Lending Club Failure Has Shocking Twist

One general rule about meeting with a banker to apply for a loan is to not present yourself like a slob. That means dress professionally, comb your hair, trim your nails, sit up straight, be polite and sound as sophisticated as you possibly can. Then maybe, just maybe you might be seriously considered for an approval.

One general rule about meeting with a banker to apply for a loan is to not present yourself like a slob. That means dress professionally, comb your hair, trim your nails, sit up straight, be polite and sound as sophisticated as you possibly can. Then maybe, just maybe you might be seriously considered for an approval.

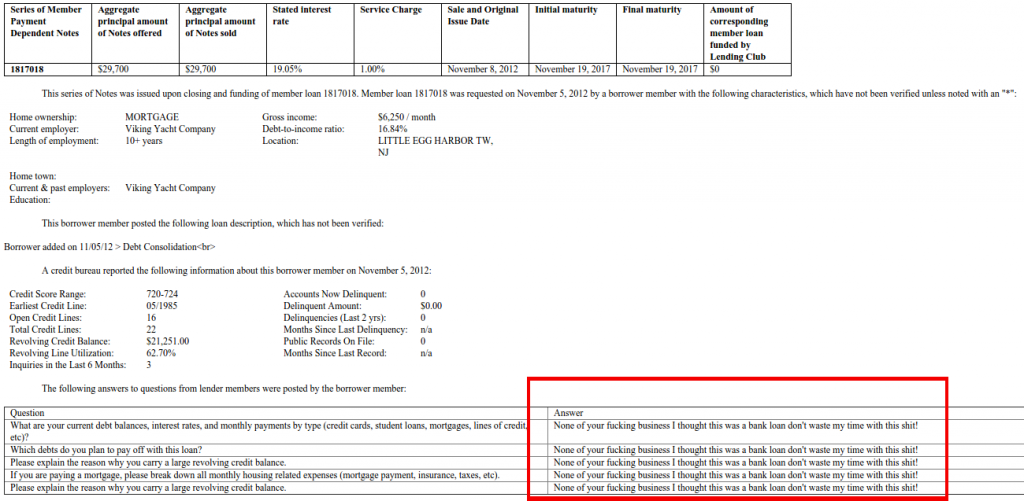

Well, things work a little bit differently out on the Internet. One applicant decided to try the opposite approach with Lending Club and their words became public record when the offering got registered with the SEC. Take a look:

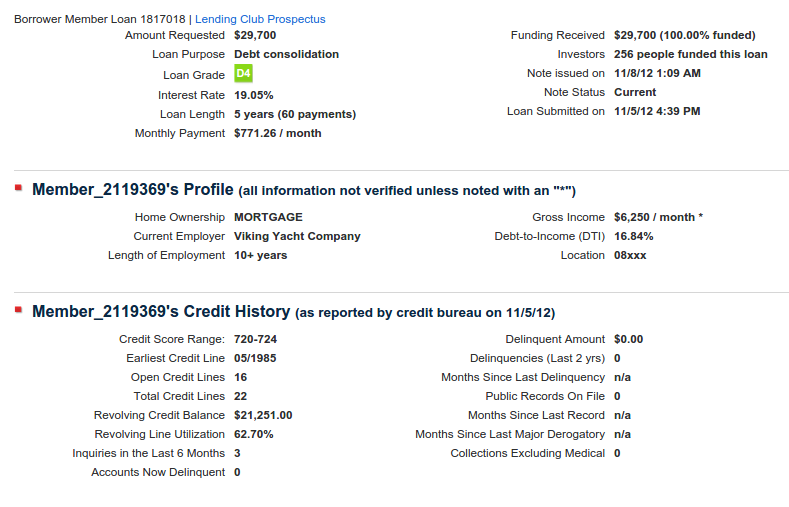

Just another D-grade note offering a 19.05% return. Oh wait…

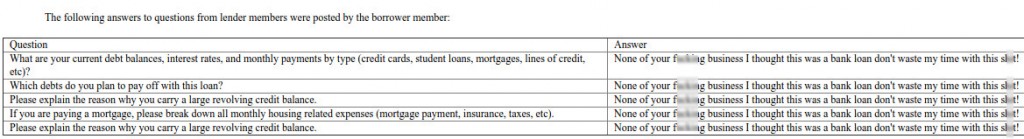

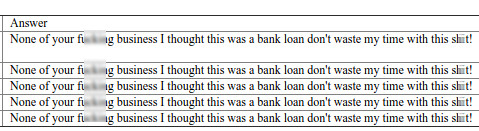

Look closer at the applicant’s answers…

Congratulations, you just fast tracked yourself to the rejection bin! Oh wait, what’s that? You can check the loan number on the filing with the public data on Lending Club?…

Umm…

Behold the power of online lending!

F you, F that, Don’t waste my time with this sh*t and send me the damn $29,000.

Sounds good to me! It was 100% funded and the borrower is currently in good standing. They are already halfway through their 5-year loan.

I honestly don’t know what to make of this. What’s crazier? The fact that 256 investors contributed money to it or the fact that the borrower is in good standing halfway into the 5-year loan?

You can find the original registered security here. Just search for the f bomb.

Last modified: April 7, 2015Sean Murray is the President and Chief Editor of deBanked and the founder of the Broker Fair Conference. Connect with me on LinkedIn or follow me on twitter. You can view all future AltFinanceDaily events here.