OnDeck Status Update

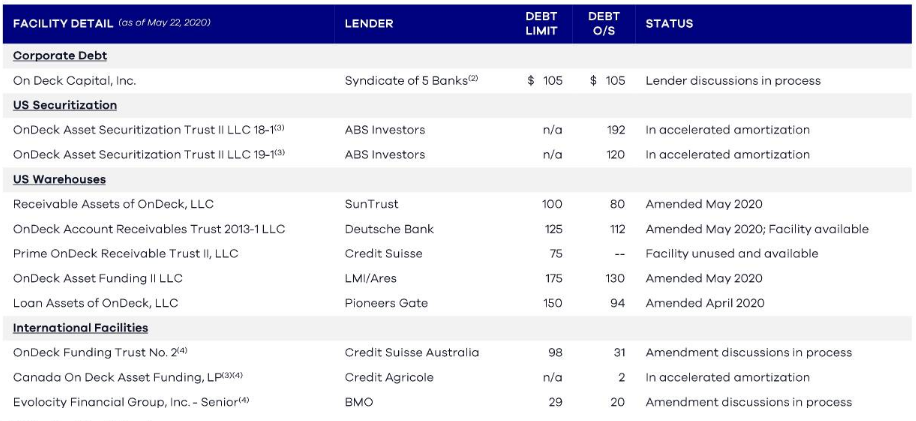

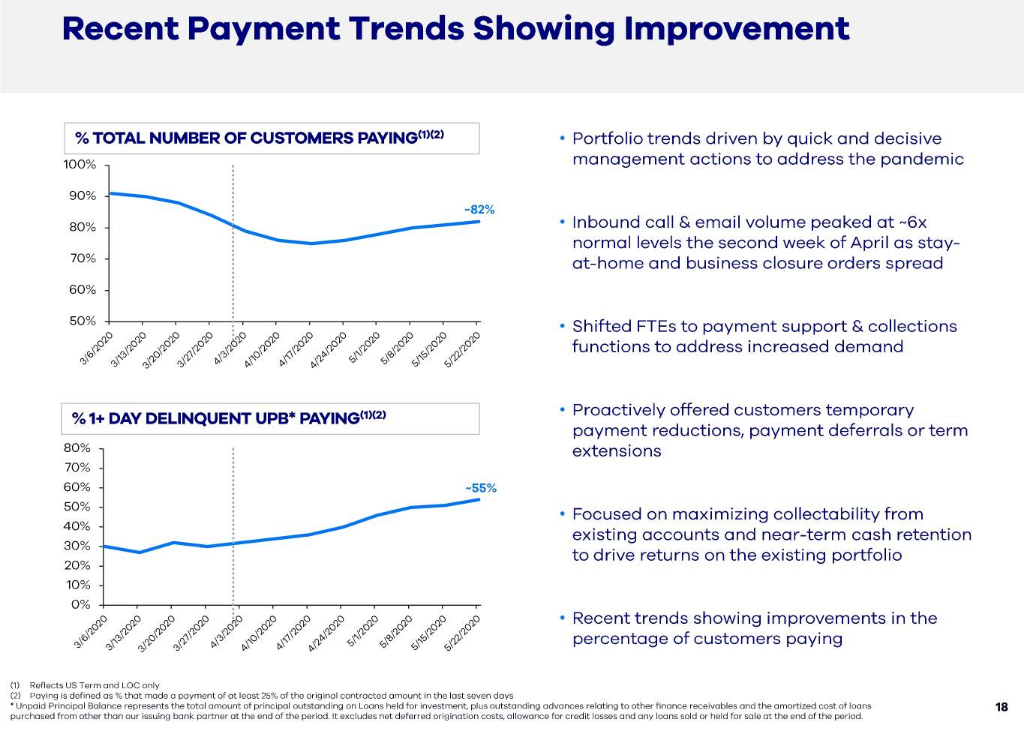

OnDeck submitted an unprompted mid-quarter update with the SEC early this morning on its status. Unlike previous submissions, the company prepared a visual of its debt situation. The bad news is that there is a good amount of negotiating with creditors left to be done. The good news was that there was an uptick in borrower payments. The attached graphics were pulled straight from their filing.

The company also said that it believes it is “well-positioned to benefit from economic recovery & market dislocation.” It based that belief on the below stated bulletpoints:

- Small business lending is a large market and will be critical in leading the economic recovery.

- OnDeck has deep experience from a 14-year operating history to increase originations with a targeted approach and reshape the portfolio.

- OnDeck is a scaled platform with demonstrated historical profitability and an established brand, unlike many competitors.

- Consistent with the last crisis, banks are likely to retrench further and only selectively serve SMBs.

- Expected consolidation of SMB lending industry will ultimately lead to improved unit economics and growth opportunities.

The full presentation, which is mostly a recap of the company’s Q1 earnings data, can be accessed here.

Last modified: May 28, 2020Sean Murray is the President and Chief Editor of deBanked and the founder of the Broker Fair Conference. Connect with me on LinkedIn or follow me on twitter. You can view all future AltFinanceDaily events here.