LendUp Stops Making New Loans

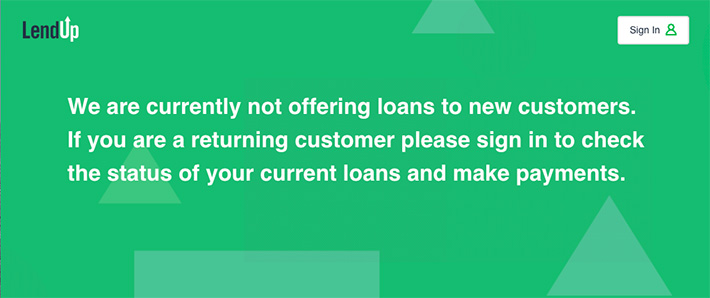

LendUp, a fintech lender that hoped to disrupt the payday loan industry, is no longer making new loans. A note posted on its website said “We are currently not offering loans to new customers.”

LendUp, a fintech lender that hoped to disrupt the payday loan industry, is no longer making new loans. A note posted on its website said “We are currently not offering loans to new customers.”

When AltFinanceDaily sat down with the now former CEO Sasha Orloff in 2017, he said that their product was simply cheaper and more flexible.

“The easiest person to convince that we’re a better product is an existing payday user because it’s slightly cheaper at the beginning, it gets much cheaper over time,” he said then. “It has a lot more flexibility.”

But for all the bells and whistles, their still relatively high rates generated a target on their back with regulators.

In 2016, for example, the CFPB said “[LendUp] did not give consumers the opportunity to build credit and provide access to cheaper loans, as it claimed to consumers it would.”

Balancing the messaging with the reality seemd a difficult task.

Orloff stepped down in January 2019, but in less than two years the CFPB took a second crack at LendUp for allegedly violating the Military Lending Act.

In January of this year, LendUp settled the charges, agreeing to pay $300,000 in redress to consumers and to pay a $950,000 civil money penalty.

As recently as April, LendUp’s website was still offering loans with a promoted APR of 400%.

Last modified: July 10, 2021Sean Murray is the President and Chief Editor of deBanked and the founder of the Broker Fair Conference. Connect with me on LinkedIn or follow me on twitter. You can view all future AltFinanceDaily events here.