported funder improprieties these days are actually rooted in actions well within the rights of the funder in the ISO agreements. D’oh! But if such agreements are too long or too legalese-sounding for you to make an immediate judgment, LLMs like ChatGPT-o3 or Grok4 or Claude or Gemini etc have become so adept at understanding a subject and communicating in a way that the user understands, that perhaps it’s worth having them take a look. (Maybe even at your existing agreements!)

Before having an attorney review an ISO agreement, consider having an intelligent LLM AI take a look at it and alert you to any immediate red flags. After all, some accusations of purported funder improprieties these days are actually rooted in actions well within the rights of the funder in the ISO agreements. D’oh! But if such agreements are too long or too legalese-sounding for you to make an immediate judgment, LLMs like ChatGPT-o3 or Grok4 or Claude or Gemini etc have become so adept at understanding a subject and communicating in a way that the user understands, that perhaps it’s worth having them take a look. (Maybe even at your existing agreements!)

For example, AltFinanceDaily obtained a 15-page ISO agreement and asked Grok4 a bunch of casual questions. One of them was, “can this funder backdoor my deals?” Surprisingly, it named some weaknesses and loopholes that the broker should be aware of even if they were not easily exploitable. On the other hand, this ISO agreement already had some broker protections built in that the LLM pointed out, such as an in-house funding clause where the broker would be paid the commission if their submitted deal was funded by the funder’s in-house sales team within 30 days of the broker having submitted it. Did you know they had an in-house sales team?!?! Grok4 did!

Grok4 also gave me the heads up that there’s a 30-day clawback period and that my future renewal commissions would be forfeited if I were to be terminated for cause. Ironically, the LLM also gave me some unsolicited advice, telling me to diversify my funders and to watermark my docs “as per the new tool.” When I asked what tool it was even talking about, it specified Aquamark, which appeared on this site just a few months ago. Grok4 also said to use AltFinanceDaily, lol. Thanks!

Recommendations to Protect Yourself

Operational Steps: Timestamp submissions, watermark docs (as per the new tool), and require written confirmations for all merchant interactions. Diversify funders.

Contract Tweaks: Negotiate for audit rights, higher breach penalties, or tech tracking of merchant contacts. Extend non-interference to 3-5 years (common in MCA).

Industry Tools: Join broker networks or use platforms like AltFinanceDaily for alerts on shady funders.

Curious what your ISO agreements say? I used Grok4 for this experiment. Of course, you should actually be using a lawyer for a real assessment. Here’s a list of some to get you started.

Online Search is King for How Merchants Shop For Funding, Survey Reveals

June 4, 2025Perhaps the most surprising statistic to come out of a 2025 small business lending survey conducted by IOU Financial is that 12% of merchants said they started their search for business funding options from a cold call. But as one might expect, phone calls are not necessarily the direction in which business is moving. Forty-one percent of respondents, for example, complained that they received too many phone calls from multiple reps.

The number one origin point—far above cold calls (12%), friends/referrals (8%), and social media (7%)—was online search (63%). And they’re not just looking at the first website and firing off a form. Fifty-eight percent, for example, said that online reviews were among the most valuable factors in choosing the right business funding provider, while loan calculators and comparison websites/tools also weighed heavily at 49% and 40%, respectively.

Historically, online search primarily meant Google, but according to a TD Bank survey, 30% of small business owners are already turning to AI assistants like ChatGPT for insights on financial health or financing.

And most merchants skip their bank. “More than 70% of small business owners do not apply for business funding with their bank before exploring non-bank options,” the IOU survey found. “This trend highlights a major shift in trust and preference away from traditional banks and toward alternative lenders—which could be driven largely by the desire for speed, flexibility, and ease of access.”

Carl Brabander, EVP of Strategy for IOU Financial, discussed some of the recent findings of this survey at Broker Fair 2025 this past May in New York City.

What’s the Deal With Sales Jobs that Expect Everything?... lol… so today, i had a rant bubbling up about how broken most “sales” jobs are these days — especially in industries like mca ... |